Briefing from United States Marine Field McConnell

Plum City Online - (AbelDanger.net)

August 6, 2015

1. In 2001, the Clinton Foundation allegedly launched a pay-to-play service for women in the hedge-fund industry where loans to selected SBA 8(a) companies would buy them a time-lapse online key to Donald Trump's assassination (contract-killing) betting suites in various international hotel chains.

2. Between 12:41 MYT (16:41 UTC) on March 8, 2014 and the present day, Serco 8(a) protégés have allegedly spot-fixed the location of a flaperon – claimed as from the lost Boeing 777-200ER of MH Flight 370 – and transmitted spot-fix data via a Ladbrokes call center in Kuala Lumpur to Clinton hedge fund guests in Trump assassination-betting suites.

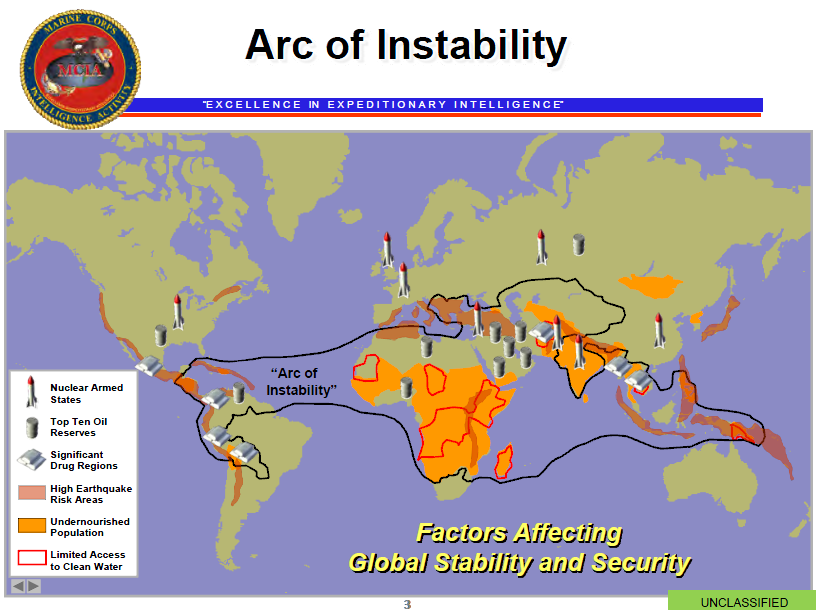

3. In 2015, Field McConnell has notified Joseph Dunford – nominee Chairman of the Joint Chiefs of Staff – of his allegation that Serco's 8(a) protégés have been engaged since 1998 in a Qui tam fraud involving the procurement of the Marine Corps clock and onion router (Tor) for online assassination betting and enrichment of women in hedge funds.

Field McConnell invites readers to refer to his Open Letter to General Joseph Dunford - Treason Against the United States - 18 U.S. Code § 2382 - Misprision of Treason - Government Drug Running - USMC Col. James Sabow's Assassination - US Military Members Are Being Threatened:

Open Letter to General Joseph Dunford - Treason Against the United States - 18 U.S. Code § 2382 - Misprision of Treason - Government Drug Running - USMC Col. James Sabow's Assassination - US Military Members Are Being Threatened

Flaperon arrives in Toulouse courtesy of Serco 8(a) air traffic control supply chain

We apply a consistent procurement process to the selection and use of suppliers. This ensures that we comply with laws and regulations and other requirements applicable to the locations where we operate. It also means that we get maximum value from our spend, whilst meeting customer requirements.

We work collaboratively to deliver sustainable value; maintain the integrity of our procurement process; and drive continuous improvements. To achieve this we apply a consistent procurement process in selecting and using suppliers, so that we:

– manage business and financial risk, derive maximum value from our spend , through appropriate procurement strategies and supplier selection criteria, such as low cost, technically acceptable or best overall value, whilst mitigating risks to business and customer objectives and meeting our customer service requirements

– work collaboratively across all Serco's Divisions and with suppliers to maximise and deliver sustainable value to Serco, maintain the integrity of our procurement process and drive continuous improvements

– comply with laws and regulations and other requirements applicable to the locations in which we operate our business

– reflect our ethical standards and code of conduct throughout our supply chain and ensure that sourcing initiatives are fair and ethical to both Serco and the participating suppliers consider social and environmental and other factors important to our clients and the communities within which we operate in the supply chain

All procurement activity is governed by the Serco Group plc Delegated Approval Authorities. Each Division has a Divisional Procurement and Supply Chain Lead to support effective sourcing and negotiating strategies.

A Procurement and Supply Chain Executive Board oversees the implementation of Procurement and Supply Chain strategy.

Sustainable procurement is our commitment to achieve value for money on a whole life basis in a way that delivers tangible social, environmental and economic outcomes. We expect our suppliers to meet a set of sustainable procurement standards. These are considered when reviewing the overall suitability and performance of suppliers.

Our commitments and required standards are defined in our policy statement and supporting Group Standard.

A Supplier Code of Conduct is made available for suppliers to ensure that they know what is expected of them."

The Boeing Supplier of the Year award is the company's premier supplier honor, presented annually to its top suppliers in recognition of their commitment to excellence and customer satisfaction. This year's 16 winners represent an elite group among more than 17,525 active Boeing suppliers in nearly 52 countries around the world. This selection was based on stringent performance criteria for quality, delivery performance, cost, environmental initiatives, customer service and technical expertise. This is the second time Serco has been recognized as Supplier of the Year by Boeing. In January 2011, Serco also received the Boeing Performance Excellence Gold Award in recognition of the Company's performance excellence.

"We are extremely honored to receive this recognition for our work in support of Boeing. This prestigious award demonstrates our passion for excellence and ability to apply Serco's Enterprise Architecture expertise across a broad range of applications," said Ed Casey, Chairman and CEO of Serco. "We continue to grow our EA practice, and over the past 15 years we have deployed solutions to support enterprises and systems across federal and commercial environments."

Serco's Enterprise Architecture Center of Excellence is based in Colorado Springs, CO. The team provides a variety of services in support of Boeing's business units as well as research and development efforts. Serco’s architecture employs object-oriented (OO)/Unified Modeling Language (UML) to define, design and satisfy defense agencies' mission-critical requirements, including Command, Control, Communications, Computers and Intelligence (C4I). This approach improves system developer's understanding of operational requirements and how best to integrate enterprise operations and systems for the optimal fulfillment of C4I and other operational needs.

