by

United States Marine Field McConnell

Plum City Online - (AbelDanger.blogspot.com)

July 21, 2016

1. Abel Danger (AD) claims that FBI director James Comey has tracked hostile actors – allegedly embedded in 8(a) companies funded by the SBA's accelerated loan guarantee program – through the 9/11 attacks and the subsequent, serial, long-range acts of sabotage.

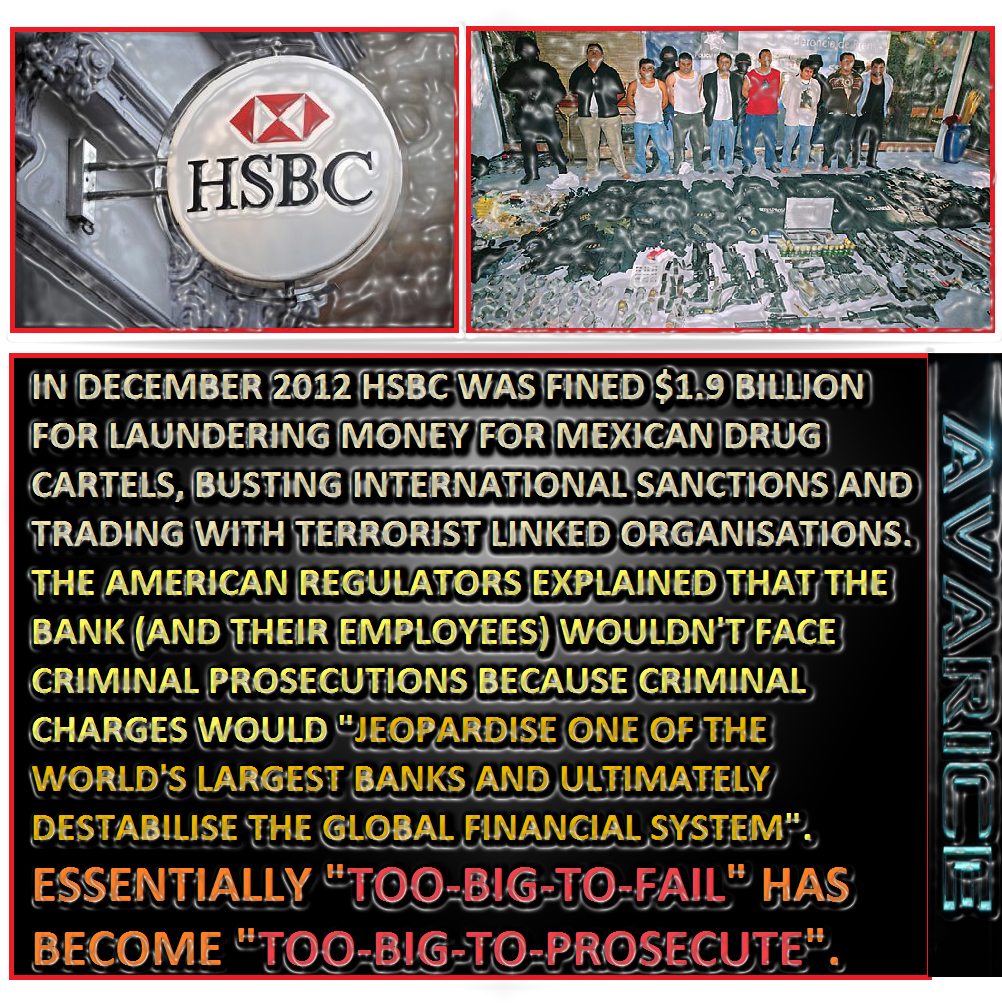

2. AD claims that Comey became a director of Serco's banker HSBC in order to track the actors through a bank of servers allegedly developed by 8(a) companies to launder money for HSBC's drug-hub clients and selected pay-to-play donors to the Clinton Foundation.

3. AD claims that Comey has tracked hostile actors through 8(a) servers to Heidi Cruz, a former Goldman Sachs manager in Houston who allegedly set up a Zulu death-betting service for insiders to bet on the time of victim deaths associated with fire bombs under the heli-deck of the BP Deepwater Horizon rig on April 20, 2010 in the Gulf of Mexico.

