________

Source: Naked Capitalism

CalPERS Chief Investment Officer Ben Meng Made False, Felonious Financial Disclosure Report; More Proof of Lack of Compliance Under Marcie Frost

August 2, 2020 | by Yves Smith

CalPERS' Chief Investment Officer Ben Meng has filed demonstrably false financial disclosure documents, flouting the requirements of the California Fair Political Practices Commission. As a result, not only has Meng committed perjury, but CalPERS' failure to review or require Meng to correct these documents points to a major compliance failure, since CalPERS has, or should have, records that would show that Meng's financial disclosures were incomplete.1 Recall that this lapse follows CalPERS having had a huge spike in personal trading violations, which it has yet to explain adequately, let alone describe what it will do to prevent abuses like that from recurring. Poor controls are a disaster in the making for a financial institution, as the Wells Fargo fake account train wreck illustrates.

To make this sorry situation worse, CalPERS delayed releasing the Forms 700s until it became clear they’d be published regardless, suggesting that they were fully aware of this and potentially other lapses, yet refused to correct them.2

As we will also discuss, even the properly completed sections of Meng's forms raise concerns, since they show that he has financial conflicts of interest with respect to private equity and has had an appetite for highly speculative instruments. The latter worrisomely may explain Meng's appetite for risk now. Readers may recall that CalPERS has announced, with great fanfare, its plan to meet its 7% return target. It amounts to putting the available casino chips on the "more risk" numbers and then borrowing from the house to buy more chips to increase the size of the wager.3

Finally, this abuse by CalPERS top investment executive occurred just as CalPERS has been successfully moving forward legislation, AB 2473, to have its private debt investments, an area it intends to expand, exempt from Public Records Act disclosure. That means Meng could approve private debt deals that would benefit him or other CalPERS executives and the public would have no way of knowing. This bill has not yet gotten all the way through the legislature, so it is still possible it could be held back for badly-needed further review.

Background: The Importance and Legal Status of the Financial Disclosure Form 700

Under Marcie Frost, CalPERS consistently failed to comply with its own transparency policy, which is to publish promptly all of the the personal financial disclosure forms known as Form 700 filed by board members and executives annually with the Fair Political Practices Commission. Form 700s are required of all public officials to show investments in their jurisdiction so as to present potential conflicts of interest.

These are public records whether or not CalPERS posts them on its website as required by its own policy. The fact that CalPERS started foot dragging, posting them only after getting complaints, is a departure from its practice under previous CEOs. Needless to say, it creates the appearance that CalPERS was hiding something, meaning trying to protect an executive or board member.

That concern looks to be well founded. After getting inquiries as well as a Public Records Act request from your humble blogger, CalPERS eventually put the 2019 Forms 700 on its site. As we will explain, the Forms 700 by Chief Investment Officer Ben Meng as of when he assumed office and for the full year 2019 taken together show that Meng has made many false statements. This means he has engaged in a felony. As you can see on first page of the Form 700, the respondent avows (emphasis original):

I have used all reasonable diligence in preparing this statement. I have reviewed this statement and to the best of my knowledge the information contained herein and in any attached schedules is true and complete.

I acknowledge this is a public document. I certify under penalty of perjury under the laws of the State of California that the foregoing is true and correct.Perjury is a felony in California. And Meng has no excuse that he does know how to fill out this document. First, he was a Form 700 filer during his previous stint at CalPERS. Second, CalPERS staff sends multiple e-mails to Form 700 filers offering to help if they have any questions.

This false declaration does not merely reflect poorly on Meng's integrity and competence. The forms also show that Meng has investments in private equity funds Ares (one of the five involved in the Fred Buenrostro bribery scandal), Blackstone, and Carlyle. As we will document shortly, CalPERS has made significant investments in Blackstone and Carlyle funds, raising the question of whether Meng recused himself (we have put in a Public Records Act request that should provide an answer) But first, let us explain why Meng's forms are false declarations.

