In the "new abnormal," this coming financial reset is for oligarchs who run their financial and economic system and it is quite clear they don't need you. They have forced you to wear a mask because you as an individual who have submitted to wearing a mask in their eyes are a "walking biohazard." After the collapse of the financial system, the central bankers will likely institute their planned cryptocurrency. The downward pressure being exerted by the oligarch class is going to become extremely dangerous for all of us in the short term. Here is the bottom line: You either "reset" yourself, or the globalist network of organizations controlled by the oligarch class will do the resetting for you.

________

Source: Fox40

Washington state town prints own wooden currency for coronavirus relief

Thursday, 9 July 2020

Washington state town prints own wooden currency for coronavirus relief A small town in Washington state has been printing its own wooden currency to help residents and businesses navigate the economic pressures of the coronavirus pandemic.

Tenino, a town of fewer than 2,000 people about 60 miles southwest of Seattle, began printing wooden $25 banknotes on an old printing press for the first time since 1931 – the wake of the Great Depression.

"It was kind of an epiphany: Why don't we do that again?" Mayor Wayne Fournier told Reuters. "It only made sense."

The Tenino banknotes are about the size and thickness of an index card. The currency is painted green with an image of George Washington and the Latin phrase "Habemus autem sub potestate," or "We have it under control," printed in cursive.

In an effort to help residents and local merchants alike get through the economic fallout of the coronavirus pandemic, the small town has issued wooden currency for residents to spend at local businesses, decades after it created a similar program during the Great Depression. (AP Photo/Ted S. Warren)

The town council in April approved a measure to issue up to $10,000 in available funds, according to the outlet, and received an extra $6,000 in donations toward the wooden bills.

Residents who have documented loss of income due to the pandemic are eligible for up to $300 a month in the wooden currency, the outlet reported.

Nearly all businesses in the town are accepting the local bills, from the gas station to grocery store, although it cannot be used to buy alcohol, tobacco or marijuana, the Associated Press reported.

Please go to Fox40 to read the entire article.

Source: RT News

'The world is going back to a GOLD STANDARD as the US dollar is about to collapse' – Peter Schiff

@GettyImages

July 20, 2020

As the world grapples with Covid-19, precious metals' prices are pushing higher. Massive moves in gold and silver are coming, according to veteran stockbroker Peter Schiff.

He says silver may hit $50 per ounce. The rally will be short-lived, however, with Schiff describing the metal as "the new bitcoin."

The rise in gold and silver price is "about to explode" and this is just the beginning of a much bigger move, according to Schiff.

"We're barely getting started," the CEO of Euro Pacific said in his podcast. He explained that is also coinciding with what's happening to the US dollar, because gold is the greenback's "principle competitor" when it comes to reserve assets.

Silver is up more than 13% so far today, while #Bitcoin is barely up 2%. #Silver is the new Bitcoin, except with direct utility. So while Bitcoin bugs are dreaming about Bitcoin going to the moon, they are missing the real life moonshot in silver.— Peter Schiff (@PeterSchiff) July 22, 2020

"The US dollar is about to collapse and when it does, gold is going to take its place. The bottom can drop out of the dollar any day, and gold could go through the roof any day. So, this is a real race and you have to get out of the dollar before it's too late," Schiff said.

Please go to RT News to read the entire article.

________

Source: Real Currencies

The Crunch Is Back, There's Going To Be A Gold Standard, And It Will Be Disastrous

by Anthony Migchels | October 14, 2019

(Left: Mark Carney, top Kingpin of the vipers enslaving and destroying the West and the World.)

There we have it folks. The next round in the Crunch is here, and Central Banks have suddenly started saying that a Gold Standard will be necessary to start anew.

The Gold Standard will force an excruciating deleveraging, austerity, deflation, and depression, and bring immense pain to the masses.

The Real Populists have been warning against the coming Gold Standard as the Banker Master Plan to destroy America for decades. The Libertarians in the Truth Movement have a lot of explaining to do, for continuing selling the Banker Plan to the uninitiated.

