Source: Simply Wall St

These 4 Measures Indicate That ASML Holding (AMS:ASML) Is Using Debt Safely

Simply Wall St | May 07, 2023

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, ASML Holding N.V. (AMS:ASML) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does ASML Holding Carry?

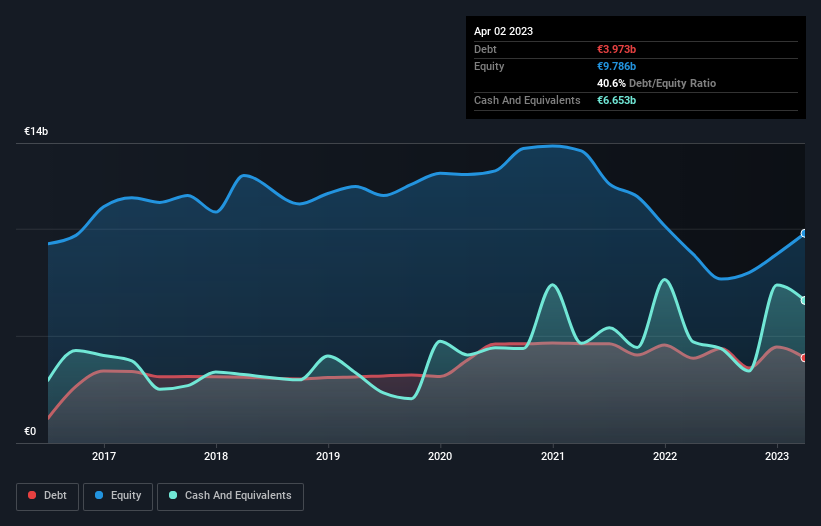

As you can see below, ASML Holding had €3.97b of debt, at April 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have €6.65b in cash offsetting this, leading to net cash of €2.68b.

A Look At ASML Holding's Liabilities

We can see from the most recent balance sheet that ASML Holding had liabilities of €16.9b falling due within a year, and liabilities of €8.41b due beyond that. On the other hand, it had cash of €6.65b and €5.29b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €13.4b.

Given ASML Holding has a humongous market capitalization of €231.1b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, ASML Holding also has more cash than debt, so we're pretty confident it can manage its debt safely.

Please go to Simply Wall St to continue reading.

These 4 Measures Indicate That ASML Holding (AMS:ASML) Is Using Debt Safely

Simply Wall St | May 07, 2023

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, ASML Holding N.V. (AMS:ASML) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does ASML Holding Carry?

As you can see below, ASML Holding had €3.97b of debt, at April 2023, which is about the same as the year before. You can click the chart for greater detail. However, it does have €6.65b in cash offsetting this, leading to net cash of €2.68b.

ENXTAM:ASML Debt to Equity History May 7th 2023

A Look At ASML Holding's Liabilities

We can see from the most recent balance sheet that ASML Holding had liabilities of €16.9b falling due within a year, and liabilities of €8.41b due beyond that. On the other hand, it had cash of €6.65b and €5.29b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by €13.4b.

Given ASML Holding has a humongous market capitalization of €231.1b, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. While it does have liabilities worth noting, ASML Holding also has more cash than debt, so we're pretty confident it can manage its debt safely.

Please go to Simply Wall St to continue reading.

________

Warren Buffet on TSMC. So why did Berkshire Hathaway sell some of its TSMC shares?

This is what it will take so we're being told to protect Taiwan, sorry, we mean TSMC. Taiwan gets some free shit. What's the trade off we're not being told because nothing is free in this world?

Related:

Outside of oil, gas and drugs, the microprocessor market is probably one of the biggest markets in the world and expected to only increase:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.