Meng's Felonious Forms

We have embedded Meng's Form 700 filings at the end of this post. Note that the first one, dated January 31 2019, is as of Meng assuming office on January 2, 2019. This document is meant to show all relevant financial holdings on that date; the filers is not required to provide any history of his investments. You will see filers are not required to provide the exact dollar amounts of their positions, merely the size category each falls in.

The annual form requires more information. Filers are required to list the name of any assets they held during the year if the position is worth more than $2000 at any point in the year, not just at year end. If they disposed of an asset, they must list the date of sale. If they bought and sold an asset during the the year, they are required to list that and provide the date of purchase and/or sale.

If you compare the two forms, you can see on Meng's initial Form 700, under Schedule A-1, which is "Stocks, Bonds, and Other Investments" Meng lists 46 holdings as of January 2, 2019. His form for the full year shows only 22 holdings. As we show below, Meng disposed of at least 23 positions without providing the date of sale as required.

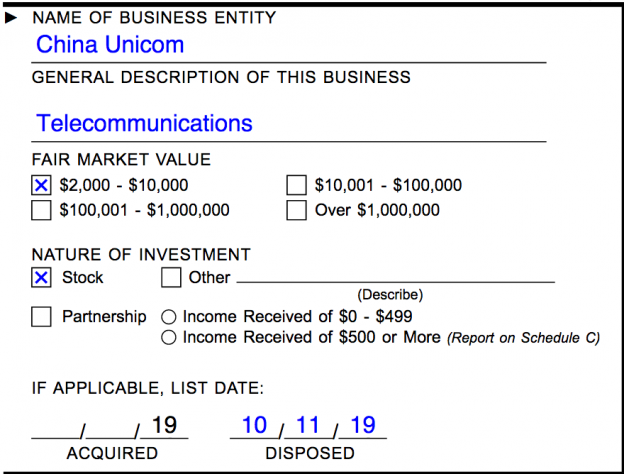

And Meng can't pretend that he didn't understand that he was to list any security he held during the year and provide the sale date, since he did so with one investment:4

Note also that Meng more often than not refers to the same investment differently across the two forms, impeding comparison. For instance, Ares Capital is "ARCC CAPITAL CORP. (ARCC)" in Meng's initial filing and "Ares Capital Corp" in his 2019 annual filing; "Open Joint Stock Company Gazprom (OGZPY)" in the initial filing becomes "PJSC Gazprom" in the annual. And Meng did not use ticker symbols consistently even in his initial filing, witness "Johnson & Johnson" in Meng’s initial filing.

Meng also has two entries for GLD in his initial filing, one as "SPDR GOLD SHARES (GLD)," at the top of page 7 of the pdf, and "SPDR GOLD TR GOLD SHS (GLD)" at the bottom of page 8. Are these listed separately, with different names despite the same ticker because they are held at different brokerage firms? If so, does CalPERS have access to both sets of records? And do these apparently separate holdings add up to more than $100,000, which would have required them to show that higher total? As you will see in the tally below, this is not Meng's only duplicate item.

Anyone in finance will tell you that this level of sloppiness is troubling. An error as minor as the omission of a period in the name of a secured loan in a contract can vitiate the security interest in that loan.5 More generally, financial services professionals fetishize the consistent use of legal names (or defined terms as substitutes) for among other reasons, accurate entry in databases to prevent back office errors, particularly in trades.6

Please go to Naked Capitalism to read the entire article.

________

Does anyone really think these 80,000 public employee retirees care where CalPERS' investments are located as long as they receive their yearly $100,000 pensions?

Nearly 80,000 California retirees are receiving $100,000 or more in pension pay, new data show

If CalPERS' management tells people their pension program is so beneficial for California in terms of providing jobs and economic growth, why are thousands of californians leaving the state and why are economic conditions worsening?

Who Pays for CalPERS Pensions?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.