By Pam Martens and Russ Martens: November 12, 2021 ~

When it comes to sycophants, Wall Street has no shortage of them willing to shill for its egregious private justice system called mandatory arbitration – a system which systematically guts the guarantee of a jury trial under the Seventh Amendment of the Bill of Rights. Think about that carefully, the industry that is serially charged with rigging markets and other felonious acts, is allowed by Congress to run its own privatized justice system. This is something one would expect to find in a banana republic, not in a country that lectures the rest of the world on democratic principles.

Wall Street's private justice system effectively locks the nation's courthouse doors to both its workers and customers, sending the claims before conflicted arbitrators who do not have to follow legal precedent, case law or write legally-reasoned decisions.

One of Wall Street's serial toadies, the U.S. Chamber of Commerce, was quick to release a statement on March 8 when it learned that the House of Representatives was likely to vote on and pass H.R. 963, the "Forced Arbitration Injustice Repeal (FAIR) Act." (Last week the House Judiciary Committee voted favorably to move the bill out of Committee and on to the full House for a vote. The bill currently has 201 co-sponsors.)

Neil Bradley, Executive Vice President of the Chamber, had this to say in March:

"The U.S. Chamber of Commerce strongly opposes H.R. 963 / S. 505, the 'Forced Arbitration Injustice Repeal (FAIR) Act'… Members who do not cosponsor this legislation will receive credit for the Leadership component of their 'How They Voted' rating.'"If that sounds to you like a threat to members of Congress that they will lose corporate campaign funding if they vote for passage of the bill, you're thinking along the right lines.

Bradley added this preposterously bogus statement: "Arbitration is a fair, effective, and less expensive means of resolving disputes compared with going to court."

The speciousness of that last statement by Bradley has now been revealed by a study released by the American Association for Justice on October 27. The study found the following:

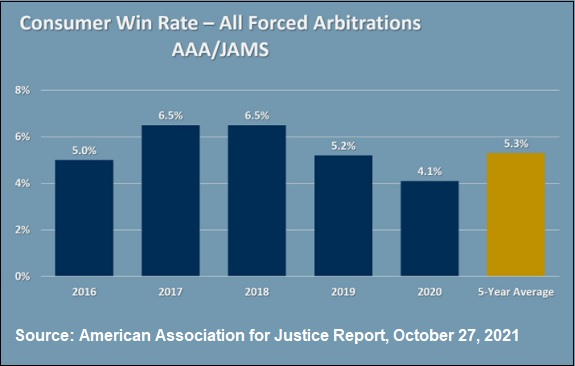

"In years past, consumers were more likely to be struck by lightning than win a monetary award in forced arbitration. In 2020, that win rate dropped even further. Just 577 Americans won a monetary award in forced arbitration in 2020, a win rate of 4.1% — below the five-year-average win rate of 5.3%. For employees forced into arbitration, the likelihood of winning was even lower. Despite roughly 60 million workers being subject to forced arbitration provisions at their place of employment, just 82 employees won a monetary award in forced arbitration in 2020."Wall Street is the only industry in America that has for decades contractually banned both its customers and its employees from utilizing the nation's courts for claims against the Wall Street firm as a condition of opening an account or getting a job there.

Instead of being able to go to court with a claim of fraud if you’re a customer, or a claim for labor law violations, like failure to pay overtime or sexual harassment if you're an employee, Wall Street makes its customers and employees sign an agreement to take all such claims into an industry-run or privately-run arbitration system. The above graphic from the study by the American Association for Justice shows how claimants faired in mandatory arbitration forums run by the American Arbitration Association (AAA) and JAMS. The findings cover a broad range of industries, not just Wall Street.

These private justice systems are certainly not fair, and on Wall Street, they are far from cheap. Fees to claimants can run into tens of thousands of dollars as opposed to a few hundred dollars to file in court. Study after study has found that arbitrators most often rule in favor of the corporate interest over the consumer because the arbitrators are financially dependent on repeat business from these corporations.

What Wall Street and its army of lawyers like most about this private justice system is its darkness. Unlike a public courtroom, the press and the public are not allowed to attend the hearings. There are no publicly available transcripts of the hearings as there would be in court. It is next to impossible to bring a court appeal of an arbitration ruling because Wall Street’s biggest law firms have spent decades convincing the courts that these arbitration decisions must be permanently binding.

Another fatal flaw for claimants in these private justice systems is that there is no jury selection from a large public pool of random citizens but rather a repeat-player pool of highly compensated arbitrators.

In September 2007, Public Citizen published a comprehensive 74-page study of mandatory arbitration with a central focus on the National Arbitration Forum. The report is titled "The Arbitration Trap." Among its findings related to the National Arbitration Forum, Public Citizen found that in California between January 1, 2003 and March 31, 2007 "…a small cadre of arbitrators handled most of the cases that went to a decision. In total, 28 arbitrators handled 17,265 cases – accounting for a whopping 89.5 percent of cases in which an arbitrator was appointed – and ruled for the company nearly 95 percent of the time…Topping the list of the busiest arbitrators was Joseph Nardulli, who handled 1,332 arbitrations and ruled for the corporate claimant an overwhelming 97 percent of the time."

Please go to Wall Street On Parade to read more.

________

You are a debt bondage slave to this Babylonian central banking commercial warfare model:

The Banking System is Responsible for Our Enslavement

The Banking System is Responsible for Our Enslavement

The fed is trapped?

Start hunting:

Hunting The Hunters: Inside The Minds of Elite Corrupt

LaRouche PAC have always advocated for reinstating the Glass–Steagall Act:

Hunting The Hunters: Inside The Minds of Elite Corrupt

LaRouche PAC have always advocated for reinstating the Glass–Steagall Act:

Related:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.