________

Source: Truth Talk

Where all Conspiracies Begin and End – the Banking system creating Money out of Thin Air: The reality of the banking system

February 1, 2023

Where all Conspiracies Begin and End – the Banking system creating Money out of Thin Air: The reality of the banking system

February 1, 2023

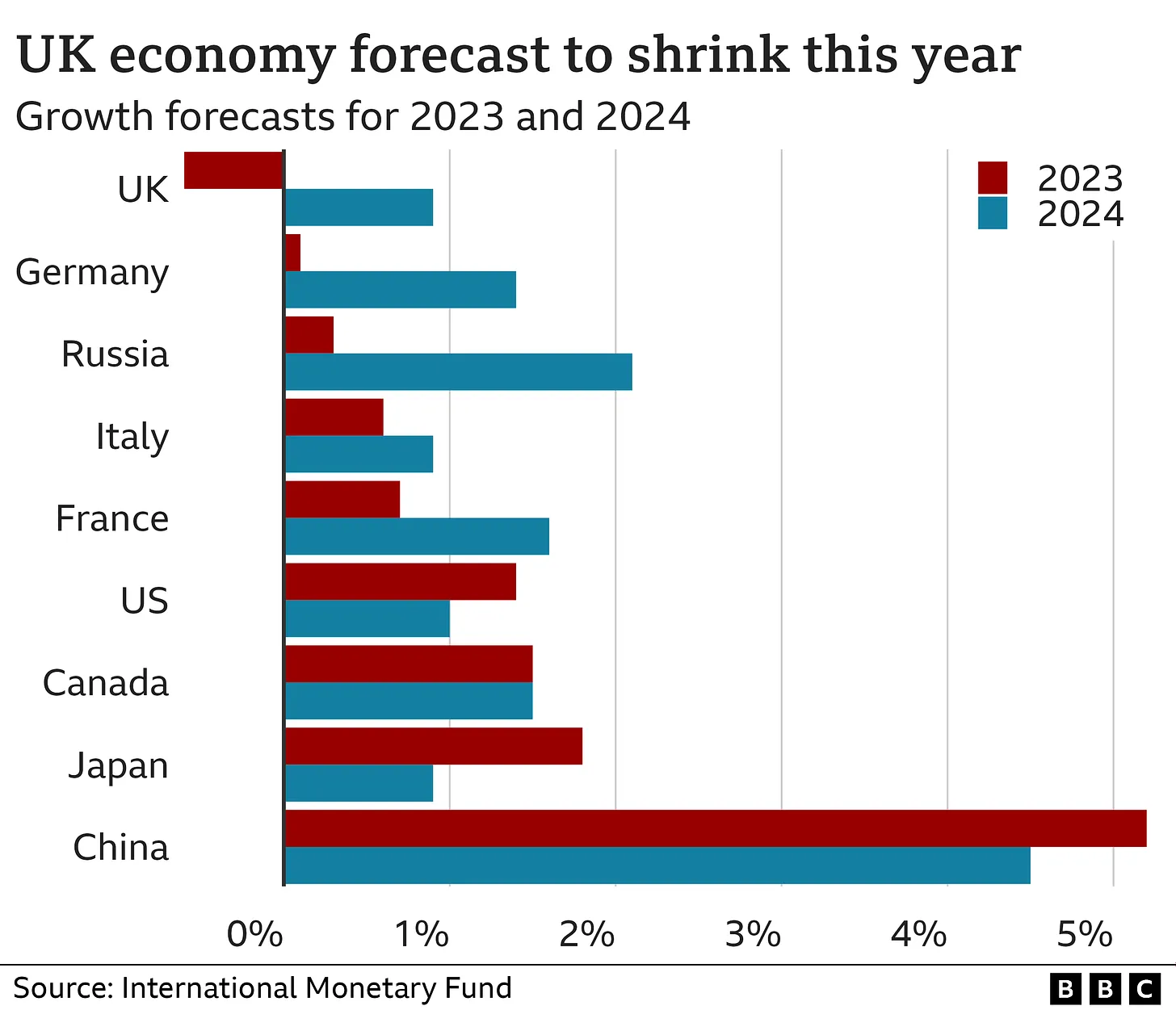

Today, the IMF downgraded the UK's 2023 growth forecast by more than any other G7 nation. Many MSM headlines state that the UK will suffer more than sanction-hit Russia. Shock!

