US Official Gold Reserves Auditor Caught Lying

________

Source: Zero Hedge

Hundreds Of Billions In Gold And Cash Are Quietly Disappearing

by Tyler Durden | Sun, 12/15/2019

Something strange is going on: at the same time that central banks are injecting $100 billion each month in electronic money to crush volatility and ramp markets, a similar amount in hard physical currency and precious metals is literally disappearing.

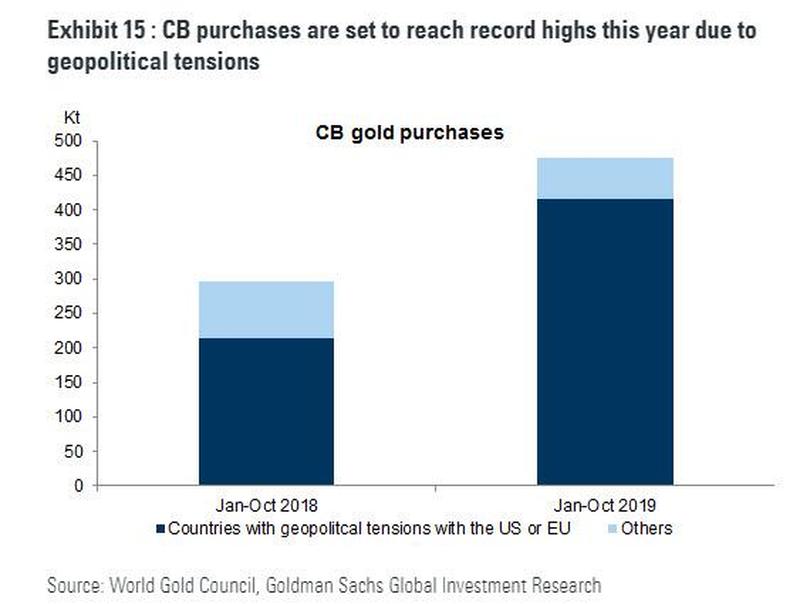

Take gold: as we reported last week, it was none other than Goldman Sachs which recently laid out the case for gold, saying "gold's strategic case still strong." One reason for this is that the same central banks that are "full tilt" printing cash, they have also been splurging on gold, and as a result of "geopolitical uncertainty" there has been a record surge in gold demand by central banks themselves. As Goldman notes, "CBs globally have been buying gold at a very strong pace" and "2019 looks to be a record year for CB gold purchases with our target of 750 tonnes combined purchases likely to be met."

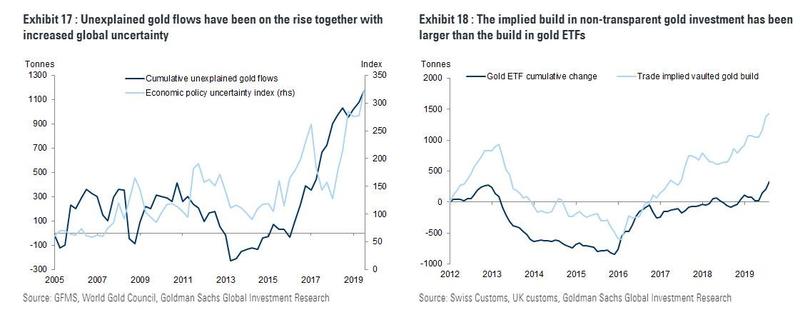

But it was another, even more bizarre discovery by Goldman, that caught our eye: according to the bank there has been a whopping 1,200 tons, or $57 billion, of "unexplained" gold flows in just the 3 years.

As Goldman's Mikhail Sprogis writes, "rising political risk - together with negative European rates - may be an important reason behind the large share of unaccounted gold investment over the past several years. Exhibit 17 shows cumulative unexplained gold demand based on World Gold Council (post 2010) and GFMS (pre 2010) balances data. It surged since 2016. Similar dynamics can be seen when we look at implied vaulted gold stocks built in the UK and Switzerland, which is calculated as implied cumulative total net imports minus transparent ETF gold stocks."

And another remarkable observation, or rather lack thereof: "One can see that since the end of 2016 the implied build in non-transparent gold investment has been much larger than the build in visible gold ETFs (see Exhibit 18). This is consistent with reports that vault demand globally is surging. Political risks, in our view, help explain this because if an individual is trying to minimize the risks of sanctions or wealth taxes, then buying physical gold bars and storing them in a vault, where it is more difficult for governments to reach them, makes sense. Finally, this build can also reflect hedges by global high net worth individuals against tail economic and political risk scenarios in which they do not want to have any financial entity intermediating their gold positions due to the counterparty credit risk involved."

In other words, Goldman points out that just over the past three years, there have been tens of billions in gold flows which have mysteriously and inexplicably disappeared from the official record, yet which are most certainly taking place behind the scenes as the world's "top 1%" brace for a major shock.

But it's not just gold that is disappearing: according to the WSJ, so is the world's cold, hard cash.

Some Australians are burying it. The Swiss might be hiding it. The Germans are probably hoarding.Indeed, while banks are printing more bank notes than ever and, these seem to be "disappearing off the face of the earth" and nobody knows where or why. or as the WSJ notes, "central banks don’t know where they have gone, or why, and are playing detective, trying to crack the same mystery."

We do know one thing: of the $1.7 trillion in US dollars in cash circulation in 2018 (up from $1.2 trillion 5 years prior), the vast majority is offshore, where it is quickly and quietly disappears as the world's second best physical store of value (after gold of course). A Fed economist, Ruth Judson, wrote in 2017 that about 60% of all U.S. currency, and about 75% of $100 bills, had left the country by the end of 2016 — for a total of about $900 billion in U.S. dollars kept overseas. Socking those bills away "provides some protection against economic turmoil, especially in countries with a record of instability in their own financial systems", the paper said.

Take Australia: there the stock of Australian bank notes on issue relative to the size of the economy is near the highest it has been in 50 years, said Philip Lowe, governor of Australia’s central bank: "He showed off newly printed bank notes to diners at a recent event in Melbourne and estimated that about $2,000 in printed bills exists for every Australian." And just to inspire confidence in his own job, he added: "I, for one, don't have anywhere near that amount" on hand. In a few years, he will wish he did.

To be sure, there is the criminal element: as anyone who has watched a documentary on Pablo Escobar knows the Colombian drug kingpin buried tens of billions in the ground for "safe keeping" (in fact, as "The Accountant's Story" writes, "Pablo was earning so much that each year we would write off 10% of the money, or about $2.1 billion, because the rats would eat it in storage or it would be damaged by water or lost"). As such, dollar bills are often vital grease for criminal gangs and tax cheats.

Please go to Zero Hedge to read the entire article.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.