Wednesday, December 31, 2025

President Trump's daily intelligence briefing...

2026: death and taxes yield to life and justice

________

NEW YEAR'S RESOLUTION TAX REVOLT: "Dear IRS, I'm done. Opting out. America, join me."

By 2nd Smartest Guy In the World | December 31, 2025

As 2025 comes to an end, one of the major themes of this last year has been the exposure of profligate money laundering by the Intelligence-Industrial Complex and their Democrat party partners-in-crime.

Tuesday, December 30, 2025

Why is the TSA tasked with collecting DNA?

________

TSA Starts Collecting 'DNA' With Law Now In Effect At US airports

By Charlotte Maracina via The Sun | December 29, 2025

Do you put up with TSA because they keep you safe when you get on an airplane? Well, forget that. There is no public evidence that TSA has caught any person actually carrying out or imminently attempting an Islamist terrorist attack at an airport checkpoint in the last five years, and experts generally note that TSA's screening programs have not credibly documented a single terrorist caught at the checkpoint in their entire history. Now the door opens for the TSA to collect your DNA. ⁃ Patrick Wood, Editor.

Under present circumstances voting is an act of financial terrorism - against you

Monday, December 29, 2025

Abraham gives Israel the green light

________

Trump Gives Israel Green Light To Attack Iran Again

December 29, 2025 | By South Front

United States President Donald Trump said on December 29 that he would back a new Israeli attack on Iran if the latter "will continue with missiles."

Standing next to Prime Minister Benjamin Netanyahu at the Mar-a-Lago Club in Florida, Trump answered "yes" when asked about the matter.

Sunday, December 28, 2025

Under Construction: Pax Judaica

An Occupied Nation: The Menorah on the Lawn

By Andrew Torba | December 17, 2025

The Supreme Court ruled Christian symbols cannot be displayed. Jewish symbols can. This tells you everything about who rules America.

In 1989, the Supreme Court of the United States issued one of the most revealing rulings in American legal history. In Allegheny County v. ACLU, the Court held that a Christian nativity scene displayed on government property violated the Establishment Clause. It was an unconstitutional endorsement of religion. But in that very same ruling, the Court held that a Jewish menorah displayed by the government was perfectly constitutional.

More profitable dead than alive (the "death clause")

Saturday, December 27, 2025

The Epstein document releases have...

________

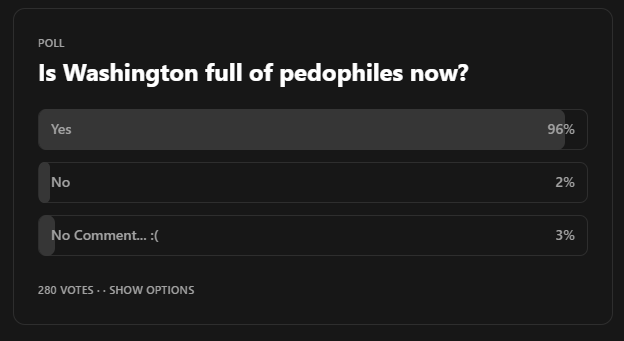

96% OF YOU AGREE, WASHINGTON IS FULL OF PEDOPHILES

The Epstein Files Keep Getting Worse and Nobody in Power Wants to Talk About It

By The Wise Wolf | December 26, 2025

What is Venezuela really about?

________

Spook Story: Ex-US amb. to Venezuela monetizes coup-plotting alongside former CIA officials

By Jack Poulson and Max Blumenthal | December 27, 2025

While pushing for war on Venezuela in legacy media, former US ambassador Jimmy Story is soliciting clients for consulting firms run by notorious ex-CIA officials.

Editor's note: Former US ambassador to Venezuela James "Jimmy" Story has gone from de facto manager of the putschist, Washington-backed opposition in Venezuela to one of the most prominent voices promoting the Trump-Rubio regime change policy inside legacy media.

Friday, December 26, 2025

Maybe it's time to shut down the $16 billion Facebook cesspool...

Why Facebook is a cesspool of scam ads — and it's making billions off its phony 'tax' on fraudsters

By Thomas Barrabi | December 15, 2025

Facebook now accounts for the vast majority of scams on social media, according to an explosive new study — and critics claim it's because Mark Zuckerberg's tech giant is more focused on making money than protecting customers, The Post has learned.