4. United States Marine Field McConnell asks James Comey to hand over any evidence of hostile actors or death betting on the Clinton server network which might help families sue for the wrongful deaths of relatives in the alleged BP firebombing of April 20, 2010 (http://www.abeldanger.blogspot.com/2010/01/field-mcconnell-bio.html).

Deepwater Horizon (2016) – Official Movie Teaser Trailer

Comey: Clinton Made United States Secrets Vulnerable To Hostile Actors

Ted Cruz BOOED by RNC Crowd After REFUSING to Endorse Donald Trump!

Copy of SERCO GROUP PLC: List of Subsidiaries AND Shareholders! [Note HSBC, British and Saudi Governments and Goldman Sachs]

Top HSBC Executive Arrested In US For Front-Running Trades

White's Club death-bet bookmaker service dates back to 1743 only the technology to spot fix the Zulu time of victim death has changed.

Defense Ammunition Center [Outsourced to Serco]

Serco... Would you like to know more?

"Digital Fires Instructor Serco - Camp Pendleton, CA Uses information derived from all military disciplines (e.g., aviation, ground combat, command and control, combat service support, intelligence, and opposing forces) to determine changes in enemy capabilities, vulnerabilities, and probable courses of action."

"The Deepwater Horizon Oil Spill (also referred to as the BP oil spill, the BP oil disaster, the Gulf of Mexico oil spill, and the Macondo blowout) began on April 20, 2010 in the Gulf of Mexico on the BP-operated Macondo Prospect.

Following the explosion and sinking of the Deepwater Horizon oil rig, a sea-floor oil gusher flowed for 87 days, until it was capped on July 15, 2010.[6][7] Eleven people went missing and were never found[6][8][9][10] and it is considered the largest accidental marine oil spill in the history of the petroleum industry, an estimated 8% to 31% larger in volume than the previously largest, the Ixtoc I oil spill. The US Government estimated the total discharge at 4.9 million barrels (210 million US gal; 780,000 m3).[3] After several failed efforts to contain the flow, the well was declared sealed on September 19, 2010.[11] Reports in early 2012 indicated the well site was still leaking.[12][13]"

"Hearings: Transocean official untroubled about various red-flag issues

Published: Thursday, May 27, 2010, 11:06 AM

Updated: Thursday, May 27, 2010, 3:31 PM

http://www.nola.com/news/gulf-oil-spill/index.ssf/2010/05/hearings_transocean_official_u.html

Throughout his testimony, Harrell expressed little concern about issues that panelists and lawyers for the various companies suggested could have raised red flags.

For example, Harrell said the reason he was suddenly handed a BP plan that didn't include the key negative pressure test was that BP was constantly changing the well plan. He said the company had added additional casings, the various size pipes that line the well, and he said the one that didn't include the pressure test had not been approved by federal regulators.

The rig's senior tool pusher, Miles Ezell, told Harrell once they were safe on the rescue ship that the rig had lost control of the well at 9:45 p.m., about eight minutes before the explosion. Harrell said the driller or tool pusher is authorized to activate the blowout preventer in case of lost well control. He said Ezell got word the well was being shut in, although it's now clear the blowout preventer didn't work.

Harrell said that when he'd started his stint on the rig a few weeks before the incident, there was a "tick" on the blowout preventer's test ram when it was in the open position. But he said he wasn't worried about it and felt the blowout preventer was functioning well before the incident.

Next to the blowout preventer, the only other emergency action the rig can take is to unhitch from the well equipment and sail away. But when the disaster struck, that system failed to work, too, Harrell testified.

"It appeared they had been taken out from the explosion," he said.

Previous testimony of Jimmy Harrell:

Members of the investigative board also asked Harrell questions that followed up on Wednesday's testimony by Douglas Brown, the rig's chief mechanic. Brown had said Harrell got into a "skirmish" with BP's company man at a meeting the morning of the incident. Harrell said he actually expressed concern to BP company man Robert Kaluza that a new drilling plan did not include a key test at a morning meeting April 19, the day before the accident.