By Anthony Migchels, for HenryMakow.com

Consider the events of the last few weeks.

First Mark Carney, boss of the Bank of England makes an incredible speech, simply announcing the end of the US Dollar's reserve currency status, and succession by an IMF generated and controlled World Reserve Currency. He went on to say the coming crises would be used to facilitate the transition.

Then two weeks ago, the FED's repo rate suddenly spiked to 10% (!!). It's supposed to be sitting at about 0%. The Banks weren't lending to each other, that's what caused the crisis. The FED had to dole out $75 Billion to get things under control.

Then over the weekend, the FED suddenly announced it would start Quantitative Easing 4.0, even though they don't want to call it that, as they don't want to admit the gravity of the situation. But it was pretty much an open secret that it would be inevitable.

And now major Central Banks are saying that we will need a Gold Standard after a reset.

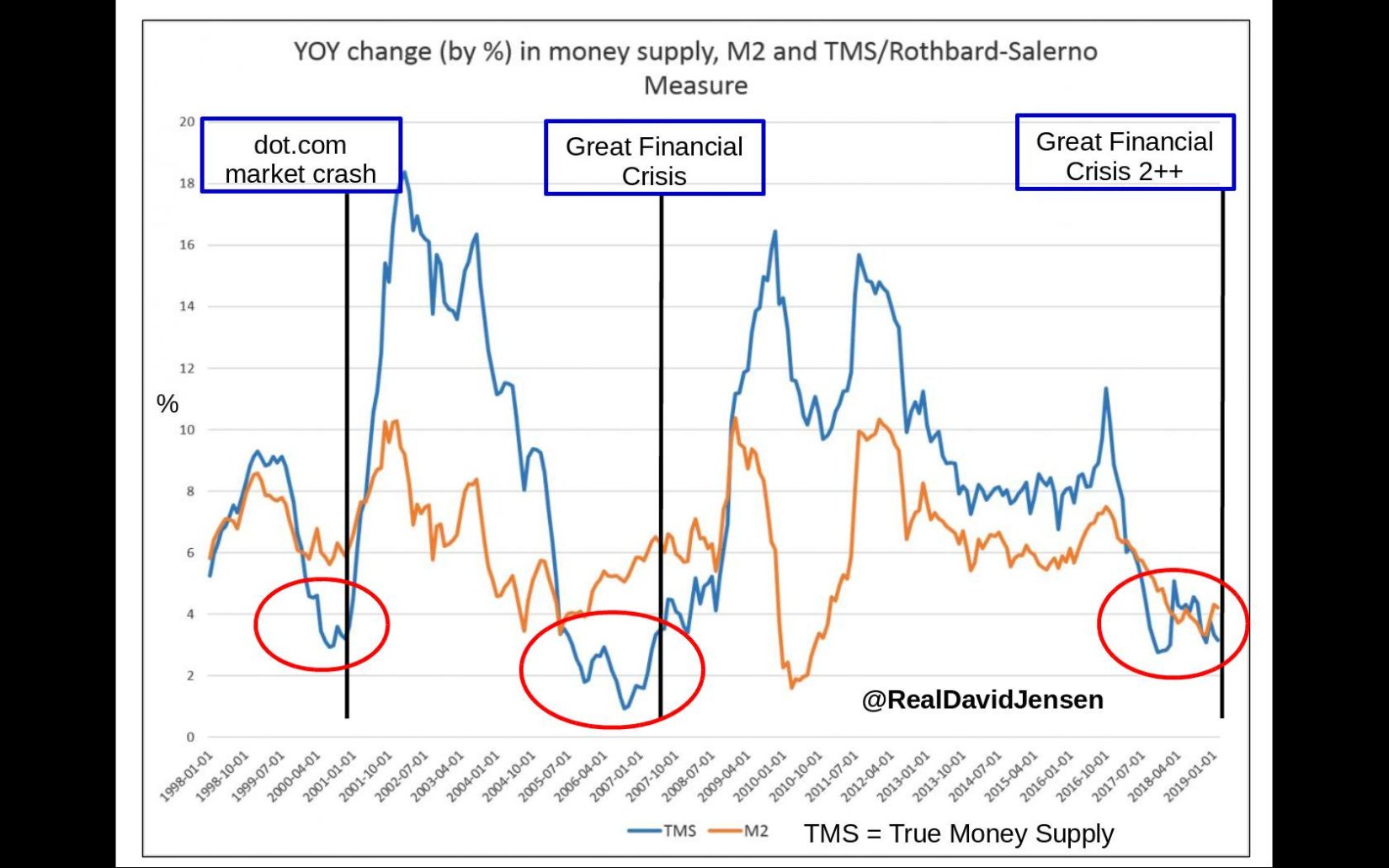

Now have a look at this graph, courtesy David Jensen:

This is the trend of M2 growth over the last few decades. As you can see, the money supply has stopped growing, while it needs to grow quite substantially to keep the interest-charges payable. As a result, there is less and less money available in the real economy, and this is hammering economic activity.

It is the result of the FED's tightening policies, raising rates and so called 'tapering', taking the cash they injected to keep things going after the 2008 crash out of the economy again.

As we can see, the results have been disastrous. We're now at 2008 levels of money growth, and a major crash is all but unavoidable, and has already begun.

Of course, this is not caused by 'incompetence'. The FED knows exactly what it has been doing, and many commentators have been pointing it out. Even Trump was on their case about it. In fact, it must have been quite unnerving for them, to do it while all the initiated saw it clear as day. On the other hand, the effects of this must not be overstated. It's over for the FED, they will be soon replaced. They will get the blame for everything, and everybody hates their guts, and the FED's owners have had their successor ready for a very long time now. The real managers and owners of the System will of course remain the same, they're just conveniently changing their vehicle, as they have so many times, in so many countries throughout Modernity.

