by

United States Marine Field McConnell

Plum City Online - (AbelDanger.net)

January 25, 2016

1. Abel Danger (AD) asserts that a cartel of Serco shareholders led by Goldman Sachs provides resilient training to Vampire City managers so they can inject news of false-flag attacks into media plays and extort citizens with outsourced protection services.

2. AD asserts that Serco's vampire-city investors in the CAI Private Equity Group and Trump Shuttle Inc. had Boeing aircraft modified by Cascade Aerospace in B.C. so passengers could participate in death-pool betting at the Pickton pig farm also in B.C.

3. AD asserts that Serco – the world's largest air traffic controller – used technology from CAI investee Macdonald Dettwiler and Associates to inject ad hoc waypoints needed for an Al-Qaeda 9/11 media play through the former Oneworld headquarters offices in Vancouver.

United States Marine Field McConnell (http://www.abeldanger.net/2010/01/field-mcconnell-bio.html) offers to show voters how to win a resilience war with the Serco as it attempts to extend Vampire City control over the governments of the United Kingdom and United States.

Copy of SERCO GROUP PLC: List of Subsidiaries AND [Loan Shark] Shareholders!

(Mobile Playback Version)

Secret City - A film about the [Vampire] City of London, the Corporation that runs it.

Serco... Would you like to know more?

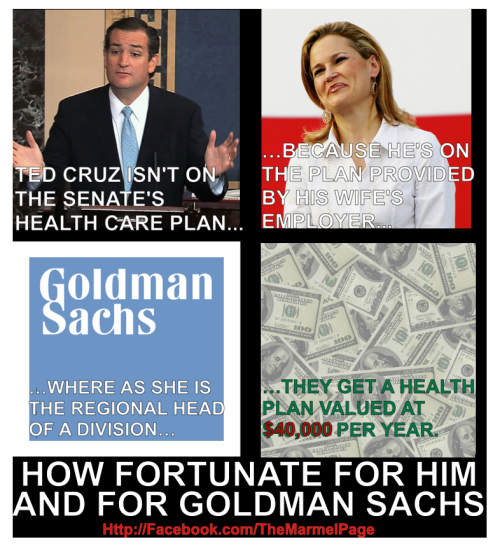

Goldman Sachs: The Vampire Squid

"U.S. Navy 'Top Gun' Pilot Questions 9/11

by Alan Miller

Page 1 of 1 page(s) September 5, 2007 - U.S. Navy Top Gun pilot, Commander Ralph Kolstad, started questioning the official account of 9/11 within days of the event. It just didnt make any sense to me, he said. And now 6 years after 9/11 he says, When one starts using his own mind, and not what one was told, there is very little to believe in the official story.

Now retired, Commander Kolstad was a top-rated fighter pilot during his 20-year Navy career. Early in his career, he was accorded the honor of being selected to participate in the Navys Top Gun air combat school, officially known as the U.S. Navy Fighter Weapons School. The Tom Cruise movie, Top Gun reflects the experience of the young Navy pilots at the school. Eleven years later, Commander Kolstad was further honored by being selected to become a Top Gun adversary instructor. While in the Navy, he flew F-4 Phantoms, A-4 Skyhawks, and F-14 Tomcats and completed 250 aircraft carrier landings.

Commander Kolstad had a second career after his 20 years of Navy active and reserve service and served as a commercial airline pilot for 27 years, flying for American Airlines and other domestic and international careers. He flew Boeing 727, 757 and 767, McDonnell Douglas MD-80, and Fokker F-100 airliners. He has flown a total of over 23,000 hours in his career.

Commander Kolstad is especially critical of the account of American Airlines Flight 77 that allegedly crashed into the Pentagon. He says, At the Pentagon, the pilot of the Boeing 757 did quite a feat of flying. I have 6,000 hours of flight time in Boeing 757s and 767s and I could not have flown it the way the flight path was described.

Commander Kolstad adds, I was also a Navy fighter pilot and Air Combat Instructor and have experience flying low altitude, high speed aircraft. I could not have done what these beginners did. Something stinks to high heaven!

He points to the physical evidence at the Pentagon impact site and asks in exasperation, Where is the damage to the wall of the Pentagon from the wings? Where are the big pieces that always break away in an accident? Where is all the luggage? Where are the miles and miles of wire, cable, and lines that are part and parcel of any large aircraft? Where are the steel engine parts? Where is the steel landing gear? Where is the tail section that would have broken into large pieces?"

"MDA Wins Key U.S. Aviation Contract

Press Release

Source: MacDonald, Dettwiler and Associates Ltd.

Posted Thursday, May 3, 2001 Richmond, B.C. - MacDonald, Dettwiler and Associates Ltd. (TSE: MDA) announced today the company has been awarded a contract by the United States Air Force to develop a system to be used by specialists at Air Force bases to design Instrument Approach Procedures (IAPs).

IAPs are published instructions to pilots specifying a series of aircraft maneuvers that must be executed for the aircraft to transition safely from an en route airway to a runway final approach when flying by instruments. MDA's system ingests digital terrain and elevation data, air navigation data (such as the locations of navigation aids, runways, buildings and towers) to build and display a virtual model of the physical environment surrounding an airport. It then develops the complex surfaces that define a safe approach corridor for any of the dozens of IAP variants, and determines whether any of the defined surfaces are penetrated by terrain or man-made obstacles. It flags these incursions to the operator, who can quickly modify the approach procedure through a drag-and-drop user interface.