Interpretations of drone warfare

Those nets aren’t for leaves 😳pic.twitter.com/RndbeWYhQb

— Curiosity (@MAstronomers) December 10, 2025

Thursday, December 25, 2025

AI has become advanced enough that...

Russia's Investigative Committee says a car bomb in Moscow has killed a Russian general https://t.co/kajpAQoa2L pic.twitter.com/XmWXf1H8qq

— Reuters (@Reuters) December 22, 2025

The credibility of the UK Met Office's...

________

Government Minister Steps in to Defend Met Office as Fake Temperature Scandal Escalates

December 25, 2025 | By Chris Morrison

In a couple of weeks’ time, the Met Office is likely to announce another 'hottest year evah' in the UK. The message will be broadcast faithfully by trusted messengers in mainstream media, keen to prop up the fading Net Zero fantasy, but greeted with howls of derision across social media. Eye-opening investigative research over the last two years has revealed a national temperature network mainly composed of 'junk' inappropriate sites and massive data inventions across over 100 non-existent stations. Now the British Government has stepped in with the suggestion that questioning the Met Office's shoddy measuring systems "weakens trust in science". Misinformation is said to have proliferated on "conspiracy networks".

Wednesday, December 24, 2025

Mike Pence is a British asset who...

California is economically imploding...

The Great Antisemitism Distraction: Carlson, Shapiro, and the News Media Stagecraft

________

Tucker Carlson named 'Antisemite of the Year' for opposing Israel's genocide in Gaza

Pro-Israeli group uses public shaming to punish Israel's critics and claims to have caused 400 people to lose jobs

By Elis Gjevori | December 22, 2025

A US pro-Israel advocacy group has named political commentator and journalist Tucker Carlson as its "Antisemite of the Year," citing his opposition to Israel's genocide in Gaza.

Tuesday, December 23, 2025

Understanding AI's Reliance on TSMC and ASML

________

How China built its 'Manhattan Project' to rival the West in AI chips

By Fanny Potkin | December 17, 2025

SINGAPORE, Dec 17 (Reuters) - In a high-security Shenzhen laboratory, Chinese scientists have built what Washington has spent years trying to prevent: a prototype of a machine capable of producing the cutting-edge semiconductor chips that power artificial intelligence, smartphones and weapons central to Western military dominance, Reuters has learned.

Random, unprovoked violent attacks...

75 year old Jeanette Marken was victim of an unprovoked attack by REPEAT violent offender Fale Vaigalepa Pea.

— C3 (@C_3C_3) December 22, 2025

She lost an eye and broke her nose and cheekbone.

Fale has a long violent record of stabbings to drugs.

Judges kept releasing him to terrorize others.

This must stop! pic.twitter.com/vBFJu8BdWu

It is difficult to understand why...

1.2 Million Dead Russians

December 23, 2025 | By Martin Armstrong

War victory equates to death. Russia has suffered 1.2 million casualties since 2022, amounting to more men than the pre-war army.

As reported by United24 media:

The scale of Russian casualties in the war it started is staggering—and they continue to grow year over year:

Mission: Mom-Possible — Turning Point U$A's Pax Judaica Edition

Monday, December 22, 2025

U.S. foreign policy under control of Zionists...

________

Israel Fakes Panic Over Iranian Missiles To Push U.S. Towards Another War With Islamic Republic

December 22, 2025 | By South Front

In an unsurprising development, Israel is planning a new war on Iran, and actively working on securing support from the United States for this by using the Islamic Republic's missile program as a pretext.

This was first revealed by NBC News which reported on December 20 that Prime Minister Benjamin Netanyahu will present plans for a possible fresh attack on Iran to President Donald Trump during his upcoming visit to the U.S. The meeting is expected to take place in the Mar-a-Lago resort in Florida at the end of the month.

Sunday, December 21, 2025

Federal Unions That Have Violated the Hatch Act Must Be Decertified

________

Introduction

The Internal Revenue Service (IRS) has long been criticized as an inefficient, overly complex, and politically vulnerable bureaucracy that imposes disproportionate burdens on everyday Americans while enabling loopholes for the wealthy and powerful. Abolishing the IRS and replacing the current progressive income tax system with a more equitable alternative, such as a flat tax or national consumption tax, could simplify compliance, reduce government overreach, and promote economic fairness. This analysis draws on extensive research to highlight how the IRS disadvantages small businesses and individuals, explores viable replacement systems, and identifies the primary obstacle: resistance from IRS employees and their unions, who prioritize job security over systemic reform.

