News update for 12 December 2019: "Massive... Huge... Largest Ever": Fed Will Flood Market With Gargantuan $500 Billion In Liquidity To Avoid Year-End Repo Crisis

The Repo Crisis & Mother of all Financial Crises Report

The Wealthy Are Hoarding Physical Gold

47 Percent Of GDP – This Is Definitely The Scariest Corporate Debt Bubble In U.S. History

________

Source: CNBC

TUE, DEC 10 2019 | By Jeff Cox

• A fourth round of quantitative easing will be needed before year's end to address stresses in short-term lending markets, according to Credit Susse analyst Zoltan Pozsar.The Federal Reserve could be launching another round of money-printing in the next few weeks as problems in the overnight lending markets reemerge and force the central bank into more aggressive action, according to a Credit Suisse analysis.

• So-called QE4 would help rebuild bank reserves, which have dropped as the Fed has shrunk its balance sheet, Pozsar said.

• Market experts continue to dissect the problems in repo markets that flared up in mid-September.

A fourth version of quantitative easing — often referred to as "money-printing" for the way the Fed uses digitally created money to buy bonds from big financial institutions — would be needed by year’s end to bridge a funding gap as banks scramble for scarce reserves, Zoltan Pozsar, Credit Suisse's managing director for investment strategy and research, said in a note to clients.

"If we're right about funding stresses, the Fed will be doing 'QE4' by year-end," Pozsar wrote. "Treasury yields can spike into year-end, and the Fed will have to shift from buying bills to buying what's on sale – coupons."

That would mean a shift from purchasing short-term Treasury debt and expanding into longer duration and more aggressive balance sheet expansion.

The Fed is in the midst of a buying T-bills in a process that it has insisted is not QE but instead an effort to keep its benchmark overnight funds rate within the 1.5%-1.75% target range. In addition to the outright purchases, the central bank is conducting daily repurchase operations to stabilize the market.

All of those efforts stem from mid-September tumult in the repo market, the place where banks go to get overnight funding critical to their operations. A Sept. 17 spike in rates amplified funding issues that Pozsar said are not going away.

"The Fed's liquidity operations have not been sufficient to relax the constraints banks will face in the upcoming year-end turn," he said, adding that investors have become complacent after an initial flare-up in 2018 turned out to be "benign" and as "repo rates have been trading normally since the September blowout" and amid the Fed’s efforts to keep reserves plenty.

"But these facts are less relevant than they seem," Pozsar said.

Please go to CNBC to read the entire article.

________

Source: Wall Street on Parade

Congress Held a Hearing on the Fed's Bailout of the Repo Market: Here's Why You Haven't Heard About It

By Pam Martens and Russ Martens: December 10, 2019 ~

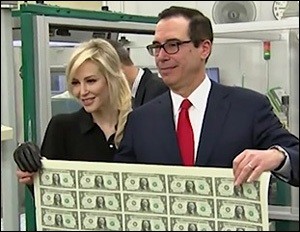

[Image] Actress Louise Linton and Husband, U.S. Treasury Secretary Steve Mnuchin Showing Off His Signature on U.S. Currency at the Bureau of Engraving and Printing in 2017

Last Thursday, U.S. Treasury Secretary Steve Mnuchin was the sole witness called before the House Financial Services Committee to answer questions on the state of financial stability in the U.S. Under the Dodd-Frank financial reform legislation of 2010, the U.S. Treasury Secretary also heads the Financial Stability Oversight Council (F-SOC) which is charged with monitoring any threats to the stability of the U.S. financial system in order to prevent a replay of the epic financial crash of 2008 and attendant devastation to the U.S. economy.

During the hearing, Mnuchin was grilled time and again by numerous Republicans and Democrats on what is necessitating the Federal Reserve Bank of New York (New York Fed) to be pumping out hundreds of billions of dollars per week to Wall Street trading houses via the repurchase agreement (repo loan) market.

But instead of reporting on that critical line of questioning and Mnuchin's lack of meaningful answers, when the New York Times reported on the hearing it focused instead on a tiny aspect of the hearing. Its headline read: "U.S. Objects to World Bank's Lending Plans for China." It made no mention at all of the still unexplained but ongoing repo crisis on Wall Street.

Since the repo lending crisis started on September 17, when major Wall Street banks simply backed away from overnight lending to some financial institutions, forcing loan rates to spike to 10 percent from approximately 2 percent, the New York Times has written exactly one article on this new financial crisis. Wall Street On Parade has written more than three dozen articles on this critical topic.

During last Thursday's hearing, Mnuchin attempted to pass off the repo loan crisis as a two-day event that occurred on September 16 and 17. The lack of reporting on the matter by the New York Times would tend to support that narrative in the public's mind.

The reality is that the New York Fed has now pumped a cumulative total of more than $4 trillion into this black lending hole on Wall Street and has been making upwards of $100 billion a day in loans to Wall Street trading houses every business day since September 17.

During the almost three months that the New York Times has not reported on this flashing red sign of a new crisis on Wall Street, the Federal Reserve has dramatically increased its original level of support to the repo market. It has expanded its overnight loans to include loans of up to 43 days; it has increased the dollar amount of overnight loans to as much as $120 billion available daily; and it has announced that it will be buying $60 billion a month in U.S. Treasury Bills, effectively creating a new round of Quantitative Easing (QE-4) – a tactic it has not used since the financial crisis.

Wall Street is New York City's most profitable hometown industry. Over many decades, the New York Times appears to have developed the mindset that what is good for Wall Street is good for The New York Times. (See The New York Times Has a Fatal Wall Street Bias.) The American people need a free and trustworthy press they can count on to give them an early heads up of a brewing financial problem.

Please go to Wall Street on Parade to read the entire article.

________

Why Are Central Banks Panicking? Global Crisis Ahead?

Here's a story by Tucker Carlson on "vulture capitalism": vultures feeding off a dying nation.

Hedge fund forced Cabela's merger, decimated jobs in Sidney, Nebraska

Related:

Japan Is Again Forced To Stimulate Its Troubled Economy

24 Voices That Are Warning America About What Is Coming, And Most Of Them Are Being Censored And Persecuted

A truckload giant just filed for bankruptcy, and it leaves nearly 3,000 truck drivers jobless

What are Americans going to do? Play catch up with over one billion Chinese?

How Dumb Have We Become? Chinese Students Are 4 Grade Levels Ahead Of U.S. Students In Math

America is drowning in corruption.

Republics & the Death of Democracy Drowning in Corruption

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.