This initial award, valued at $2.9 million (CDN), consists of a fixed price element to develop, integrate, and test the system. The next phase will include installation, government testing, and operator training. The contract includes an option for the U.S. Federal Aviation Administration (FAA) to adapt the system for their needs. The U.S. Air Force also has options to field the successful system at up to 108 air bases around the world, and to award T&M support contracts for up to 8 years. MDA plans to team up with Air Navigation Data (AND) of Ottawa to offer a custom solution, based on AND's "Final Approach" product.

MDA President and CEO Daniel Friedmann said: "This is a significant project for MDA that has the potential to improve the safety of air transportation for many other air forces and civil aviation authorities world wide."

Related web sites:

www.mda.ca

www.usaf.com

For more information, please contact:

Ted Schellenberg

Media Relations

MacDonald Dettwiler

Telephone: (604) 231-2215

E-mail: teds@mda.ca"

"Willie Card, manager of FAA's Contract Tower Office, died unexpectedly on June 10. Those of us who knew Willie in his official capacity became his friends as well and we mourn the tragic loss of our colleague. Willie would have been a speaker at the USCTA Contract Tower Program Workshop July 14-16. He was a frequent speaker at USCTA and other industry events and loved the contact and interaction with those who staff the airports and towers in his program. This would have been Willie’s last time to speak at our annual workshop, since he was planning to retire at the end of 2002. Willie Fred Card was born Dec. 26, 1946, in Louisville, Ala. He lived in Lorain, Ohio, from 1952 until he joined the U.S. Air Force in 1965. Willie served in the Air Force from July 1965 until March 1969, where he was trained as an air traffic controller. He was a dedicated employee of the Federal Aviation Administration for more than 30 years. Willie's career also included air traffic control positions at Cleveland ATCT, the FAA Academy, Pittsburgh ATCT and Boston ATCT. His career culminated at FAA headquarters where he served as an Air Traffic Control Specialist, manager of the Runway Incursion Program and manager of the Contract Tower Program. The Contract Tower Program is considered as one of the most successful in FAA. Under Willie’s outstanding leadership and guidance, the Contract Tower Program now operates with a budget approaching $80 million and includes 217 towers. He received numerous awards during his tenure at FAA and was highly respected in his profession. He enjoyed traveling, playing golf, building computers and he loved barbecuing, jazz and blues music. Willie was a devoted father and grandfather, and is survived by his longtime companion, Ms. Mabel C. Jones, and his children Erica, Scott, William, Vanessa and Nicole. Log on to www.bms-llc.com/willie_card/index.htm to view the website in honor of Willie. Willie's funeral was held June 18 in Lorain, Ohio, and he was buried in Avon, Ohio. A memorial service for friends and FAA colleagues was held in FAA's headquarters auditorium on June 25, when memories of Willie were shared. Tributes were given by a number of government and industry officials, including Steve Brown, acting FAA associate administrator for air traffic; Steve Christmas, vice president-aviation, Serco Management Services; Shane Cordes, president/CEO Midwest ATC Service; Wes Cozart, president, Robinson-Van Vuren Associates, and Spencer Dickerson, executive vice president of AAAE and executive director of the U.S. Contract Tower Association."

"[Former CAI special investor in Macdonald Dettwiler and vampire lender to Trump Shuttle Inc.] Walter Bigelow Wriston (August 3, 1919 – January 19, 2005) was a banker and former chairman and CEO of Citicorp. As chief executive of Citibank / Citicorp (later Citigroup) from 1967 to 1984, Wriston was widely regarded as the single most influential commercial banker of his time.[1][2] During his tenure as CEO, the bank introduced, among other innovations, automated teller machines, interstate banking, the negotiable certificate of deposit, and "pursued the credit card business in a way that no other bank was doing at the time".[3][4] With then New York Governor Hugh Carey and investment banker Felix Rohatyn, Wriston helped save New York City from bankruptcy in the mid-1970s by setting up the Financial Control Board and the Municipal Assistance Corporation, and persuading the city's union pension funds and banks to buy the latter corporation's bonds.[5]"

"Oneworld (marketed as oneworld; CRS: *O) is an airline alliance founded on 1 February 1999. The alliance's stated objective is to be the first-choice airline alliance for the world's frequent international travelers. Its central alliance office is currently based in New York, New York, in the United States. Its member airlines include Air Berlin, American Airlines, British Airways, Cathay Pacific, Finnair, Iberia, Japan Airlines, LAN Airlines, Malaysia Airlines, Qantas, Qatar Airways, Royal Jordanian, S7 Airlines, SriLankan Airlines and TAM Airlines, plus some 30 affiliated airlines. As of 31 March 2014, Oneworld is the third largest global alliance in terms of passengers with 512.8 million passengers, behind Star Alliance (637.6 M)[2] and SkyTeam (588 M).[3] Its slogan is "An alliance of the world's leading airlines working as one."

As of October 2013, its member airlines collectively operate a fleet of 2094 aircraft, serve about a thousand airports in more than 150 countries, carrying 475 million passengers per year on 14,000 daily departures, generating annual revenues of more than US$140 billion.