About Serco Inc.: Serco Inc. is a leading provider of professional, technology, and management services focused on the federal government. We advise, design, integrate, and deliver solutions that transform how clients achieve their missions. Our customer-first approach, robust portfolio of services, and global experience enable us to respond with solutions that achieve outcomes with value. Headquartered in Reston, Virginia, Serco Inc. has approximately 11,000 employees, annual revenue of $1.5 billion, and is ranked in the Top 30 of the largest Federal Prime Contractors by Washington Technology. Serco Inc. is a wholly-owned subsidiary of Serco Group plc, a $6.6 billion international business that helps transform government and public services around the world. More information about Serco Inc. can be found at www.serco-na.com."

He made the announcement that the SBA would become a cabinet-level agency in front of small-business owners at the White House. The head of the SBA was a cabinet-level position under the Clinton Administration.

The announcement was part of a larger proposal that would combine the SBA with five other government agencies that focus on business and trade.

Those organizations include the Commerce Department's core business and trade functions; the Office of the U.S. Trade Representative; the Export-Import Bank; the Overseas Private Investment Corporation; and the Trade and Development Agency.

These agencies combined would, according to Obama, create a more efficient climate for business development and entrepreneurship. In addition, according to AP, the merger would save the federal government $3 billion over 10 years by eliminating duplicate costs and human resources.

Barry Sloane, CEO of the Small Business Authority, applauded the move. "I think it's constructive for two reasons," he told CNBC.com. "By doing this, Obama is making a statement that small business is important. And, he's making good on his promise of reducing overlapping agencies, which will reduce government spending."

The proposal to merge the agencies must be approved by Congress. If the merger is approved, the SBA would no longer be in the cabinet.

Sloane the SBA has been an engine for recovery from the recession. "Under the Obama Recovery Act, he increased loan size from the SBA from $2 million to $5 million, and increased the amount of government guarantee on those loans, which has been helpful to business owners. This proposal is another acknowledgment of the importance of small business."

House Small Business Committee Chairman Sam Graves (R-MO) said in a statement today that "I look forward to examining the [proposed merger] further, and I hope the President will work very closely with Congress before finalizing any changes."

While he was non-committal on whether he would vote to approve the changes, he said: "Decreasing the size of government and reducing bureaucracy is something that I support in principle, however, it is important that any effort to make significant changes to federal commerce and trade programs be done carefully, and in a way that protects America's small businesses."

"Serco farewell to NPL after 19 years of innovation 8 January 2015 .. During that period under Serco's management and leadership.. .. NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency [GPS remote assassination betting] trading in the City through NPLTime."

"Serco's Office of Partner Relations (OPR) helps facilitate our aggressive small business utilization and growth strategies. Through the OPR, Serco mentors four local small businesses under formal Mentor Protégé Agreements: Three sponsored by DHS (Base One Technologies, TSymmetry, Inc., and HeiTech Services, Inc.,) and the fourth sponsored by GSA (DKW Communications, Inc.). Serco and HeiTech Services were awarded the 2007 DHS Mentor Protégé Team Award for exceeding our mentoring goals." http://www.dtic.mil/whs/directives/corres/pdf/100515p.pdf

"Government still paying G4S and Serco millions for tagging despite ban Alan Travis Home affairs editor

Thursday 25 June 2015 00.01 BST

The Ministry of Justice is still paying security firms G4S and Serco millions of pounds every month for supplying electronic tagging equipment, more than a year after both companies were barred from running the contract.

Both companies faced criminal investigations by the Serious Fraud Office over allegations of overcharging that led to them repaying nearly £180m.

The continuing monthly payments to the two companies were uncovered by an analysis of Ministry of Justice (MoJ) data by the Centre for Crime and Justice Studies which shows that G4S was paid a total of £8.7m between March 2014 – when it lost the tagging contract – and February 2015. Serco was paid £4.5m over the same period.

The electronic monitoring tags are used to enforce curfews on more than 100,000 offenders each year. The outsourcing giant Capita took over the contract on an interim basis in April last year.

In July 2014, Capita and three other companies were named as the winners of a £265m six-year contract to supply the next generation of satellite tracking tags, which would allow dangerous and repeat offenders to be monitored around the clock."

Serco Prisoners arrive in jail courtesy of Serco 8(a) supply chain

Flaperon arrives in Toulouse courtesy of Serco 8(a) air traffic control supply chain

"BBC – MH370 search: Families vent anger over inquiry

Relatives of those missing on Malaysia Airlines flight MH370 are angry at apparent mixed signals over whether part of the plane has been found.

Relatives of those missing on Malaysia Airlines flight MH370 are angry at apparent mixed signals over whether part of the plane has been found.

Malaysian PM Najib Razak said experts in France had "conclusively confirmed" the wing part found on an island in the Indian Ocean was from the aircraft.

But French investigators stopped short of confirming the link, only saying it was highly likely.

Chinese relatives staged a protest outside the airline's Beijing offices.

The Boeing 777 was travelling from Kuala Lumpur to Beijing on 8 March 2014 when it vanished from radar. It had 239 people on board, most of them Chinese.

Debris found on the remote French island of Reunion a week ago - a wing part known as a flaperon - was the first possible physical trace of the aircraft.

Experts in the French city of Toulouse are carrying out tests on the aircraft piece.

Mr Najib, in an announcement that came after the first day of tests, said investigators had "conclusively confirmed that the aircraft debris found on Reunion Island is indeed from MH370".

Malaysian transport minister Liow Tiong Lai said elements of the flaperon, including the paint colour, matched with maintenance records for the missing flight.

He also said, in another development, that more suspected plane debris had been found on Reunion, including window panes and seat cushions.

Those items had been sent to French authorities to be verified, he said, although French investigators have denied this.

Mr Liow said he understood why the French team had been less categorical in their conclusions over the flaperon, saying: "We respect their decision to continue with their verification."

French prosecutor Serge Mackowiak has said only that there are "very strong indications" that the flaperon does belong to MH370, adding that confirmation would only come after further tests.

The BBC's Hugh Schofield in Paris says Mr Mackowiak's wording does not suggest he has doubts, but that he is exercising legal caution.

Who has said what about the flaperon?

Malaysia Airlines: "This is indeed a major breakthrough for us."

French investigators: "There exists a very high probability that the flaperon indeed belongs to Flight MH370."

Australian PM: Debris "does seem to indicate the plane did come down more or less where we thought it did".

Australian search team: "It is heartening that the discovery of the flaperon is consistent with our search area."

Passenger's relative, Sara Weeks: "After 17 months, we need definite answers."

