________

Source: Zero Hedge

by Tyler Durden | Monday, 12/23/2019

Last week we reported that something strange was going on at the same time that central banks are injecting $100 billion each month in electronic money to crush volatility and ramp markets: a similar amount in physical currency and precious metals was literally disappearing.

The mystery, in a nutshell, was as follows: while banks are printing more bank notes than ever, these seem to be "disappearing off the face of the earth" and nobody knows where or why, or as the WSJ notes, "central banks don't know where they have gone, or why, and are playing detective, trying to crack the same mystery."

And while readers can read up much more on the topic of disappearing hard assets here, a few days after, Fox Business picked up on this thread, writing that almost $1.5 trillion of the world's physical cash, with $100 dollar bills making up the vast majority, was reportedly unaccounted for.

So what happened to the money?

To get to the bottom of this mystery, this was the question FOX Business anchor Lou Dobbs asked the man who literally signs every single US dollar bill, Treasury Secretary Steven Mnuchin. The response" "Literally, a lot of these $100 bills are sitting in bank vaults all over the world," Mnuchin said.

Mnuchin pointed to the negative interest rates causing people to turn to American dollars as a solid investment.

The dollar is the reserve currency of the world, and everybody wants to hold dollars," Mnuchin said on "Lou Dobbs Tonight." "And the reason why they want to hold dollars is because the U.S. is a safe place to have your money, to invest and to hold your assets."

Mnuchin said it's interesting that, in a increasingly digital world, "the demand for U.S. currency continues to go up." Adding that "there's a lot of Benjamins all over the world."

Actually, it's not that interesting: the world's growing appetite for physical assets such as paper dollars and gold, coupled with the continued interest in cryptocurrencies and other traditional currency alternatives, merely confirms that faith in artificially levitated markets is approaching a tipping point. Meanwhile the world's "top 0.001%ers" continue to quietly cash out, literally, and put their Benjamins in secret vaults in the middle of somewhere, even as central banks do everything in their power to reduce the amount of physical currency in circulation and replace it with easily trackable digital alternatives.

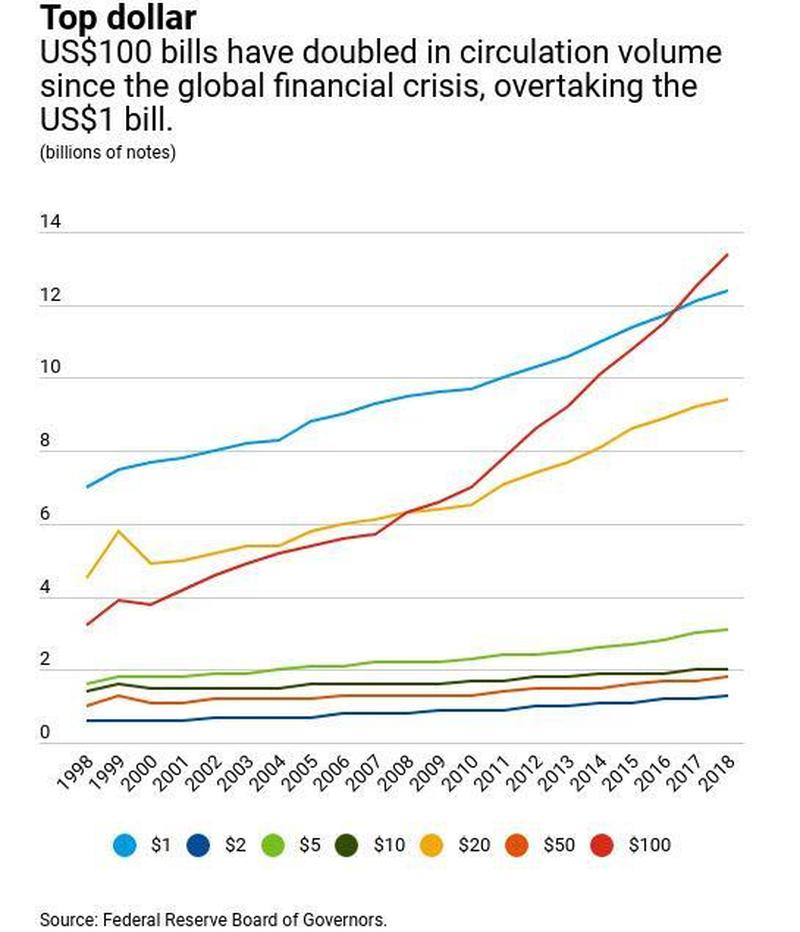

As we reported back in August, there are now more $100 bills in circulation than $1 bills, according to data from the Federal Reserve, which found there are more $100s than any other denomination of U.S. currency. And as an indication of just how much demand there is for physical stores of value, consider this: the number of bills featuring a picture of Benjamin Franklin has about doubled since the start of the recession.

In 2018, the Federal Reserve Bank of Chicago illustrated a correlation between low interest rates and high currency demand, though it also noted outside factors could help explain swelling demand.

The bank estimated that 80% of all $100 bills last year were actually in circulation in foreign countries, and explained that residents in other countries, particularly those with unstable financial systems, often use the notes as a safe haven.

To watch the exchange, click on the image below and fast forward to 7 minutes 30 seconds in.

Historic Trade Victories. @stevenmnuchin1 praises @POTUS for continuing to deliver on all of his trade & economic promises. #MAGA #AmericaFirst #Dobbs pic.twitter.com/K0i9jjzCHH— Lou Dobbs (@LouDobbs) December 18, 2019

It's not just US dollar that are disappearing, however.

Few are as perplexed by the fate of the missing cash as the German central bank: according to the Bundesbank more than 150 billion euros are being hoarded in Germany. This has led the European Central Bank, and others, to ask the public for help.

"Everyone says that they are not hoarding cash but the money is clearly somewhere," said Henk Esselink, head of the issue and circulation section in the ECB's currency management division.

"People hide their money everywhere," said Sven Bertelmann, head of the Bundesbank's National Analysis Centre in Mainz, Germany. Sometimes bank notes are buried in the garden, where they start decomposing, or hidden in attics, where they are used by mice for building nests. "It happens again and again that people keep money in an envelope and then they shred it by mistake," Bertelmann said. "We pick up the bank notes with tweezers and then start to put them together, like a jigsaw puzzle."

Please go to Zero Hedge to read the entire article.

________

Related:

Fed Is Losing Control (Where Is All the Cash Going?)

The Crunch Is Back, There's Going To Be A Gold Standard, And It Will Be Disastrous

The Vile Obscenity of Wall Street

Global Wave of Debt Is Largest, Fastest in 50 Years

Here is where the money is going:

Space Weaponization

One of the biggest oil companies in the world losing money hand over fist:

Royal Dutch Shell: Going Through Reality Checks

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.