Management[edit]

Oneworld announced the formation of a central alliance team, the Oneworld Management Company (oMC), in February 2000, to mark the alliance's first anniversary. The oMC was established in May 2000 in Vancouver, Canada, and in June 2011 relocated to New York City. It acts as the alliance's central secretariat, with responsibility for driving future growth and the launch of new customer services and benefits. The oMC was first led by Managing Partner Peter Buecking, previously Director of Sales and Marketing at Cathay Pacific; followed by John McCulloch, previously the alliance's Vice-President for Marketing; and since December 2011 by Bruce Ashby, who previously held roles of CEO of Saudi Arabia's SAMA Airlines, CEO of India's IndiGo, and Executive Vice-President for US Airways. Reporting to the CEO are Vice-Presidents for Commercial; Membership and Customer Experience; and Corporate Communications, a Chief Financial Officer and an IT Director.[4][5][6]"

"The making of CAI

At or about the same time that Restler was guiding the privatization of Hydro's gas division, he decided to leave Shearson Lehman Brothers. Along with about a half dozen others from business and Wall Street, he started a small, boutique investment firm called CAI Capital Management.

CAI opened its doors in 1989, and began looking for both investors and investment opportunities. It found both in Canada.

MacDonald Dettwiler and Associates, the Richmond-based firm specializing in satellite imaging, space robotics and environmental monitoring, was one of the earliest companies with which Restler and CAI held discussions. Talks remained exploratory until 1999, when the New York firm and another investor together acquired a one-third interest in the Richmond company [and allegedly had it develop the anti-hijacking technology tested on 9/11].

Restler soon took a seat on MDA's board of directors, and a year later he was joined by David Emerson -- a CAI investor and, since 2008, a "senior advisor" at the equity firm's Vancouver office.

By 2004, CAI (with a substantial profit) had exited its position in MacDonald Dettwiler, and that same year Emerson won election as a Liberal Member of Parliament for Vancouver-Kingsway. (He crossed the floor days after the 2006 general election to join the victorious Conservatives and retain his seat at the cabinet table. Rather than face his constituents and answer for that controversial decision, Emerson retired prior to the 2008 election.)"

"Aircraft Maintenance, Repair & Overhaul

Cascade Aerospace is Canada's largest exclusively-third party Transport Canada-Approved Maintenance Organization (AMO) and industry leader in low span times. Cascade provides comprehensive nose-to-tail maintenance services for a range of aircraft platforms and our service offerings include:

Light and heavy maintenance checks (A through D level/intermediate and depot level)

Major structural inspection and repair

Corrosion Prevention Control Programs

Supplemental Structures Inspection Programs

Bridge maintenance and maintenance planning

Component repair and overhaul

Operational support

Fly-in and AOG support

Aircraft Types: Lockheed Martin C-130, L-382 and L-100 Hercules and C-130J Super Hercules aircraft Boeing 737 (all models) and Boeing 757 (all models) Bombardier Q400, Dash 8 series, CRJ 100/200 regional aircraft and CL-215 and CL-215T water scooper aircraft"

"AUG 8, 2013 @ 01:43 PM 13,203 VIEWS

"The Great Vampire Squid Keeps On Sucking

Jake Zamansky , CONTRIBUTOR I write about securities law Opinions expressed by Forbes Contributors are their own. The now famous Rolling Stone magazine article in 2009 by Matt Taibbi unforgettably referred to Goldman Sachs, the world’s most powerful investment bank, as a "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money."

At the time, Taibbi was describing Goldman's role in the 2008 financial crisis and the speculative bubble of mortgage-backed securities assets which later came crashing down."

"B.C. pension fund invested in defence, oil, tobacco [and pig farm mortgage]

The pension fund that underwrites retirement for B.C.'s firefighters, police officers and public workers is heavily invested in the oilsands, mining companies, defence contractors and big tobacco.

An evaluation of B.C. Investment Management Corp.'s (bcIMC) equity holdings has revealed how billions of dollars of public money is invested.

Although bcIMC's $32.5 billion in equity investments, the largest chunk of its total assets, are spread across dozens of companies ranging from Air France to billionaire Warren Buffett's Berkshire Hathaway, the pension fund also has holdings in large defence contractors such as Lockheed Martin and General Dynamics."

"$10M mortgage on pig farm

Steve Mertl Canadian Press

Sunday, August 21, 2005 VANCOUVER --The B.C. government has put a mortgage worth $10 million on accused serial killer Robert Pickton's notorious pig farm to cover his publicly funded defence, The Canadian Press has learned. Robert Pickton's farm in Port Coquitlam, B.C. December 20, 2004. (CP/Chuck Stoody) But no one at the Attorney General's Ministry will say if that figure represents the estimated cost of Pickton's seven-member legal team in the long and hugely complex case.

And Robert Pickton's share of the property _ his brother and sister are co-owners is currently worth only a fraction of that amount. It's also saddled with several other mortgages and legal judgments that pre-date the province's mortgage.

Even if it could be sold, relatives of the Pickton's alleged victims have other ideas for the land, including turning it into a memorial park or using proceeds of development to compensate the families.

The government's mortgage was registered on the suburban Port Coquitlam property and a nearby smaller parcel, on Feb. 28, 2003, a year after police raided the farm and arrested Pickton.