Will the debris lead us to MH370?

But the lack of a consistent message from the various authorities has angered many of the families of those missing.

But the lack of a consistent message from the various authorities has angered many of the families of those missing.

A number of relatives gathered outside Malaysia Airlines' offices in Beijing to demand answers.

"France is being cautious about it, but Malaysia is desperate to put an end to this case and run away from all responsibilities," said Dai Shuqin, sister of one of the passengers.

"We suspect that the plane wreckage could be faked," said Liu Kun, whose younger brother was on the plane.

Media captionMalaysian Prime Minister Najib Razak says the wreckage is from MH370

Many relatives have long been frustrated by Malaysia's handling of the disaster, which at times has been marred by contradictory and conflicting information.

Because of this, many families have pretty much lost trust and don't know what to believe anymore, the BBC's John Sudworth reports from Beijing.

China's foreign ministry said Malaysia must keep investigating the crash and "safeguard the legitimate rights and interests" of relatives.

Australia, which is leading the search for the plane in the southern Indian Ocean, said the discovery of the flaperon suggested they were looking in the right area.

Prime Minister Tony Abbott said the search would continue as "we owe it to the hundreds of millions of people who use our skies".

The Australian Transport Safety Bureau (ATSB) has been co-ordinating the deep-sea hunt in the southern Indian Ocean, where the plane is believed to have gone down, thousands of miles east of Reunion."

"U.S. says missing Malaysian jet could be 'act of PIRACY': Evidence shows plane changed direction and climbed to 45,000 feet 'under command of a pilot' after tracking devices were manually disabled

Sources: Plane may have been deliberately flown across Malay peninsula

Military radar-tracking evidence reportedly suggests it was heading towards the Andaman Islands

US inquiries are increasingly focusing on theory someone who knew how to fly a plane deliberately diverted the flight, according to reports

Investigation sources also say plane may have climbed to more than 45,000ft immediately after losing contact - higher than the plane is allowed

Rival theory: Cargo of batteries could have caught fire, downing the plane

Search efforts are now being stepped up in the Andaman Sea and Indian Ocean

By JAMES RUSH and RICHARD SHEARS FOR MAILONLINE and KIERAN CORCORAN

PUBLISHED: 09:33 GMT, 14 March 2014 | UPDATED: 04:30 GMT, 15 March 2014"

"The Duke and Duchess of Cambridge and the £1.3 trillion hedge fund women

In their elegant ballgowns, they could be among the guests at any charity reception hosted by the Duke and Duchess of Cambridge.

By David Harrison and Claire Duffin

8:00AM BST 23 Oct 2011

38 Comments

In fact, these are some of the most powerful and influential individuals to have gathered at St James's Palace. All leading figures in finance, they help to control assets totalling £1.3 trillion.

In their elegant ballgowns, they could be among the guests at any charity reception hosted by the Duke and Duchess of Cambridge.

By David Harrison and Claire Duffin

8:00AM BST 23 Oct 2011

38 Comments

In fact, these are some of the most powerful and influential individuals to have gathered at St James's Palace. All leading figures in finance, they help to control assets totalling £1.3 trillion.

The 14 women posed with the royal couple at a gala evening this month which raised £675,000 for charity. Now their identities and the extraordinary wealth for which they are responsible can be revealed.

They range from the senior executive at one of the world's biggest banks who competes in triathlons in her spare time, to the investment consultant who admits to owning 110 pairs of shoes.

The event marked a rare foray into the public arena for the women. Several are heads of hedge funds, the secretive investment vehicles which put money into complex financial schemes and can profit in a downturn by effectively betting on markets falling.

Others are executives at banks or asset management companies. Among them are chief executives, presidents, directors, and consultants. Members cover a range of nationalities, reflecting the cosmopolitan nature of the industry.

All are senior figures in 100 Women in Hedge Funds, a philanthropic organisation. The duke became a patron last year, and 100WHF will raise money for charities he is associated with; this month's gala supported the Child Bereavement Charity.

The link-up suggests that the Duke and Duchess are following the lead of the Prince of Wales in ensuring that their charitable initiatives win support from wealthy and influential figures.

100WHF, which has branches around the world, has raised millions of pounds for causes including women's health, education and mentoring.

Anne Popkin, chair of the organisation's global board, flew over from San Francisco for the London event. She said: "It is wonderful to raise such an amount. The reason we work so well with His Royal Highness is our aims and his aims are the same."

In a letter to 100WHF, the Duke wrote: "It is a privilege for me to be Patron of this exciting endeavour."

Left-to-right in photograph:

1) Anne Popkin, 46: President of San Francisco-based Symphony Asset Management, founded in 1994, which manages assets of £5.65 billion. Lives in San Francisco and chairs 100WHF's global board. Previously a managing director at Lehman Brothers. Studied maths and economics at Harvard, has an MBA from Northwestern University and studied for a diploma in art history at Oxford University in 1991.

2) Amanda Pullinger. 45: Chief executive of Pullinger Management in New York. Executive director of 100WHF. Studied modern history at Oxford University where she was a contemporary of David Cameron. Originally from Solihull, has lived in New York for 24 years. Fan of Downton Abbey.

3) Effie Datson, 41: Head of foreign exchange and global macro prime brokerage for Deutsche Bank, which has managed assets of £480 billion. Previously worked at IKOS and Goldman Sachs. London Board Chair of 100WHF. Has a degree in social sciences and MBA, both from Harvard. Lives with husband Edwin, a venture capitalist, in a £1 million flat in Battersea, southwest London. Competes in triathlons.

4) Claire Smith, 48: Research analyst and partner with Albourne Partners, independent global advisers whose 200 clients worldwide have an estimated £145 billion invested in hedge funds. Works from home in Geneva.

5) Kathryn Graham, 39: Director of BT Pension Scheme Management in London, BT's pensions advisory arm, the largest scheme in the UK at £34 billion. Has an MA in economics and mathematics from Edinburgh University. Trustee of hedge fund standards board in London.

6) Roxanne Mosley Sargent, 43: Previously co-head of sales and marketing at Armajaro Asset Management, formerly head of hedge fund capital group for Europe at Deutsche Bank. MBA from Harvard. Married with young children, lives in Notting Hill, west London.

7) Kristen Eshak Weldon, 33: Managing director of Blackstone Group International Partners which has £99 billion of managed assets. 100WHF London board member. Previously worked at JP Morgan. Studied at Georgetown University, Washington DC. Originally from Houston, Texas and now living in London. Likes designer fashion labels including Diane von Furstenberg, Max Mara and Donna Karan.