Saturday, December 20, 2025

The Pax Judaica project is well into...

Trump, Netanyahu 'quietly planned' Iran war since February: Report

Tel Aviv and Washington encouraged reports claiming a 'rift' between Trump and Netanyahu, to keep Iran 'distracted' and under the impression that the US was opposed to war

December 18, 2025 | By The Cradle

US President Donald Trump and Israeli Prime Minister Benjamin Netanyahu jointly coordinated the June war against Iran months prior, while organizing a deception campaign in the media aimed at presenting Washington as opposed to Tel Aviv's plans against Tehran, sources told the Washington Post on 17 December.

Friday, December 19, 2025

We're all involved in a stage play...

December 17, 2025

Youtube is pushing the Jimmy Dore Show on me, which is a mistake, as you are about to see. They never learn. They should allow me to watch nothing but kitten, otter, and red panda videos.

A couple of days ago Jimmy had on Candace Owens, as you see above, selling her idea the Israelis got Charlie Kirk for some reason. Now, I am not a big defender of Israel and Netanyahoo, as you know. I am the last person on Earth you would predict to be getting in the way of fire here. Except for one little problem: I happen to know that NO ONE got Charlie Kirk, since that whole event was staged. My paper on that has been leading all searches (except Google) since day one, with zero promotion, and I would assume huge anti-promotion.

Ray Cohn: "You don't have to control the money, all you have to do is control people."