He faces face 27 counts of first-degree murder related to women, mostly drug-addicted prostitutes, who disappeared from Vancouver's seedy Downtown Eastside in the 1990s. He has not yet entered a plea, and the legal process against him has not as yet resulted in any court findings that he was responsible for any of the deaths.

Documents obtained by The Canadian Press show a mortgage principal of $10 million with no interest rate and no repayment schedule.

The lender is listed as the B.C. Crown, represented by the attorney general. The mortgage was handled by a lawyer for the ministry's legal services branch, who authorized its registration in a Feb. 27 letter to the New Westminster land title office.

Pickton, his brother David and sister Linda Wright each own one-third shares in the pig farm located on Port Coquitlam's Dominion Avenue, which they inherited from their parents. The Pickton brothers split the ownership of the smaller Burns Road property that housed Piggy's Palace, often used for parties.

B.C. Assessment, which tracks property values for tax purposes, valued the seven-hectare pig farm at about $5.9 million as of last fall, up from $4.2 million in the previous assessment. The Burns Road property is assessed at about $140,000.

Both are still zoned for agricultural use, although the surrounding land, some of it former Pickton property, was rezoned and now has big-box stores and condominiums.

Pickton lived in a mobile home on the Dominion Avenue property, running a small-scale piggery and slaughter operation. The brothers also ran a variety of other small businesses from there.

Attorney General's Ministry officials would not say whether the $10 million figure is an estimate of the properties' future value or perhaps a ballpark figure for the cost of Pickton's defence.

"I'd love to answer your question but it's not a matter of choice," said assistant deputy minister Jerry McHale, responsible for justice services. "I'm bound by the confidentiality. We just can't get into the funding arrangements during the trial.'' Attorney General Wally Oppal was unavailable for comment. Pickton was committed for trial after a lengthy preliminary hearing in 2003. Pre-trial hearings began in June under a publication ban and the trial itself won't start until sometime next year, with thousands of pieces of evidence and testimony from dozens of witnesses. Pickton's lead defence lawyer, Peter Ritchie, also would not discuss his funding arrangements with the government nor speculate on the defence's ultimate cost.

The stepmother of Marnie Frey, one of Pickton's alleged victims, is angry his defence could ultimately be paid out of the public purse.

"Why does he have seven lawyers?" Lynn Frey asks. "Nobody else ... has that many lawyers to defend them. Why doesn't he just have one lawyer and be done with it?"

But Russ MacKay, executive director of the B.C. Trial Lawyers' Association, says while such arrangements are extremely rare, Pickton's platoon of lawyers is fair given the mountain of evidence expected at the trial.

Pickton has been in custody since his arrest on Feb. 7, 2002. Police investigators, bolstered by civilian experts, spent more than a year combing the Pickton properties for evidence.

Documents show Pickton initially mortgaged his share of the larger Dominion Avenue property to Ritchie for $375,000 in April 2002. The mortgage, in the form of a demand loan, was to cover Ritchie's retainer.

It was apparently superseded the following February by the government's $10-million mortgage on the Dominion Avenue and Burns Road properties. Both mortgages carry Pickton's signature.

When shown a copy of the mortgage that he had provided, Ritchie said it was no longer applicable.

With property holdings and business interests, Pickton never qualified for legal aid. The Legal Services Society of B.C. normally pays defence lawyers $80 an hour on lengthy cases and $125 an hour for exceptional ones.

Ritchie launched what's known as a Robotham application in 2002, asking a judge to order Pickton to receive a publicly funded defence.

The hearing ended in October 2002 with Associate Chief Justice Patrick Dohm of B.C. Supreme Court ordering the Attorney General's Ministry to negotiate a funding arrangement directly with Ritchie.

An expert in real-estate law who didn't want to be named says it's not unusual for mortgages not to reflect the value of a property. The $10-million principal in the Pickton mortgage may represent an estimate of the government's maximum security, he says.

Whether it can recover any of that is another question.

Land title records show a long list of charges, mortgages and judgments registered against the two properties, often against Pickton's share and most pre-dating the government's mortgage.

Linda Wright, for example, registered a mortgage in 1998 on the smaller Burns Road. property owned by her brothers. She and David Pickton registered a mortgage on the pig farm itself through a numbered company, also in 1998.

Karin Joesbury, whose daughter Andrea was another of Pickton's alleged victims, also registered a certificate of pending litigation against the pig farm in 2002 as part of a lawsuit filed against Pickton, the RCMP and Vancouver police.

If the government wants to foreclose on the properties it would have to take Pickton's brother and sister to court and apply to force a sale because of their joint ownership, the real estate lawyer says.

Once it does, the rule of "first in time, first in line," applies, meaning earlier creditors would be paid before the province.

Frey says the costs of Pickton's defence should come out of his assets but is torn on what should happen to the properties if he is convicted.

"One time there was talk of some family members wanting to make it a memorial area, a memorial park," she says.

"I would never want it as a memorial park. I'd like to see the monies divided between all the families and their children."

However Maggie de Vries, whose sister Sarah is among the women who vanished from the Downtown Eastside, says she's not opposed to using the properties to pay for Pickton's defence but is not interested in seeing the land become a park.