8) Natasha Sai, 35, a managing director with the banking giant Goldman Sachs, America's 5th largest bank by revenue, which has £515 billion of managed assets. Lives in Hammersmith, west London. Featured in a 2001 Sky One series called The Real Sex in the City, about the lives of single girls in New York.

9) Sonia Gardner, 49: Moroccan-born president and co-founder, Avenue Capital Group, a global investment firm with £12.5 billion of managed assets. Made a donation to Hillary Clinton's New York Senate re-election campaign. Mrs Clinton's daughter Chelsea joined Ms Gardner's Avenue Capital Group in 2006. [Steering Trump Entertainment Resorts Inc. out of bankruptcy protection; allegedly with the proceeds of online assassination betting!!!]

10) Stephanie Breslow: partner and co-head of the investment management group at Schulte Roth & Zabel, a New York law firm with an office in London. Lives in New York with husband and two stepchildren. Graduate of Columbia University School of Law. Is on the advisory board of the Columbia Law School's Gender and Sexuality Centre.

11) Mindy Posoff, 51: Founder, Traversent Capital Partners, a consultancy for hedge funds and asset managers. Also managing director of Golden Seeds, dedicated to investing in young companies founded or led by women. Former director of Credit Suisse. Likes Queen Latifah, the American rapper.

12) Carol Kim: managing director, the Blackstone Group, based in Hong Kong. Previously based in New York as a Vice President in the Absolute Return Strategies Group at Lehman Brothers. 100WHF co-founder and board director. Has a BA in Urban and Economic Studies from the University of Toronto.

13) Mimi Drake, 42: President of Permit Capital Advisors, an independent investment advisory firm based in Philadelphia. Previously in magazine publishing. Has an MBA in finance from the University of Pennsylvania. Formerly Mimi Keller, she married Thomas Drake, a doctor, in 1996.

14) Kristin Fox, 47: Former journalist, founder and principal of FoxInspires consultancy. Chicago-based. A former news director of HedgeWorld. Owns 110 pairs of shoes and admits to a penchant for the creations of Mephisto, Icon and Stuart Weitzman.”

2) Amanda Pullinger. 45: Chief executive of Pullinger Management in New York. Executive director of 100WHF. Studied modern history at Oxford University where she was a contemporary of David Cameron. Originally from Solihull, has lived in New York for 24 years. Fan of Downton Abbey.

3) Effie Datson, 41: Head of foreign exchange and global macro prime brokerage for Deutsche Bank, which has managed assets of £480 billion. Previously worked at IKOS and Goldman Sachs. London Board Chair of 100WHF. Has a degree in social sciences and MBA, both from Harvard. Lives with husband Edwin, a venture capitalist, in a £1 million flat in Battersea, southwest London. Competes in triathlons.

4) Claire Smith, 48: Research analyst and partner with Albourne Partners, independent global advisers whose 200 clients worldwide have an estimated £145 billion invested in hedge funds. Works from home in Geneva.

5) Kathryn Graham, 39: Director of BT Pension Scheme Management in London, BT's pensions advisory arm, the largest scheme in the UK at £34 billion. Has an MA in economics and mathematics from Edinburgh University. Trustee of hedge fund standards board in London.

6) Roxanne Mosley Sargent, 43: Previously co-head of sales and marketing at Armajaro Asset Management, formerly head of hedge fund capital group for Europe at Deutsche Bank. MBA from Harvard. Married with young children, lives in Notting Hill, west London.

7) Kristen Eshak Weldon, 33: Managing director of Blackstone Group International Partners which has £99 billion of managed assets. 100WHF London board member. Previously worked at JP Morgan. Studied at Georgetown University, Washington DC. Originally from Houston, Texas and now living in London. Likes designer fashion labels including Diane von Furstenberg, Max Mara and Donna Karan.

8) Natasha Sai, 35, a managing director with the banking giant Goldman Sachs, America's 5th largest bank by revenue, which has £515 billion of managed assets. Lives in Hammersmith, west London. Featured in a 2001 Sky One series called The Real Sex in the City, about the lives of single girls in New York.

9) Sonia Gardner, 49: Moroccan-born president and co-founder, Avenue Capital Group, a global investment firm with £12.5 billion of managed assets. Made a donation to Hillary Clinton's New York Senate re-election campaign. Mrs Clinton's daughter Chelsea joined Ms Gardner's Avenue Capital Group in 2006. [Steering Trump Entertainment Resorts Inc. out of bankruptcy protection; allegedly with the proceeds of online assassination betting!!!]

10) Stephanie Breslow: partner and co-head of the investment management group at Schulte Roth & Zabel, a New York law firm with an office in London. Lives in New York with husband and two stepchildren. Graduate of Columbia University School of Law. Is on the advisory board of the Columbia Law School's Gender and Sexuality Centre.

11) Mindy Posoff, 51: Founder, Traversent Capital Partners, a consultancy for hedge funds and asset managers. Also managing director of Golden Seeds, dedicated to investing in young companies founded or led by women. Former director of Credit Suisse. Likes Queen Latifah, the American rapper.

12) Carol Kim: managing director, the Blackstone Group, based in Hong Kong. Previously based in New York as a Vice President in the Absolute Return Strategies Group at Lehman Brothers. 100WHF co-founder and board director. Has a BA in Urban and Economic Studies from the University of Toronto.

13) Mimi Drake, 42: President of Permit Capital Advisors, an independent investment advisory firm based in Philadelphia. Previously in magazine publishing. Has an MBA in finance from the University of Pennsylvania. Formerly Mimi Keller, she married Thomas Drake, a doctor, in 1996.

14) Kristin Fox, 47: Former journalist, founder and principal of FoxInspires consultancy. Chicago-based. A former news director of HedgeWorld. Owns 110 pairs of shoes and admits to a penchant for the creations of Mephisto, Icon and Stuart Weitzman.”

"Trump Plaza was a hotel and casino located on the Boardwalk in Atlantic City, New Jersey.

Designed by architect Martin Stern, Jr., it was opened in 1984 and was owned by Trump Entertainment Resorts. It was closed permanently on September 16, 2014.[2] ..

Designed by architect Martin Stern, Jr., it was opened in 1984 and was owned by Trump Entertainment Resorts. It was closed permanently on September 16, 2014.[2] ..