Harrell said Kaluza's plan did not include a "negative test" to measure pressure in the well, and Harrell said he made sure the test was done before he would agree to displace mud from the riser with lighter seawater. He said he was successful at getting BP to authorize the test and, in fact, the test was performed twice. Harrell said the other BP company man, Don Vidrine, wanted to do the second negative test.

Harrell said he was happy with the results of the two negative tests, which, ideally, would have shown no drilling mud being returned to the rig. But he acknowledged that the first negative test returned 23 barrels of mud and the second test returned 15 barrels. According to previous testimony, a total of 51 barrels of cement slurry was used to seal the well casing.

Federal regulations require drilling rigs to perform a definitive test of the integrity of a well's cement -- called a cement bond log -- if there are concerns with the results of negative and positive pressure tests. Harrell said BP had a team from Schlumberger at the ready to perform a cement bond log, but Harrell said he was happy with the results of the negative test.

A Schlumberger official told The Times-Picayune last week that the team of testers was sent home at 11 a.m. the morning of the accident without ever conducting the cement bond log.

Robert Kaluza declined to testify Thursday, invoking his Fifth Amendment right against self incrimination."

"The first thing you need to know about Goldman Sachs is that it's everywhere. The world's most powerful investment bank is a great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money. In fact, the history of the recent financial crisis, which doubles as a history of the rapid decline and fall of the suddenly swindled dry American empire, reads like a Who's Who of Goldman Sachs graduates."

"Heidi Cruz

Heidi Suzanne Cruz (née Nelson; August 7, 1972) is an American investment manager at Goldman Sachs. She served in the Bush White House as the economic director for the Western Hemisphere at the National Security Council, as the director of the Latin America Office at the U.S. Treasury Department, as Special Assistant to U.S. Trade Representative Robert B. Zoellick, and as economic policy advisor to the 2000 George W. Bush presidential campaign. She is the wife of Republican Texas senator and former 2016 U.S. presidential candidate Ted Cruz.

Early life and education[edit]

Heidi Nelson was born on August 7, 1972 in San Luis Obispo, California, to parents Suzanne Jane (née Rouhe), a dental hygienist,[2] and Peter Christian Nelson, a dentist.[3] Heidi Nelson was raised as a Seventh-day Adventist.[4][5][3][2] During a part of Nelson's childhood, she lived with her family in Kenya and Nigeria, and also Asia, where they served as missionaries, while both parents participated in dental health work.[6][7][4][8] Nelson attended Valley View Adventist Academy in Arroyo Grande, California, near her home town of San Luis Obispo.[9] She completed her secondary education in 1990 at Monterey Bay Academy, an Adventist boarding school about 150 miles north in La Selva Beach, California.[9]

Following high school, Nelson attended Claremont McKenna College, graduating Phi Beta Kappa with a B.A. in Economics and International Relations in 1994.[10][11] While attending the school, she was active in the student Republican group.[12] Prior to graduation, she studied abroad at the University of Strasbourg.[13] In 1995, she received a Masters of European Business degree from Solvay Brussels School of Economics and Management in Brussels, Belgium.[11] Her second graduate degree was an M.B.A. from Harvard Business School in 2000.[4][10][14][10]

Career[edit]

In 2000, Nelson worked as an economic policy director on the Bush for President campaign,[2] where she met her future husband Ted Cruz.[3] Following her marriage to Cruz in 2001, she went on to work for the Bush Administration.[3][4] She began as a top deputy to U.S. Trade Rep. Robert Zoellick, focusing on economic policy.[15][3][4] Cruz worked as director of the Latin America desk at the Department of Treasury in 2002.[16][15]

In 2003, Cruz reported directly to National Security Advisor Condoleezza Rice.[16] Cruz eventually became the director for the Western Hemisphere on the National Security Council where she had Rice's ear.[16][15][3][4][14][17] During a New York Times interview, Cruz recalled enjoying her tenure with the Bush administration and found her work to be "personally fulfilling."[18]