"That idea doesn't appeal to me at all," de Vries said. "I personally wouldn't go to a memorial site there or want to be involved with setting one up."

Frey says she has no objection if the land was rezoned and developed if proceeds were used to help the victims' children, many of whom are in government care. "They've already got townhouses and an elementary school (on) the property that he sold even before he got arrested," she says.

"Obviously it's a great development area. It's a good place to be. I would personally never want to live there."

© Canadian Press 2005"

"18 U.S. Code § 1958 - Use of interstate commerce facilities in the commission of murder-for-hire Whoever travels in or causes another (including the intended victim) to travel in interstate or foreign commerce, or uses or causes another (including the intended victim) to use the mail or any facility of interstate or foreign commerce, with intent that a murder be committed in violation of the laws of any State or the United States as consideration for the receipt of, or as consideration for a promise or agreement to pay, anything of pecuniary value, or who conspires to do so, shall be fined under this title or imprisoned for not more than ten years, or both; and if personal injury results, shall be fined under this title or imprisoned for not more than twenty years, or both; and if death results, shall be punished by death or life imprisonment, or shall be fined not more than $250,000, or both."

"BCIMC vs. PACIFIC RIM RESORT, THE TRUE STORY "THEFT OF PARADISE"

This is a major worldwide story not just a local British Columbia matter.

It stretches from the office of the High Commissioner of British Columbia, Gordon Campbell, in London England to the corporate boardrooms of CAI Private Equity Partners in New York and Vancouver, to the Governor General's Office in Ottawa, to the Boardroom of BCIMC, a 120 Billion Dollar Pension Fund, In Victoria, B.C., to the Long Beach Reserve of the Tla-O-Quit-Aht First Nations, and finally to a one room shack with no water or toilet occupied by myself and my two children huddled in terror as to when we will finally be killed by these power mad, money addicted, psychopaths and criminals in suits who had us under siege, trying to take our family’s home and business we had owned and operated for 30 years. This is our story of how we survived multiple murder attempts, arson, nightly vandalism and graffiti, telephone threats, false police reports and publicity, constant lies, court cases, false and defamatory internet postings, being penniless to the point that we were starving and had to borrow toilet paper from the public washroom. This is the story of a father and this two young children up against a consortium of some of the most evil and ruthless billion dollar corporations on the planet and our own Government. This is Pacific Rim: The Theft of Paradise.

The attacks on our family and our property which we had owned for over 30 years were orchestrated and managed by a US based international Real Estate Consulting company called CBRE which apparently has a history of corrupt and questionable dealings in the US and around the world. I have read about CBRE's involvement in real estate deals and land development in Australia where a land developer involved with them had his house arsoned and was finally murdered. From what I recall CBRE was not directly charged but they were definitely implicated.

In our case, the man who set us up to be taken out by BCIMC was the Senior Vice President of CBRE in Atlanta Georgia, Michael Nissley. He contacted us in the spring of 2010 and then he came and visited us at our Resort in September 2010 and told us that he would be our Realtor and was negotiating on our behalf to lease part of our property with a fellow named Bob Pearce of Parkbridge/BCIMC for a long term lease to them from us as our family has owned the property for 30 years and didn’t want to sell it. As far as I know Mr. Nissley was not licensed to be a Real Estate Agent in BC and after a year of delaying us and running us in circle he finally admitted to us that he had actually been working on behalf of BCIMC the entire time.

We have also been informed by a very experienced professional that this fellow from CBRE, Michael Nissley, is most likely the one who arranged for the bribing of our Lawyer and our Appraiser who both lied and betrayed us in the court hearing where we lost our property and that he was the one hired/arranged for the criminals who attacked our property with over 100 major Vandalism, Arson and other attacks on our family and our property from 2009 to present."

"8(a) Business Development Program [Run through the Serco protégée company Base One Technologies] The 8(a) Business Development Program assists in the development of small businesses owned and operated by individuals who are socially and economically disadvantaged, such as women and minorities. The following ethnic groups are classified as eligible: Black Americans; Hispanic Americans; Native Americans (American Indians, Eskimos, Aleuts, or Native Hawaiians); Asian Pacific Americans (persons with origins from Burma, Thailand, Malaysia, Indonesia, Singapore, Brunei, Japan [Mineta interned in WWII], China (including Hong Kong), Taiwan, Laos, Cambodia (Kampuchea), Vietnam, Korea, The Philippines,U.S. Trust Territory of the Pacific Islands (Republic of Palau), Republic of the Marshall Islands, Federated States of Micronesia, the Commonwealth of the Northern Mariana Islands, Guam, Samoa, Macao, Fiji, Tonga, Kiribati, Tuvalu, or Nauru); Subcontinent Asian Americans (persons with origins from India, Pakistan, Bangladesh, Sri Lanka, Bhutan, the Maldives Islands or Nepal). In 2011, the SBA, along with the FBI and the IRS, uncovered a massive scheme to defraud this program. Civilian employees of the U.S. Army Corps of Engineers, working in concert with an employee of Alaska Native Corporation Eyak Technology LLC allegedly submitted fraudulent bills to the program, totaling over 20 million dollars, and kept the money for their own use.[26] It also alleged that the group planned to steer a further 780 million dollars towards their favored contractor.[27]"

"Serco also integrated voice, video teleconferencing capabilities and situational awareness displays, along with the VDI, into the facility's network distribution system across multiple networks. The result is an integrated IP-based total capability that is centrally managed and consistent across all platforms. Serco also implemented Defense Red Switch Network (DRSN), completed a structured fiber optic and Category 6 cabling system, and participated in the construction design working group to ensure supporting systems (e.g. Power and HVAC) were able to support the 24 AF's IT needs. As a result of Serco's support, 24th Air Force enjoys a true state-of-the-art environment that has delivers the high level of performance and security requires to continue fulfilling the important missions protecting the nation's security."