Harrah's at Trump Plaza opened May 26, 1984, as a joint venture between Donald Trump and Harrah's Atlantic City.[3][4] Trump built the complex and it was managed by Harrah's and contained 614 rooms, seven restaurants, a health club, a 750-seat showroom and a 60,000 sq.ft. casino all on a narrow 2.6-acre plot of land next to Caesars Atlantic City. Within five months, the Harrah's name was removed from the casino and it became known only as Trump Plaza.[3] Part of the reason for this is that Harrah's was commonly associated and attracted low-rolling gamblers, but Trump had built 85 high-roller suites, which were rarely used.[4] Revenue for the seven months it was open in 1984 the casino was placed seventh out of the ten casinos operating in the city at the time, which led to Trump taking over the entire casino from Harrah's. In 1989, the East Tower of the complex was opened, expanding the resort to a total of 906 rooms. The East Tower is a former Holiday Inn constructed in the 1960s, but closed after gambling was approved in 1976 with the intention of becoming the Penthouse Hotel and Casino. Trump later purchased the unfinished casino project, demolished the shell that was to become the casino, renovated the tower and covered its brick facade in white stucco to match the rest of the casino."

"Avenue Capital's Plan Picked for Trump Casinos

By ALEXANDRA BERZON Updated

April 12, 2010 10:20 p.m. ET

A group of bondholders aligned with real-estate magnate Donald Trump won a victory over financier Carl Icahn Monday in a bid to control three casinos in Atlantic City that bear Mr. Trump's name.

By ALEXANDRA BERZON Updated

April 12, 2010 10:20 p.m. ET

A group of bondholders aligned with real-estate magnate Donald Trump won a victory over financier Carl Icahn Monday in a bid to control three casinos in Atlantic City that bear Mr. Trump's name.

The ruling, issued by U.S. Bankruptcy Court Judge Judith Wizmur in New Jersey, puts bondholders owed $1.2 billion in unsecured debt and led by Avenue Capital Management, in charge of steering Trump Entertainment Resorts Inc. out of bankruptcy protection. It also would ensure that the casinos will retain the Trump brand that Mr. Trump first established in the seaside casino resort in the 1980s.

The use of the name had turned into something of a spat between the two high-profile investors.

Mr. Trump aligned with private investment fund Avenue Capital, threatened to contest the use of his brand name if the victory had gone to Mr. Icahn. Mr. Trump boasted that the name on the casinos was worth at least $50 million and that overall his brand name was worth more than $3 billion.

Judge Wizmur wrote that while some aspects of the bondholder agreement was less favorable than Mr. Icahn's plan, the use of the name and likeness of Mr. Trump and his daughter Ivanka "tilt the balance in favor of approving the settlement as being in the paramount interest of the Reorganized Debtors." The plan will require some changes to the original plan that bondholders presented. But David Friedman, an attorney for Mr. Trump, said he expected all parties to agree to the terms.

Attorneys aligned with Mr. Icahn had argued that in Atlantic City, the value of Mr. Trump's name was diminished by previous bankruptcies and by delayed capital investment. Neither Mr. Icahn nor his attorneys could be reached for comment.

In an interview, Mr. Trump and Ms. Trump said they saw the victory over Mr. Icahn's plan as a confirmation of their brand value because the judge had written in an opinion that the bondholders' deal to use the brand name was a significant component of her decision. The Trumps will take an equity stake of up to 10% in the company, under the deal.

"The name is the hottest name, period," Mr. Trump said.

In making her decision, Judge Wizmur also rejected Mr. Icahn's argument that the bondholder plan would leave the company too heavily in debt as it emerged from bankruptcy.

With the loss in court, Mr. Icahn, who purchased the $480 million mortgage at a discount, will remain a creditor in the company. He will have 10 days to appeal the decision after a hearing Thursday, attorneys involved in the case said.

The decision comes amidst a period of instability in Atlantic City, where a number of properties are actively seeking buyers even as revenue has plummeted to its lowest point in a decade.

"I think Atlantic City has a great future," Mr. Trump said Monday.

Bondholders warned Mr. Icahn would cannibalize the Trump casinos to strengthen his Tropicana Casino & Resort in Atlantic City, which he acquired in another bankruptcy case.

Mr. Icahn denied the accusation, and said he wanted to get the three on sound financial footing and prevent their fourth return to bankruptcy.

—Peg Brickley contributed to this article.”

"For the high rollers, the game never ends

Kerry Packer won $20m in 40 minutes at blackjack. And the casino door is still open. Why? asks David Spanier

DAVID SPANIER

Monday 29 May 1995

When you are very, very rich, rich beyond National Lottery dreams, and there is really nothing more you need in life or can think of buying, there is still one challenge left. To break the casino.

Monday 29 May 1995

When you are very, very rich, rich beyond National Lottery dreams, and there is really nothing more you need in life or can think of buying, there is still one challenge left. To break the casino.

In essence, that is what Kerry Packer, the Australian media multimillionaire, sets out to do when he hits the casinos in Las Vegas or Sydney or London. Earlier this month, he took the MGM Grand in Las Vegas for $20m, playing blackjack. Betting up to $250,000 on a box, as the betting square is called, he racked up his win in 40 minutes' play. In the past few days, he has been through London and will have been playing in the casinos of Park Lane, where he may easily have walked away with a million: five years ago, he took pounds 5m from the Clermont.

Mr Packer, as is the custom with high rollers, tipped the 40-strong blackjack crew in Las Vegas generously. He handed out $2,500 to each dealer, which cost him the best part of 100,000 bucks. At these levels, who's counting?

The answer is that the casino is counting. A potent mixture of fear and greed, laced with adrenaline, courses through the casino management's veins when Packer or one of the other big high rollers walks through the swing doors. Greed, because the action of a player such as Packer can send the casino's bottom line soaring upward, to turn a whole month golden; fear, because if the punter gets lucky, the casino's profits take a blow in the breadbasket that no amount of play by ordinary gamblers playing red or black can match.

The MGM in Vegas, the biggest hotel casino on earth, knows it will beat the daylights out of high rollers like Packer - in the long run. Casinos trust in the percentages like the saints believe in heaven: it will all come right in the end. But in the short run, of a night or a weekend's play, the fluctuations in the law of probability can break the bank. Indeed, a player like Packer probably has more money behind him than most casinos. Such players relish the challenge of playing eyeball-to-eyeball with a Vegas monolith or a smart club such as Aspinalls in Mayfair.

In the glory days of Monte Carlo, when a player broke the bank, it meant cleaning out the table. A black cloth was laid over the roulette lay-out and the management sent for another tranche of Fr10,000 plaques. In the modern game, the equivalent coup of breaking the bank risks ruining a casino's balance sheet, upsetting its share price, and sending the management into heart seizure - if not early retirement.