After commuting between Washington, D.C. and her husband's home state of Texas for a year,[19] she moved to Texas in 2004.[3][20] Cruz later stated that she did not see the move as giving up her career but as a relocation.[18] Cruz has worked for three investment banks, JP Morgan Chase, Merrill Lynch, and Goldman Sachs.[21][2] In 2005, she went to work for Goldman Sachs as a private wealth manager.[22] After serving at Goldman Sachs for seven years, Cruz was promoted in 2013 to regional head of the Southwest United States for the Investment Management Division in Houston.[4][14][23][24]

From 2005-2011 Heidi Cruz was an active member of the Council on Foreign Relations and was a member of the Independent Task Force on North America that in 2005 published a report entitled "Building a North American Community."[15][25]"

"Furious Republicans turn on Ted Cruz and his wife Heidi has to be escorted off Convention floor after he avoids endorsing bitter rival Trump and tells Americans to 'vote your conscience'

Ted Cruz refused to endorse Donald Trump and instead urged Americans to 'vote your conscience' in November

He delivered a calculated speech that divided the hall at the Republican National Convention in Cleveland, Ohio

Cruz's own supporters cheered loudly as he spoke while some pro-Trump delegates yelled out in apparent disgust

Video footage has emerged showing Cruz's wife Heidi being led out of the Quicken Loans Arena

Angry Republicans reportedly had to be restrained from assaulting failed presidential candidate Cruz

Speaker Newt Gingrich of Georgia then addressed the turmoil to ‘paraphrase’ what Cruz had said earlier

Gov. Chris Christie said 'it was an awful, selfish speech' and Cruz showed himself 'to not be a man of his word

Trump told his Twitter followers he saw Cruz's speech two hours earlier but 'let him speak anyway'

Eric Trump gave a rousing tribute to his father, however it was beset by technical difficulties

Mike Pence's speech bled into the 11:00 hour and out of prime time but Trump made a surprise entrance on stage"

"Top HSBC manager charged in forex probe

21 July 2016

A top HSBC executive has been charged with fraud in the US. Mark Johnson, HSBC's global head of foreign exchange trading was arrested on Tuesday night. A former colleague, Stuart Scott, has also been charged.

The two traders are accused by the US Department of Justice (DoJ) of using inside information to profit from a $3.5bn (£2.6bn) currency deal.

HSBC said it did not comment on individual employees or active litigation.

However, a spokesman said the bank was cooperating in the DoJ's ongoing investigation into global currency markets. Mr Johnson was released on $1m bail following a court hearing on Wednesday. Mr Scott has denied the allegations. The US Department of Justice (DoJ) accuses the traders of "front-running".

That is misusing confidential information provided by a client who planned to convert $3.5bn into British pounds. It is claimed that the two executives bought sterling themselves before handling the order, because they knew that such a large transaction would push up the value of the currency, and allow them to make money.

Holding executives 'accountable'

The DoJ also claimed the traders timed the purchase in order to maximise its effect on the value of the British currency. As a result it's alleged they were able to generate significant profits for the bank. They are also accused of concealing their actions from the client.

"The charges and arrest announced today reflect our steadfast commitment to hold accountable corporate executives and licensed professionals who use their positions to fraudulently enrich themselves," said the US Attorney Robert Capers.

US prosecutors cited emails and conversations from Bloomberg chats that indicated the two men plotted to see how high they could raise the the dollar to pound exchange rate before the clients would 'squeal'.

The DoJ said that HSBC brought in roughly $8m profit from the currency trades they conducted for the client. What is front running?

Front running is an unethical way for a broker to benefit from a client's trade.

When companies or individuals want to buy a substantial amount of currency- for example dollars in exchange for pounds - they typically go through a broker. A large purchase can push up the value of that currency.

Knowing this, the broker can buy dollars on his own account ahead of the deal, carries out his client's transaction, watches the value of dollars rise, and then sells his own dollars at a handsome profit.

Specific charges

In the charges released on Wednesday, the DoJ cites specific trades Mr Johnson and Mr Scott made in late 2011. In late November and early December of that year, Mr Johnson allegedly purchased pounds in exchange for euros, and pounds in exchange for dollars.

Mr Scott allegedly made a purchase of pounds in exchange for euros.