"Opened in 1994 as the successor to the Transitional Immigrant Visa Processing Center in Rosslyn, Va., the NVC centralizes all immigrant visa preprocessing and appointment scheduling for overseas posts. The NVC collects paperwork and fees before forwarding a case, ready for adjudication, to the responsible post. The center also handles immigrant and fiancé visa petitions, and while it does not adjudicate visa applications, it provides technical assistance and support to visa-adjudicating consular officials overseas. Only two Foreign Service officers, the director and deputy director, work at the center, along with just five Civil Service employees. They work with almost 500 contract employees doing preprocessing of visas, making the center one of the largest employers in the Portsmouth area. The contractor, Serco, Inc., has worked with the NVC since its inception and with the Department for almost 18 years. The NVC houses more than 2.6 million immigrant visa files, receives almost two million pieces of mail per year and received more than half a million petitions from the U.S. Citizenship and Immigration Service (USCIS) in 2011. Its file rooms' high-density shelves are stacked floor-to-ceiling with files, each a collection of someone’s hopes and dreams and each requiring proper handling."

"The Telgraph .. Police drop investigation into Serco prisoner transport contract The outsourcing group said there was no evidence of individual or corporate wrongdoing

The City of London Police has closed an investigation into Serco's prisoner transport contract after more than a year of work, enabling the firm to continue with the contract until 2018.

The Ministry of Justice called in the police in August 2013 to examine whether Serco had misleadingly recorded prisoners as being ready for court when they were not, in order to meet the performance criteria of the contract.

However, Serco said on Friday that the probe into the Prisoner Escort and Custody Services (PECS) contract had been closed after the police found no evidence to support bringing charges against the outsourcing firm or its staff.

"The information obtained was also sufficient for the City of London Police to conclude there was no evidence of any corporate-wide conspiracy or an intention to falsify figures to meet the DRACT [designated ready and available for court time] contract requirement by senior Serco management or at the board level of the company," the firm said in a statement. The Ministry of Justice had said it would end the contract immediately if the firm's board was found to have done wrong."

"NOSE DIVE

10.04.1512:01 AM ET

The Crash of Trump Air The real story behind The Donald's brief and bizarre career as an airline chieftain.

Donald Trump strode into a ballroom at the Plaza Hotel he owned on October 12, 1988, to announce his acquisition of yet another trophy property: the venerable Eastern AIR Shuttle, which had pioneered the original power flights between New York, Washington, and Boston.

The 42-year-old Manhattan real estate tycoon exuded an outsize confidence, airily waving aside any concerns about his ignorance of the business he was wading into. "It's a diamond, it's an absolute diamond," he crowed to the packed crowd.

Classic Trump bravado, of course, but the airline insiders he'd tapped to run the show were already rolling their eyes. "When he started with that 'diamonds in the sky' line, I said, 'We're going to have to settle for cubic zirconia,'" said Henry Harteveldt, a former TWA and Continental executive who was the nascent line’s new marketing director.

"We inherited more than 20 of the world's oldest 727 airplanes, because that's what had been allocated to the shuttle,” said Harteveldt, now head of Atmosphere Research, a travel data research firm. "At first all we could do was to clean the planes and put a sticker with Trump's name on the side."

And so began one of the stranger episodes in aviation history.

Trump, according to sources close to him at the time, seemed less interested in the inner workings of the business than in what it could do for his brand. "It was this flying billboard for Trump properties," said Harteveldt. “At the time, he was expanding his casino business [in Atlantic City], jet fuel was still relatively cheap. It was a combination of vanity and the lure of an appealing business." Trump, sources said, apparently also dreamed of creating a national airline 10 times the size of the shuttle, a natural fit with the hotels he was rapidly collecting.

That was not to be, and interestingly, Trump's airline dalliance appears to have been airbrushed from his official biography. He makes virtually no mention of it in the numerous memoirs and self-help books he's penned since its demise in late 1991 [with one exception: in the 2008 tome Trump Never Give Up: How I Turned My Biggest Challenges into Success, he admits that the shuttle "never turned a proper profit," but in typical fashion, accepts no responsibility and blames the failure on ‘timing” and the vagaries of the airline business.] Other business setbacks like his casino bankruptcies have been spun into inspirational comeback tales in the Trump narrative—or used by Trump's rivals for the GOP presidential nomination as a way to bash him on the debate stage. His airline adventure, on the other hand, is an outlier: maybe that has something to do with the fact that Trump never was able to get his airline to produce enough cash flow to pay down the massive debt Trump accumulated when he bought the shuttle.