Why is this? Lockdowns, borrowing and policies are major factors but so is the UK’s over-reliance on the financial sector.

Most people gush over how great the City of London is and how much wealth it brings to the country but the reality is very different.

Learning about how banks operate and where money comes from was an eye-opener to me. I properly delved into the mechanics of it all during the Great Financial Crash in 2007/2008. I wondered why I had never been taught this stuff at school or university. Even worse, why did 99% of City workers not understand the system they were participating in!?

In the video interview below, Professor Richard Werner does a great job at explaining what happens in the banking system, why it is destructive and what needs to change. Topics covered include:

Most people gush over how great the City of London is and how much wealth it brings to the country but the reality is very different.

Learning about how banks operate and where money comes from was an eye-opener to me. I properly delved into the mechanics of it all during the Great Financial Crash in 2007/2008. I wondered why I had never been taught this stuff at school or university. Even worse, why did 99% of City workers not understand the system they were participating in!?

In the video interview below, Professor Richard Werner does a great job at explaining what happens in the banking system, why it is destructive and what needs to change. Topics covered include:

• What deposits really are;• What loans really are;• How money is created out of thin air;• How this creates asset bubbles and inflation; and• What regulations are required to stop this.

I have summarised his main points below and the video is at the bottom of the page.

Private debt in the UK (as a percentage of GDP) never went above 50% and remained relatively flat until Thatcher came into power in 1979. It then rose to almost 200% before the Great Financial Crisis in 2008.

GDP is calculated by adding up value-added activities. This is the problem with the financial sector – what is the value added? It is so difficult to work out the value added by the financial sector that a fictional value is made up and added onto GDP. The difficulty in calculating the figure is because essentially there is no value added, only value extracted and so in reality, it should be deducted from GDP.

Textbooks show banks as financial intermediaries, however the problem is we pay a high price for these services. Furthermore, people working within the banking sector earn very high salaries for something that should just be an intermediary service.

There is a structural problem, especially in the UK, with the concentration of the banking sector. In the UK, five banks account for 90% of deposits which is one of the most concentrated banking systems in the world. In Germany, that figure is 12% and 70% of deposits are accounted for by 1,500 small, local, not-for-profit banks.

When corporations get too big, too many decisions are made without accountability and the temptations of power strike. Large banks focus on large customers and large deals so that they can get large bonuses. What is needed in the UK is decentralisation and the creation of small, community banks which can be held accountable.

Please go to Truth Talk to continue reading.

Private debt in the UK (as a percentage of GDP) never went above 50% and remained relatively flat until Thatcher came into power in 1979. It then rose to almost 200% before the Great Financial Crisis in 2008.

GDP is calculated by adding up value-added activities. This is the problem with the financial sector – what is the value added? It is so difficult to work out the value added by the financial sector that a fictional value is made up and added onto GDP. The difficulty in calculating the figure is because essentially there is no value added, only value extracted and so in reality, it should be deducted from GDP.

Textbooks show banks as financial intermediaries, however the problem is we pay a high price for these services. Furthermore, people working within the banking sector earn very high salaries for something that should just be an intermediary service.

There is a structural problem, especially in the UK, with the concentration of the banking sector. In the UK, five banks account for 90% of deposits which is one of the most concentrated banking systems in the world. In Germany, that figure is 12% and 70% of deposits are accounted for by 1,500 small, local, not-for-profit banks.

When corporations get too big, too many decisions are made without accountability and the temptations of power strike. Large banks focus on large customers and large deals so that they can get large bonuses. What is needed in the UK is decentralisation and the creation of small, community banks which can be held accountable.

Please go to Truth Talk to continue reading.

A useful read:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.