Blackjack is like the family game 21. The dealer and the player are dealt two cards with the option of drawing further cards, and the winner is whoever gets closer to 21 (aces count 1 or 11). There is a high degree of skill in this game based on memorising the sequence of cards.

Baccarat, the high roller's favoured game, is played at stakes of up to $250,000 a hand. There may be 60 hands an hour. There is no skill in baccarat. Two players each draw two cards to see who can get closest to a total of nine (court cards count for zero); sometimes a third card is drawn. That is all there is to it. The whole point is the money and the excitement it generates. The Mirage in Las Vegas has more than 20 million-dollar players on its private list.

Packer has made it known he would like to play even higher at baccarat, to raise the stakes to $1m a hand. Why? More thrill, more tension. This is too high, even for Vegas. At such stakes, it would not take a very long streak of luck to turn the casino over. And Packer is renowned as a good gambler: he cuts short his losing runs, which in the nature of the play are bound to be big, and pushes his good fortune. In the end, the casinos can't resist his action.

The MGM Grand, inspired and largely owned by the movie mogul Kirk Kerkorian, is not just enormous, covering an area that would stretch from Downing Street to Trafalgar Square. It is also the last word in kitsch. Its theme is the Wizard of Oz. The MGM lion, looking a bit like a lugubrious golden calf, bestrides the entrance. Inside there are acres of gaming, rainbow strobes of colour, a cornucopia of fun and noise. The public has flocked to it without stopping since its opening a year ago.

For Packer's night out, the management cleared a space of eight blackjack tables and roped it off. The big player is given this kind of semi-privacy, half in the public eye and half concealed, so that he can cut about from table to table and make his huge plays undisturbed. A high roller attracts other players, gives the place excitement, just like the MGM's other recent guest, heavyweight contender Mike Tyson, letting off steam after getting out of jail.

The aim of high rollers is not just to win money. The idea behind the play is to show who's boss, who is impervious to fortune, who can snap his fingers at lady luck and bring her running. Money for the high roller is simply a way of keeping score. He is not going to go hungry next day. On the contrary, the casino will do everything to gratify the high roller's slightest whim, to keep him playing.

This is the essence of the curiously ambivalent relationship casinos have with big players. It is a small group, of probably not more than a few score players throughout the world, who really play high. All are men, most of them come from the Orient, now that the petro-dollar boom is over - Chinese, Japanese, Malaysians and other plungers from the Pacific Rim.

The top casinos in Las Vegas, Atlantic City and elsewhere go to extraordinary lengths to attract such players. They will, as a matter of course, fly them into town by private jet, accommodate them in splendid suites, gratify their slightest wish - for example, maintaining a favourite chef on duty night and day. They will offer expensive gifts to wives and mistresses on their birthdays (hopefully not at the same time - there have been mix- ups); and lay on every kind of sport or entertainment. Special "hosts" are appointed whose sole duty is to keep the players happy.

"If a guy is playing off a million dollars," one hard-boiled Vegas manager once confided, "and he wants six ladies in red garters suspended from the chandelier, he can have 'em. Anything he wants, to keep him here." The only time a casino feels badly let down is when the player leaves for somewhere else.

In their sober moments (which is most of the time), Las Vegas managers insist that they would never risk their gaming licences by breaking the strict prohibition against prostitution. For those who want them, there are licensed brothels, a couple of hours' drive outside the city limits. Besides, the casinos do not want their prize players, known as "whales", beached by some expensive ladies relieving them of their wallets.

A whale is a very big player at baccarat. If the casino can land him, it has hit the jackpot. The prize whale was the celebrated player Akio Kashiwagi, who was even bigger in his day than Packer. Donald Trump once staged a special session for him in Atlantic City on the top floor of Trump Plaza. Trump got so nervous that when the house was a few million ahead, he called the joust off. A furious Kashiwagi was driven off in a white Rolls-Royce, sent to collect him by Caesar's Palace.

Unfortunately, Kashiwagi, who went by the nickname of "the Warrior" and modelled himself on the Samurai tradition, came to a sticky end. He was found murdered back home in Tokyo, amid rumours of heavy debts to unsavoury elements in the Japanese underworld.

Of course, the high rollers understand that all the flattery and free hospitality is, in a sense, false, based on the casino's desire to beat them out of their bankroll. At the same time, the relationship is often based on genuine respect. Both sides are trying to win; so each appreciates the other.

In London, the casinos are not allowed to offer any inducement to play. This was why, some 15 years ago, Ladbroke's - now back on the green baize - ran into trouble. It is a sore point at the elegant casinos around Park Lane that despite the foreign currency they earn and the high taxes they pay, they cannot do more than offer players dinner or a visit to the races.

Players such as the business tycoon Adnan Khashoggi, Saudi middle-man Hassan Anani, who reportedly dropped pounds 7m in the Ritz casino in Cannes, or the scions of Oriental potentates play over here because they enjoy being in London. Until now, the Gaming Board, which once suggested pens and diaries as suitable gifts for gamblers, has refused to soften its animus against casinos proffering air fares or hotel rooms. Some restrictions on casinos are being eased - the number of permitted slot machines in a casino is about to be raised from two to six - but clubs still cannot advertise, serve drink after 11pm, or allow gamblers to drink at gaming tables.

Now that the summer season is coming, the high rollers are back in town. The Derby, Ascot, Henley, Wimbledon all beckon. London's most successful group, London Clubs International, which runs the Ritz and Les Ambassadeurs clubs, reported record profits of pounds 30m last week. And Packer, the victor in Vegas, will be back. The casinos will be ready for him, they will welcome him. But they will tremble."

"Each year billions of dollars of illegal gambling takes place in New Jersey.[51] Illegal gambling operations range from employees who make money on office sports betting pools to online poker websites to multi-million dollar enterprises run by organized criminals.[52][53] Despite the availability of legal gambling in New Jersey, studies have shown that illegal gambling persists because it offers options that are not available legally (e.g., casino gambling outside of Atlantic City), and because some gamblers prefer using a bookmaker who they personally know.[54] State law does not punish players, but a person operating an illegal gambling enterprise, or possessing equipment or records used for illegal gambling can face up to 5 years imprisonment depending on the quantity and size of the bets.[55] However, illegal gambling arrests are rare in New Jersey, and there is presumption of non-incarceration for first-time offenders.[56][57]"

"Serco – Procurement and Supply Chain

The nature of our business means that we have relationships with a large number of suppliers across our operations. We recognise the importance of these relationships in achieving our business goals.