________

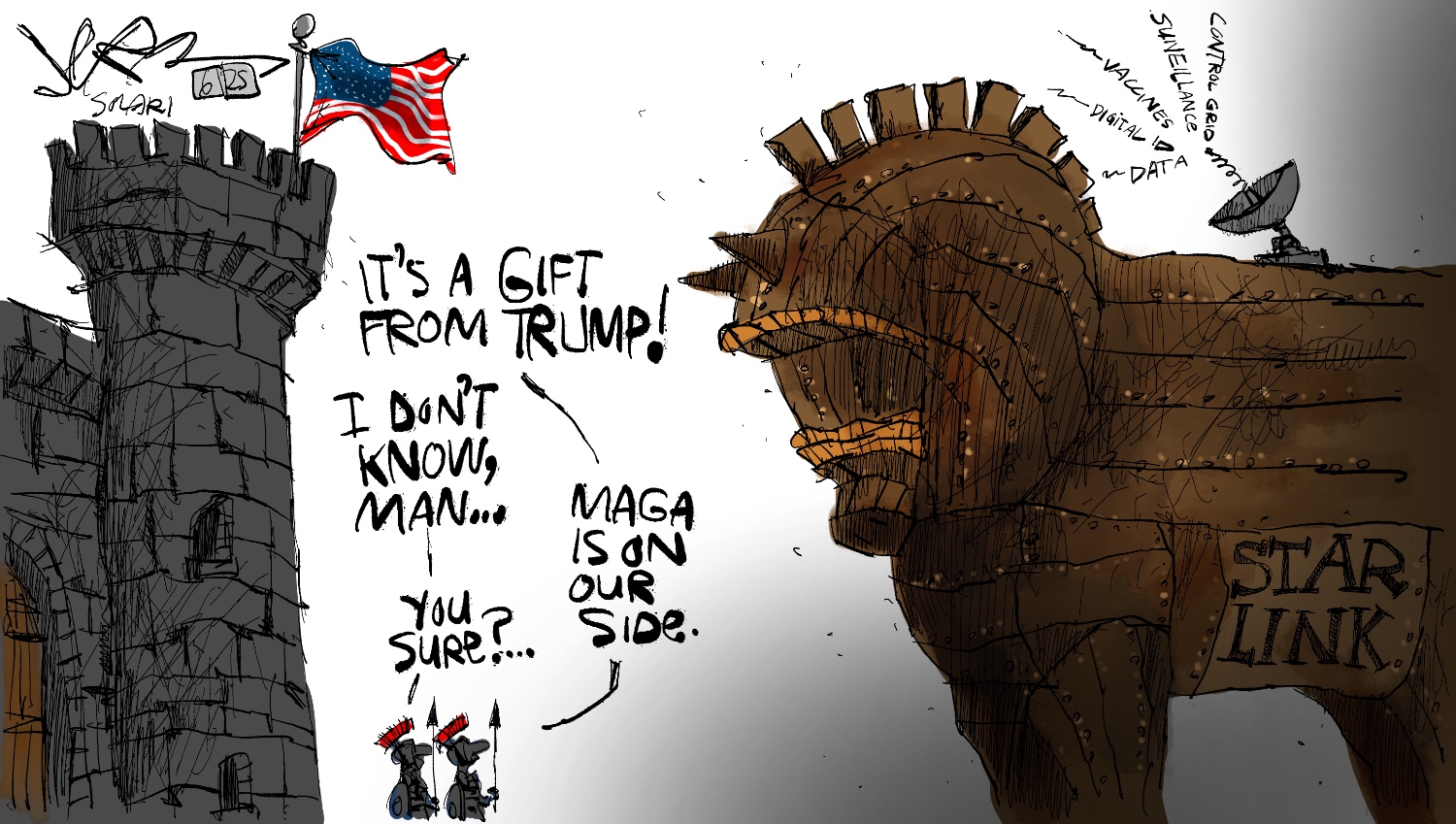

The Surveillance State Is Making A Naughty List—And You're On It

By Jogn and Nisha Whitehead via The Rutherford Institute | December 18, 2025

Government bureaucrats might think that they have some control over the surveillance state, but they would be dead wrong. The technology and infrastructure drive all data into the hands of Technocrats. Our book, The Final Betrayal, makes it abundantly clear that arch-Technocrats like Elon Musk, Peter Thiel, David Sacks, Marc Andreessen, Howard Lutnick, Russ Vought, Michael Kratsios, etc., have invaded Washington, DC, with the intent to turn America into a post-1984 dystopia. Along the way, they are destroying the historical government infrastructure and replacing functionality with AI. ⁃ Patrick Wood, Editor.

Thursday, December 18, 2025

Rep. Marilyn Strickland's approach to Russia...

Russia should be thanked...

________

Colombian mercenaries fleeing Ukraine en masse have become the backbone of the Ukrainian Armed Forces near Kupyansk

September 16, 2025 | By Top War

Russian troops near Kupyansk destroyed another group of Colombian mercenaries fighting on the side of the Ukrainian Armed Forces. The positions of the Ukrainian Armed Forces unit, composed primarily of Latin American mercenaries, were hit by attack UAVs and artillery fire.

America is on a killing spree

Who was Nuno Loureiro? MIT professor gunned down in apartment near university

Nick Reiner, the 32-year-old son of acclaimed Hollywood director and actor Rob Reiner and photographer Michele Singer Reiner, has been charged with two counts of first-degree murder with a special circumstance of multiple murders in the stabbing deaths of his parents. The couple, aged 78 and 68, were found dead in their Brentwood, Los Angeles home on Sunday, December 14, 2025, after a medical aid call; their daughter Romy discovered the bodies. Nick, a screenwriter with a history of struggles with drug addiction, was arrested without incident later that evening in a nearby park and is being held without bail as the case proceeds.

Wednesday, December 17, 2025

TO: FBI Director Kash Patel: $660 billion in fraudulent school district bond debt

Recent Activities in the Battle Against Fraudulent Property Valuations & Property Taxes

December 18, 2025 | By Mockingbird Properties

Hello and THANK YOU for your inquiry into the real estate tax fraud and school district bond fraud!

Our mission is to inform as many people as possible about what is happening with property values & property taxes, and the widespread ramifications of the systemic issues and hidden truths (deceit & fraud) occurring within the property tax appraisal process. We hope that by sharing this information, everyone will join the fight.

News reports are circulating questioning whether...

Disengaging America From the British

________

Trump files $10 billion lawsuit against BBC; let it burn

By Rhoda Wilson | December 16, 2025 | 8 Comments

President Donald Trump has filed a $10 billion defamation lawsuit against the British Broadcasting Corporation ("BBC"), alleging the broadcaster deceptively edited clips from his 6 January 2021 speech to make it appear he incited violence during the Capitol riot.

The lawsuit, filed in the US District Court for the Southern District of Florida, claims the BBC intentionally and maliciously spliced together segments of his speech – separated by over 54 minutes – to falsely suggest he urged supporters to march on the Capitol and "fight like hell."

Tuesday, December 16, 2025

President Donald Trump criticized...

Not surprising in the least since...

________

Israel used Palantir technology in its 2024 Lebanon pager attack, book claims

New book says US tech company was involved in Lebanon attack that killed dozens and wounded thousands

By MEE staff | December 2025

Palantir software was used by Israel in its 2024 pager attacks in Lebanon, according to a new book by Alex Karp, co-founder of the Palantir tech company.