The story does, however, reveal much about the Trump now appearing in the national spotlight. He lied about his competitors. He trotted out plans to attract customers—but many of them made no sense from a business standpoint. Those who worked with him at the airline describe him as a loose cannon; a generous and engaged boss on the one hand, obnoxious and impulsive at other times—especially in public.

As former Trump Shuttle president Bruce Nobles told The Daily Beast, "I cringed every time he opened his mouth."

"He really didn't understand the business and at times he said things that really weren’t helpful” to his new company, Nobles said. "That was his style and it really hasn't changed."

And this tale might also say something about how Trump may behave as this presidential contest continues: When that sunny business climate turned stormy, Trump got out of the airline business—and fast.

He spent more than $1 million on each jet, going well beyond the normal cabin upgrades to add thick maroon carpeting, maple-veneer paneling, beige leather seats, and even faux marble sinks and gold-colored fixtures in the lavatories.

The aviation business has always been a tough one. More than a few corporate titans have been humbled by it. (Think Carl Icahn and TWA, Kirk Kerkorian and his MGM airline.) "I remember telling [Trump]: ‘There's an old saying in the business: the way to make a little money in the airlines is to start with a lot," said Nobles, who'd previously helmed the rival Pan Am shuttle. Airlines have been notoriously poor investments, what with high fixed costs and a vulnerability to unpredictable forces like gyrating fuel prices and economic downturns. In fact, although the economy in general was in decent shape in 1988, the airline business Trump was entering was in turmoil—dozens of airlines had shut down since deregulation was passed in 1978, and many major airlines had either merged or gone into bankruptcy court protection.

One of the first signs of trouble came soon after the deal was signed when the neophyte airline chief set out to destroy his rival—the Pan Am Shuttle, its only direct competition in the market. The Eastern Shuttle, which had had the market all to itself before deregulation, had struggled to keep up when New York Air, and later Pan Am, offered free drinks and food and made the Eastern flights (which then had neither) look spartan by comparison.

Trump decided he’d win customers away from Pan Am—by scaring them. Pan Am was unsafe, he said. He had no proof of this, of course; his message was simply: "I wouldn't fly them; they're losing money and their planes are old," all of which was equally true of Eastern and the planes he’d just bought. Trump’s seasoned airline hands were horrified; even in the combative airline business, such talk was regarded as out of bounds, as it would only stoke more general fears of flying. Moreover, it revealed his lack of understanding of this business—at the time, competitors would help each other if delays or other problems arise. "We told him 'Don’t attack Pan Am, they're the grandfather of this business,'" said Harteveldt.

Next, Trump turned his attention to his fleet, where he was soon to get an education in airline economics. Trump had paid $365 million for the assets of the Eastern shuttle operation and its 17 planes, which he'd spun as a great deal—negotiated down from the $400 million asking price. But later, as the closing was delayed by Eastern’s bankruptcy and other bidders emerged, Trump tried to get Eastern chief Frank Lorenzo to lower the price, since the value of the asset had indeed diminished. Instead Trump ended up taking five additional planes as compensation, which he described as a victory in his book The Art of Survival, published in 1990, when the airline was still flying. "This allowed me to refurbish my fleet without taking any planes out of service," he said.

True, but the shuttle needed only 16 planes to operate a full hourly schedule at its three cities, with one or two jets as spares, and extra aircraft are anathema to an airline—they don't make money sitting on the ground. Even though Trump was later to deploy some of them on flights to Florida, those additional planes were later to prove a drag on the airline as it struggled to make enough money to service its heavy debt. "Lorenzo must have been laughing all the way to the bank," wrote John O'Donnell, former president of the Trump Plaza Hotel, wrote in his book Trumped!

"The shuttle was a clear example of how the exaggerated value of his [Trump's] name led him into a purchase whose foolishness was apparent almost immediately," he added. (The Trump organization declined to comment for this article.)

To his credit, though, Trump decided that since the planes, on average about 20 years old, needed an overhaul anyway, he could use the chance to spiff up passenger comfort and service. He spent more than $1 million on each jet, going well beyond the normal cabin upgrades to add thick maroon carpeting, maple-veneer paneling, beige leather seats, and even faux marble sinks and gold-colored fixtures in the lavatories.

"The bathroom was a work of art," joked Nick Santangelo, who ran maintenance and engineering at the shuttle. “They used ideas from the hotel business, which wasn't bad, but they didn't always work." Older jets in particular guzzle fuel and airline executives are obsessed with saving even a few ounces of weight. Not so Trump: "At first they wanted to put in a ceramic sink, that was too heavy," said Santangelo. "Then one of his henchman decided they were going to put brass handles on the doors you use to get out in an emergency. Normal handles weigh a few ounces, and these things probably weighed five pounds each... you'd kill to save one pound, and they wanted to add 20 to 30 pounds to each plane."

Still, the airline lured customers with frills like airport concierges who would book same-day reservations at fancy restaurants; gourmet food and drink and tarted-up departure lounges. "We spent a lot on service," recalls Harteveldt. "Bagels and coffee in the morning; boxed dinners with sliced chateaubriand and salad; the flight attendants hustled to serve everyone meals and then pour two or even three rounds of drinks" in the 45 minutes the plane was in the air.

Trump's flight attendants—the female ones, at least—wore matching fake pearl necklaces and earrings to go with what the Trump organization described as an "upscale" look, with outfits of navy with burgundy trim. The uniform belts incorporated the Trump Shuttle "T" logo.

