________

Source: Global Times

China, EU extend currency swap for 3 yrs, in fresh sign of close economic ties

By GT staff reporters | October 10, 2022

A view of the PBC building in Beijing on August 22, 2022 Photo: VCG

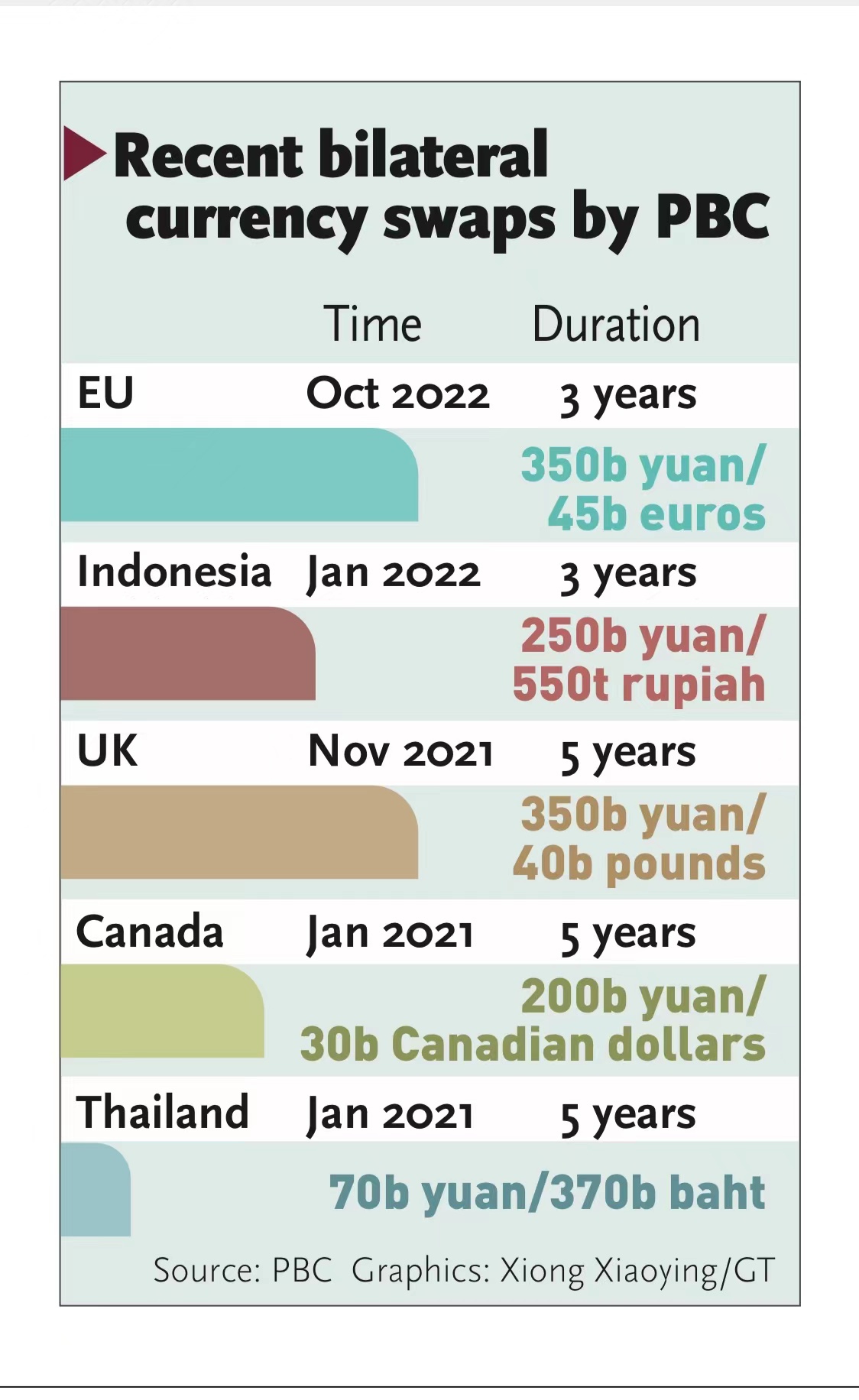

The People's Bank of China (PBC), the country's central bank, on Monday revealed an extension of its local currency swap agreement with the European Central Bank (ECB) for another three years, in a fresh sign of closer ties between the two major currencies amid mounting pressure from a strong US dollar.

By conducting currency swaps, the two sides' trade or financial transactions could have lower costs, as companies don't need to resort to a third-party currency, usually the US dollar, to complete the deals, market watchers said. It could also lower the risks of foreign exchange reserve shortages, as well as help promote the yuan's internationalization, they noted, reckoning the move will shore up China-EU trade.

The PBC recently extended for three years a bilateral currency swap with the ECB worth 350 billion yuan or 45 billion euros ($49 billion), according to a statement issued by the PBC on Monday.

The scale of the currency swap is unchanged from the previous rounds, the statement noted, saying that the deal will help deepen financial cooperation between China and Europe, boost the two sides' trade and investment, and maintain the stability of the financial market.

A currency swap is an agreement between two central banks to exchange currencies. It allows a central bank to obtain foreign currency liquidity from the central bank that issues it, usually because it needs to provide this to domestic commercial banks.

Local swaps mainly exist to solve the settlement needs between two major trading partners, including cross-border trade settlement and investment, Dong Dengxin, director of the Finance and Securities Institute of the Wuhan University of Science and Technology, told the Global Times on Monday.

Please go to Global Times to read more.

________

What is going on with the US dollar?

What is going on in China?

Related:

THREAD: The US government's new export controls are wreaking havoc on China's chip industry

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.