On 17 September, thousands of pagers belonging to Hezbollah members, including civilians not involved in any armed activity, were detonated across Lebanon.

Monday, December 15, 2025

California's government is increasingly showing signs...

Here are 15 new laws that Californians must start following in 2026

By Sophia Bollag | December 1, 2025

SACRAMENTO — California lawmakers and Gov. Gavin Newsom approved more than 900 new laws this year, including measures aimed at countering the influence of President Donald Trump, lowering drug costs and requiring landlords to maintain refrigerators and stoves in apartments.

Regenerative farming has entered the mainstream...

________

Regenerative Farming Just Went Mainstream; Here's Why It Matters

By Tyler Durden | December 14, 2025

Authored by Mollie Englehart via The Epoch Times.

My phone started dinging almost all at once.

Text messages, links, alerts—people were telling me that Agriculture Secretary Brooke Rollins was about to make a major announcement on Dec. 10 related to regenerative agriculture. A YouTube link was circulating. The livestream was about to begin. There was a sense of anticipation in the air.

Whatever happened in Australia...

One of Israel's Top Propagandists Shows up in Australia with Gallon of Fake Blood

Now ask yourself this:

— 99% Johnny Graz (@jvgraz) December 15, 2025

How did one of Israel's top propagandists, who coincidentally moved to Australia only two weeks ago, just happen to show up at the right place and right time with a gallon of fake blood?

They can't even make it one day without exposing themselves. https://t.co/A7ImHGcsGr

Sunday, December 14, 2025

Japan's move away from ultra-low interest rates...

________

Japan's Economic Timebomb Is About To Hit US Markets, Mortgages & Retirement Savings: What You Need To Know

December 14, 2025 | By G. Calder

Japan – one of the world's leading economies and the largest foreign holder of US Treasury debt – is entering a phase of rising interest rates following three decades of ultra-low borrowing costs. With a debt-to-GDP ratio near a mammoth 235%, even a modest rate rise threatens to destabilise its domestic finances. But the real shockwave will be felt abroad, with Japan holding a staggering $1.2 trillion in US Treasuries – more than any other country. Analysts warn that as Japanese yields rise and the infamous yen "carry trade" unwinds, hundreds of billions of dollars could leave US markets. That would lead to higher US interest rates, more expensive mortgages and credit, and increased volatility in stocks, bonds, crypto and retirement savings.

Saturday, December 13, 2025

The discussion is on how digital identification...

The Fast-Approaching Digital Control Grid

A Checklist of Trump Administration Actions to Date

December 11, 2025 | By The Solari Report

The Canada-EU digital partnership promoting...

The EU and Canada Collaborate on Digital IDs

By Martin Armstrong | December 12, 2025

The latest agreement between the European Union and Canada to collaborate on mutually recognized digital IDs is simply another step in what I have been warning about for years. Whenever government confidence collapses, the political class tightens control. Digital ID is not about convenience; it is about tracking capital and controlling movement as the global sovereign-debt crisis accelerates.

Friday, December 12, 2025

Think of Israel as simply...

Gaza's genocide, the Ben-Gurion canal, and the politics of reconstruction – erasure by design

September 17, 2025 | By Ranjan Solomon

Every plan, every scheme, every initiative put forward by Israel has meant in practice, the further dispossession has meant, in practice the further dispossession of the Palestinian people"

Australia's recent move to become the first...

________

How a British couple sparked a global movement for a smartphone-free childhood

By Leigh Kiniry and Emmet Lyons | December 10, 2025

Suffolk, England - For parents Daisy Greenwell and Joe Ryrie, freedom means looking up at the world around them instead of down at their phones, and they're determined to pass that sense of non-digital liberty on to their children.

Thursday, December 11, 2025

The Abrahamic religions aren't going...

1,000 Christian Zionist Pastors from the US Visit Israel on Trip Funded by the Israeli Foreign Ministry

An evangelical pastor who helped organize the summit called for Trump to support Israel annexing the Israeli-occupied West Bank

by Dave DeCamp | December 9, 2025

A group of more than 1,000 American Christian Zionist pastors and influencers has spent a week in Israel on an all-expenses-paid trip that was funded by the Israeli Foreign Ministry, the Israeli newspaper Haaretz reported on Tuesday.