The Coming Gold Standard

The Bankers have routinely switched between Gold and Credit based systems, and it's always the same: credit if they want to create debt and inflate, Gold Standards, when they want deflation and associated depression. They went paper based money in 1914, to finance the War. Their man Winston Churchill reinstated the Gold Standard for the Bankers in 1925. It duly led to scarcity of money, and a terrible crash. Germany left the Gold Standard in 1931, but only under Hitler and Schacht did the economy get reflated, something that only happened in the US and Britain when the War started.

After the War, all currencies were tied to the Dollar, which in turn could be converted into Gold. This was mainly to drain America’s Gold Reserves, and this worked like a charm. When America lost most of its Gold, it closed the Gold window, and since then Gold convertibility was over. And now it’s back to Gold again.

Of course, the Gold Standards of the 19th Century were all Rothschild controlled: Rothschild controlled the Bank of England, which ruled through the Pound Sterling as World Reserve Currency. The same people are obviously behind the FED, and the coming Gold Standard.

The Twenties are going to be terrible. The West's free fall will escalate. America is the main target and will get hit beyond belief. Before the decade is over, the American Empire will be gone: they simply won't be able to afford these 800 foreign bases and $1 Trillion fighter gadgets, and $8 Trillion Middle Eastern extravaganzas anymore.

But rest assured the Pentagon will demand Social Security, State Pensions, and Food Stamps must go first. And that they will get their way.

The Empire's demise will leave a huge power vacuum, and will create only vastly more chaos all over the World.

Please go to Real Currencies to read the entire article.

________

Destroying the myth of the "gold backed" fiat currency...

Related:

Banking as a Public Utility – with Ellen Brown

Monetary Reform

Game On!

The EU's €1.1 trillion budget and €750 billion bailout prove you can never taper a Ponzi scheme

Central Bank Issues Stunning Warning: "If The Entire System Collapses, Gold Will Be Needed To Start Over"

Webinar, Center for Global Justice, "Why Banking Needs to Be Run as a Public Utility"

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.