We apply a consistent procurement process to the selection and use of suppliers. This ensures that we comply with laws and regulations and other requirements applicable to the locations where we operate. It also means that we get maximum value from our spend, whilst meeting customer requirements.

We work collaboratively to deliver sustainable value; maintain the integrity of our procurement process; and drive continuous improvements. To achieve this we apply a consistent procurement process in selecting and using suppliers, so that we:

– manage business and financial risk, derive maximum value from our spend , through appropriate procurement strategies and supplier selection criteria, such as low cost, technically acceptable or best overall value, whilst mitigating risks to business and customer objectives and meeting our customer service requirements

– work collaboratively across all Serco's Divisions and with suppliers to maximise and deliver sustainable value to Serco, maintain the integrity of our procurement process and drive continuous improvements

– comply with laws and regulations and other requirements applicable to the locations in which we operate our business

– reflect our ethical standards and code of conduct throughout our supply chain and ensure that sourcing initiatives are fair and ethical to both Serco and the participating suppliers consider social and environmental and other factors important to our clients and the communities within which we operate in the supply chain

Small firms, voluntary and community organisations, social enterprises and ethnic minority businesses are part of Serco's supply chain. We work with Minority Supplier Development organisations where available to encourage diverse suppliers to participate in our procurement processes on a local basis.

All procurement activity is governed by the Serco Group plc Delegated Approval Authorities. Each Division has a Divisional Procurement and Supply Chain Lead to support effective sourcing and negotiating strategies.

A Procurement and Supply Chain Executive Board oversees the implementation of Procurement and Supply Chain strategy.

Sustainable procurement is our commitment to achieve value for money on a whole life basis in a way that delivers tangible social, environmental and economic outcomes. We expect our suppliers to meet a set of sustainable procurement standards. These are considered when reviewing the overall suitability and performance of suppliers.

Our commitments and required standards are defined in our policy statement and supporting Group Standard.

A Supplier Code of Conduct is made available for suppliers to ensure that they know what is expected of them."

"Serco Receives "Supplier of the Year" from Boeing for Enterprise Architecture Expertise

5/19/2011

RESTON, VIRGINIA – May 19, 2011 – Serco Inc., a provider of professional, technology, and management services to the federal government, has been recognized as Supplier of the Year by The Boeing Company in the Technology category for its state-of-the-practice Enterprise Architecture solutions.

The Boeing Supplier of the Year award is the company's premier supplier honor, presented annually to its top suppliers in recognition of their commitment to excellence and customer satisfaction. This year's 16 winners represent an elite group among more than 17,525 active Boeing suppliers in nearly 52 countries around the world. This selection was based on stringent performance criteria for quality, delivery performance, cost, environmental initiatives, customer service and technical expertise. This is the second time Serco has been recognized as Supplier of the Year by Boeing. In January 2011, Serco also received the Boeing Performance Excellence Gold Award in recognition of the Company's performance excellence.

"We are extremely honored to receive this recognition for our work in support of Boeing. This prestigious award demonstrates our passion for excellence and ability to apply Serco's Enterprise Architecture expertise across a broad range of applications," said Ed Casey, Chairman and CEO of Serco. "We continue to grow our EA practice, and over the past 15 years we have deployed solutions to support enterprises and systems across federal and commercial environments."

Serco's Enterprise Architecture Center of Excellence is based in Colorado Springs, CO. The team provides a variety of services in support of Boeing's business units as well as research and development efforts. Serco’s architecture employs object-oriented (OO)/Unified Modeling Language (UML) to define, design and satisfy defense agencies' mission-critical requirements, including Command, Control, Communications, Computers and Intelligence (C4I). This approach improves system developer's understanding of operational requirements and how best to integrate enterprise operations and systems for the optimal fulfillment of C4I and other operational needs.

About Serco Inc.: Serco Inc. is a leading provider of professional, technology, and management services focused on the federal government. We advise, design, integrate, and deliver solutions that transform how clients achieve their missions. Our customer-first approach, robust portfolio of services, and global experience enable us to respond with solutions that achieve outcomes with value. Headquartered in Reston, Virginia, Serco Inc. has approximately 11,000 employees, annual revenue of $1.5 billion, and is ranked in the Top 30 of the largest Federal Prime Contractors by Washington Technology. Serco Inc. is a wholly-owned subsidiary of Serco Group plc, a $6.6 billion international business that helps transform government and public services around the world. More information about Serco Inc. can be found at www.serco-na.com."

"In 1998 the City of Chicago awarded Serco a contract for collections from the approximately 28,000 parking meters. Serco collects more than $27 million revenue for the City every year having increased collection figures by more than $2.4 million from previous years. Serco also provides parking enforcement services including issuing citations for violations. Serco provides various levels of parking collection and enforcement services in a number of Maryland municipalities, Washington DC and West Hollywood, California."

"Obama Elevates SBA to Cabinet-Level Agency

Patricia Orsini|

Small Business Editor

Friday, 13 Jan 2012 | 2:53 PM ETCNBC.com

CNBC.com

Barack Obama

President Barack Obama today announced that the head of the U.S. Small Business Administration, Karen Mills, will be the newest cabinet member.

He made the announcement that the SBA would become a cabinet-level agency in front of small-business owners at the White House. The head of the SBA was a cabinet-level position under the Clinton Administration.

The announcement was part of a larger proposal that would combine the SBA with five other government agencies that focus on business and trade.

Those organizations include the Commerce Department's core business and trade functions; the Office of the U.S. Trade Representative; the Export-Import Bank; the Overseas Private Investment Corporation; and the Trade and Development Agency.

These agencies combined would, according to Obama, create a more efficient climate for business development and entrepreneurship. In addition, according to AP, the merger would save the federal government $3 billion over 10 years by eliminating duplicate costs and human resources.

Barry Sloane, CEO of the Small Business Authority, applauded the move. "I think it's constructive for two reasons," he told CNBC.com. "By doing this, Obama is making a statement that small business is important. And, he's making good on his promise of reducing overlapping agencies, which will reduce government spending."

The proposal to merge the agencies must be approved by Congress. If the merger is approved, the SBA would no longer be in the cabinet.

Sloane the SBA has been an engine for recovery from the recession. "Under the Obama Recovery Act, he increased loan size from the SBA from $2 million to $5 million, and increased the amount of government guarantee on those loans, which has been helpful to business owners. This proposal is another acknowledgment of the importance of small business."

House Small Business Committee Chairman Sam Graves (R-MO) said in a statement today that "I look forward to examining the [proposed merger] further, and I hope the President will work very closely with Congress before finalizing any changes."