The two men are accused of then selling their sterling to HSBC, for a profit on the day of the alleged victim's foreign exchange transaction.

The DoJ also accused the two men of encouraging the alleged victim to conduct the trade at a specific time during the day, because it was easier to manipulate the price then.

"It was advantageous to them and HSBC, and disadvantageous to the victim company, to execute the victim company foreign exchange transaction" at the time they did, the DoJ said.

This case is related to a three-year long investigation by regulators into rigging of the currency market globally, but is the first time the Department of Justice has brought charges against individuals.

In May 2015, four banks pleaded guilty to conspiring to manipulate the foreign exchange market.

HSBC was not part of those criminal cases, but it was one of six banks fined by UK and US regulators over their traders' attempted manipulation of foreign exchange rates in November 2014.

HSBC spokesman Robert Sherman said the bank was cooperating with the DoJ's continuing foreign exchange investigation.

Forex market

About 40% of the world's currency dealing is estimated to go through trading rooms in London. The massive market, in which $5.3 trillion worth of currencies are traded daily, dwarfs the stock and bond markets. There is no physical forex marketplace and nearly all trading takes place on electronic systems operated by the big banks and other providers.

Daily "spot benchmarks" known as "fixes" are used by a wide range of financial and non-financial firms to, for example help value assets or manage currency risk.

"Serco do a bunch more that didn't even make our story: As well as thanking God for his success, CEO Chris Hyman is a Pentecostal Christian who has released a gospel album in America and fasts every Tuesday. Amazingly, he was also in the World Trade Centre on 9/11, on the 47th floor addressing [Serco] shareholders. Serco run navy patrol boats for the ADF, as well as search and salvage operations through their partnership with P&O which form Defence Maritime Services. Serco run two Australian jails already, Acacia in WA and Borallon in Queensland. They’re one of the biggest companies In the UK for running electronic tagging of offenders under house arrest or parole."

"FBI: 'Hostile Actors' Likely Hacked Clinton Email Secrets

Comey recommends not prosecuting presumed Democratic nominee

BY: Bill Gertz

July 6, 2016 5:00 am

An extensive FBI investigation found evidence that foreign government hackers accessed private emails sent by former secretary of state Hillary Clinton but no direct evidence spies hacked into the several unsecure servers she used.

FBI Director James Comey revealed Tuesday the 11-month probe into Clinton's private email servers uncovered negligent handling of very sensitive classified information that was placed on several unsecure servers between 2009 and 2013, when Clinton served as secretary of state.

In an unusual public announcement, Comey outlined findings that included discovery of highly classified information sent and received on Clinton's private email servers, and signs that "hostile actors" gained access to email accounts of people who were sharing emails with Clinton."

"UK Cabinet Office – Emergency Planning College – Serco …..Types of Exercise

Workshop Exercises These are structured discussion events where participants can explore issues in a less pressurised environment. They are an ideal way of developing solutions, procedures and plans rather than the focus being on decision making. Table Top Exercises These involve a realistic scenario and will follow a time line, either in real-time or with time jumps to concentrate on the more important areas. The participants would be expected to be familiar with the plans and procedures that are being used although the exercise tempo and complexity can be adjusted to suit the current state of training and readiness. Simulation and media play can be used to support the exercise. Table-top exercises help develop teamwork and allow participants to gain a better understanding of their roles and that of other agencies and organisations. Command/Control Post Exercises These are designed primarily to exercise the senior leadership and support staff in collective planning and decision making within a strategic grouping. Ideally such exercises would be run from the real command and control locations and using their communications and information systems [Feeling lucky, Punk?]. This could include a mix of locations and varying levels of technical simulation support. The Gold Standard system is flexible to allow the tempo and intensity to be adjusted to ensure maximum training benefit, or to fully test and evaluate the most important aspects of a plan. Such exercises also test information flow, communications, equipment, procedures, decision making and coordination. Live Exercises These can range from testing individual components of a system or organisation through to a full-scale rehearsal. They are particularly useful where there are regulatory requirements or with high-risk situations. They are more complex and costly to organise and deliver but can be integrated with Command Post Exercises as part of a wider exercising package.”