While he was non-committal on whether he would vote to approve the changes, he said: "Decreasing the size of government and reducing bureaucracy is something that I support in principle, however, it is important that any effort to make significant changes to federal commerce and trade programs be done carefully, and in a way that protects America's small businesses."

"Base One Technologies – Corporate Strategy – We are a Government Certified Women-Owned Business

We practice Diversity Recruitment and Staffing for IT positions

Base One was founded in 1994 by a women engineer who had made a career in technology research for many years. Base One has been very successful in focusing on diversity recruiting and staffing for IT projects. It has been our experience that the greater the diversity mix, the more creative the solution. As in any field the more diverse the viewpoint the more thorough your analysis. Our engineers can think out of the box.

Because of our affiliations we have access to pools of resources among more diverse groups & individuals. We work with a large pool of minority professionals who specialize in IT skills. We are able to have access to these resources through our status as a D/MWBD firm and our affiliations. These affiliations assist us in working with resources among more diverse groups & individuals.

We are also partnered with firms that are 8A certified as Minority firms, Disabled Veteran firms, Native American firms, Vietnam veteran firms, women owned firms.

Our hub zone location keeps us close to the professional organizations of great diversity. We are active in recruiting from and networking with these community organizations of local IT professionals. This has given us access to a large pool of diversity talent.

Base One's staff of engineers are a diverse group of professionals. This diverse network of engineers helps us to branch out to other engineers and creates an even larger network of resources for us to work with.

The greater the diversity the more complete & thorough the analysis. The broader the spectrum of points of view the broader the scope of the analysis. We feel that a diverse team gives us a greater advantage in creating cutting edge solutions. To that end we will continue to nurture these relationships to further extend our talent pool.

The greater the diversity mix, the more creative the solution.

The more diverse the viewpoint, the more thorough the analysis.

The more diverse our team, the more our engineers can think out of the box.

This is why Base One Technologies concentrates on diversity recruitment in the belief that a diverse team gives us a greater advantage in creating cutting edge solutions."

Information Security Planning is the process whereby an organization seeks to protect its operations and assets from data theft or computer hackers that seek to obtain unauthorized information or sabotage business operations.

Key Clients Benefiting From Our Information Security Expertise: Pentagon Renovation Program, FAA, Citigroup, MCI.

Base One technologies

Expertly researches, designs, and develops information security policies that protect your data and manage your firm's information technology risk at levels acceptable to your business.

Performs architectural assessments and conducts both internal and external penetration testing. The results of these efforts culminate in an extensive risk analysis and vulnerabilities report.

Develops, implements and supports Information Security Counter measures such as honey-pots and evidence logging and incident documentation processes and solutions."

"The 8(a) Business Development Program assists in the development of small businesses owned and operated by individuals who are socially and economically disadvantaged, such as women and minorities. The following ethnic groups are classified as eligible: Black Americans; Hispanic Americans; Native Americans (American Indians, Eskimos, Aleuts, or Native Hawaiians); Asian Pacific Americans (persons with origins from Burma, Thailand, Malaysia, Indonesia, Singapore, Brunei, Japan, China (including Hong Kong), Taiwan, Laos, Cambodia (Kampuchea), Vietnam, Korea, The Philippines, U.S. Trust Territory of the Pacific Islands (Republic of Palau), Republic of the Marshall Islands, Federated States of Micronesia, the Commonwealth of the Northern Mariana Islands, Guam, Samoa, Macao, Fiji, Tonga, Kiribati, Tuvalu, or Nauru); Subcontinent Asian Americans (persons with origins from India, Pakistan, Bangladesh, Sri Lanka, Bhutan, the Maldives Islands or Nepal). In 2011, the SBA, along with the FBI and the IRS, uncovered a massive scheme to defraud this program. Civilian employees of the U.S. Army Corps of Engineers, working in concert with an employee of Alaska Native Corporation Eyak Technology LLC allegedly submitted fraudulent bills to the program, totaling over 20 million dollars, and kept the money for their own use.[26] It also alleged that the group planned to steer a further 780 million dollars towards their favored contractor.[27]"

"On October 6, 2000, the NMCI contract was awarded to Electronic Data Systems (EDS), now HP Enterprise Services (HP).[11] Secretary of the Navy Gordon England summed up the Navy's IT Environment prior to the commencement of NMCI: "We basically had 28 separate commands budgeting, developing, licensing, and operating IT autonomously. It was inefficient and from the larger Department perspective, produced results that were far from optimal."[12]

NMCI consolidated roughly 6,000 networks—some of which could not e-mail, let alone collaborate with each other—into a single integrated and secure IT environment. HP updated more than 100,000 desktop and laptop PCs in 2007.[13] The program also consolidated an ad hoc network of more than 8,000 applications to 500 in four years and 15,003 logistics and readiness systems to 2,759 over a two-year period.[14]

Sub-contractors to HP include:

Harris Corporation (which acquired Multimax formerly known as Netco Government Services and WAM!NET), which provided enterprise network infrastructure design and support until its contract expired in 2014.[16]

Verizon, which provides wide area network (WAN) connectivity.

HP also provides the security services once provided by Raytheon.

"HP also has worked with more than 400 small businesses, with 5 percent for small disadvantaged businesses, 5 percent for women-owned small businesses and 1.5 percent for HUBZone small businesses. Since its inception, NMCI has exceeded the minimum 40% small business objective set for the contract.[17]

…

The Department of the Navy has shown no desire to scale back or cancel the program. On 24 March 2006 the Navy exercised its three-year, $3 billion option to extend the contract through September 2010.[1]

In April 2006, users began to log on with Common Access Cards (CACs), a smartcard-based logon system called the Cryptographic Log On (CLO). In October 2008, NMCI’s prime contractor HP posted a set of procedures so Apple Mac users can access NMCI's public-facing Web services, such as the e-mail and calendar functions, using their CAC readers with their Macs. The workaround also works with other Defense Department CAC-enabled networks.[27] Alternatively, NMCI and all other CAC-authenicated DoD websites may be accessed using LPS-Public."

Serco... Would you like to know more?

SWISSLEAKS - "HSBC developed dangerous clients: arms merchants, drug dealers, terrorism financers"

Copy of SERCO GROUP PLC: List of Subsidiaries AND Shareholders! (Mobile Playback Version) [HSBC is Serco's drug-hub Silk Road banker and a major shareholder with the 9/11 8(a) lenders including Her Majesty's Government and JPMorgan]

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.