"Serco farewell to NPL after 19 years of innovation 8 January 2015 Serco said goodbye to the National Physical Laboratory (NPL) at the end of December 2014 after 19 years of extraordinary innovation and science that has seen the establishment build a world-leading reputation and deliver billions of pounds of benefit for the UK economy. During that period under Serco's management and leadership, NPL has delivered an extraordinary variety and breadth of accomplishments for the UK's economy and industry. Some of the key achievements during that time have been:… It has been estimated that work carried out by the Centre of Carbon Measurement at NPL will save eight million tonnes of carbon emissions reductions (2% of UK footprint) and over half a billion pounds in economic benefit over the next decade…. NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency trading [for Serco's front running banks] in the City through NPL [Zulu] Time."

"Base One Technologies, Ltd. is a DOMESTIC BUSINESS CORPORATION, located in New York, NY and was formed on Feb 15, 1994. This file was obtained from the Secretary of State and has a file number of 1795583.

This business was created 7,695 days ago in the New York SOS Office and the registered agent is C T Corporation System that does business at 111 Eighth Avenue , New York in New York.

After conducting a search for principals and owners of Base One Technologies, Ltd., we were able to find 2 owners and/or executives. Their information is listed below.

This file was last updated on May 14, 2013.

Principals

Liza R Zaneri

Chief Executive Officer

15 Irving Place New

Rochelle, NY 10801"

"Serco's Office of Partner Relations (OPR) helps facilitate our aggressive small business utilization and growth strategies. Through the OPR, Serco mentors four local small businesses under formal Mentor Protégé Agreements: Three sponsored by DHS (Base One Technologies, TSymmetry, Inc., and HeiTech Services, Inc.,) and the fourth sponsored by GSA (DKW Communications, Inc.). Serco and HeiTech Services were awarded the 2007 DHS Mentor Protégé Team Award for exceeding our mentoring goals." http://www.dtic.mil/whs/directives/corres/pdf/100515p.pdf

"[White's Club member] Rupert Christopher Soames OBE (born 18 May 1959) is a British businessman, CEO of the outsourcing [and long range death-betting bookmaker] company Serco.[1] Soames was born in Croydon, Surrey, to Lord and Lady Soames. He is a grandson of Sir Winston Churchill, a nephew of the former Defence Secretary Duncan Sandys and Diana Churchill; the journalist Randolph Churchill and the actress and dancer Sarah Churchill and a great-nephew of the founders of the Scout movement, Robert Baden-Powell and Olave Baden-Powell. His brother is the Conservative MP Sir Nicholas Soames.

Education[edit]

Soames was educated at St. Aubyns Preparatory School in Rottingdean, East Sussex and Eton College,[2] and then Worcester College at the University of Oxford,[3] during which time he worked as a DJ at the London nightclub Annabel's, as well as being elected to the Presidency of the Oxford Union.[3] Career[edit]

Upon graduation, he was offered a position at General Electric Company (GEC) by the managing director Arnold Weinstock. He remained at GEC for 15 years, working in the company's avionics and computing divisions, and became managing director of Avery Berkel, running the company's UK, India, Asia and Africa operations.[4]

After leaving GEC in 1997, Soames joined the software company Misys as chief executive of its Midas-Kapiti division. He was promoted to chief executive of the Banking and Securities Division in June 2000.[5]

Soames left Misys after a disagreement with Misys founder Kevin Lomax on the company's direction, and was appointed chief executive of power hire group Aggreko in June 2003,[6] replacing Philip Harrower who died when his car collided with a train in the United States.[7]

Soames was appointed Officer of the Order of the British Empire (OBE) in the 2010 New Year Honours.[8] In November 2010 Rupert Soames gave a speech to Holyrood in which he warned, "In the UK, we are already close to the rocks, because, over the next 8 years a third of our coal-fired capacity, two-thirds of our oil-fired capacity, and nearly three-quarters of our nuclear capacity will be closed down either through age or the impact of the European Large Combustion Plant Directive. Absent a massive and immediate programme of building new power stations, with concrete being poured in the next two years, we will be in serious danger of the lights going out."

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.