It got noticed: an August 21, 1989 New York magazine column said that Trump apparently wanted his attendants to have "the look of old money." The jewelry was a “required part of the uniform," and the magazine quoted a spokesman as saying they were "real, of course," but according to Harteveldt, they were in fact faux. "But we did raffle off a pair of real ones," he said, and even as the go-go 1980s were winding down that was an unusual stunt for an airline.

And then there was the cult of Donald. Frequent travelers would often get thank-you letters after a flight with Trump's personal signature. A glossy inflight magazine was launched, and Trump at first insisted that the cover resemble theArt of the Deal, his best-selling business book. "The attention to detail was incredible," said Harteveldt. "Pretty soon we were at 50 percent of the market, and keep in mind, we started with about zero," the result of Eastern's prolonged labor strife, said Nobles. "But it was also 50 percent of a shrinking market," he said.

Yet another reality was setting in: Business travel was slowing in the Northeast.

Nonetheless, Nobles said the balance sheet improved as the shuttle regained market share, enough to show an operating profit, but not to cover debt payments. And the recession was not just affecting the airline but most of Trump’s other assets, like his hotels and casinos. In fact at one point Trump came up with a plan to help both, by giving away casino chips to his airline passengers in the expectation they'd come to one of his Atlantic City properties to redeem them. It was a bust. "I think something like two chips got cashed in," Nobles recalled with a laugh. ***

Trump's airline, for all its brass-handled glitz, was a relatively minor player. So in late 1989, he made a bid for control of American Airlines, then the largest airline in the country—and one of the few that had avoided a bankruptcy or merger to survive. His $7.5 billion offer was, at $120 a share, well above the $83 per share the airline was then trading for. But Wall Street and industry insiders were unimpressed, especially after Trump boasted that he'd picked up "substantial insight" in the business he'd just entered. He was, after all, taking on American CEO Bob Crandall, one of the most respected executives in the business. When Crandall immediately took steps to thwart the unwanted advance the bid fizzled. Did Trump he seriously think he could fill Crandall's shoes? "He thought he saw an opportunity, and he likes to own the best," said Nobles. "He thought American was the best airline, it was as simple as that."

Was Trump chastened? Probably not, but it may have dawned on him at that point that he was out of his depth.

"Trump did see that it was a difficult business," said Nobles. "The number of people who want to fly and the money they'll pay to do that is pretty much out of your control. All you can hope for is your fair share, and we got our fair share. But the size of the pot was shrinking." And in the final analysis, the shuttle, whether it had Trump’s or Eastern's name on it, was a basic conveyance, its short hops that departed on the hour, with no reservations required, were closer to a flying bus than a first-class hop across the pond. Things like punctuality were far more important to its clientele than a better cut of steak. When Trump looked back on the experience in 2008 and wrote that "I knew it could be successful…. it just needed to be buffed up a bit, to make the travel time a bit more luxurious," it's clear how little he learned.

Meanwhile, relations between Trump and some of his shuttle executives had started to fray as market conditions went south. Nobles had offered his resignation in early 1990, because he disagreed with some of Trump’s ideas for cutting costs, some of which flew in the face of reality. "He insisted I fly the planes with only two pilots in the cockpit," said Nobles, instead of the required trio at the controls. To a layman, that might not seem unreasonable, but it spoke volumes about Trump’s lack of understanding of the airlines—and of his very own fleet. The 727s Trump owned could not be flown with two pilots; it was designed for three and "would have been unflyable” otherwise, according to aviation expert (and Beast columnist) Clive Irving. "The FAA would have never permitted it," he said.

But Trump was unmoved. He fired Nobles in the middle of 1990 and did not honor the executive's severance contract. His reason? He told reporters at the time that while the airline was doing well, he just wasn’t pleased "with some of the people running it."

By the middle of 1991, it was clear that the situation was not going to improve; Trump had raised $380 million from a syndicate of 22 [narco?] banks led by Citicorp, [led by the late Walter Wriston] putting in just $20 million of his own money. But the airline was just one of a cluster of assets that were at stake; and Trump finally hammered out a deal that gave bankers control of the airline; the climate was turned so sour that no bidders came forward to buy it. US Airways was later tapped to run it and by mid-1992, the plus-size "T" logos on the planes were replaced by more conventional airline livery.

For all that, it can be said that Trump's transformation of the Eastern Shuttle was not for naught; he'd ended up stuck with damaged goods when he bought the shuttle and made changes that were welcomed by both customers and employees (given the condition the shuttle was in when he took over, however, anything would have been an improvement). But other claims he's made about the shuttle over the years don't really stand up; yes, he did rescue a distressed property—but other bidders did come forward at the time and the value of the shuttle franchise was beyond dispute. True, he hired more than a thousand employees from Eastern—and most of them, understandably were happy to have jobs and enjoyed the brief ride while Trump was lavishing perks on his passengers. Most of them continued on after the tycoon departed. And Trump's brief shining moment as a flyboy remains a mere footnote in the annals of aviation.

As for the shuttle—it still chugs along today and on October 17 it will enter its fourth incarnation, as American Airlines formally takes over as part of its merger with US Airways."

"Inside the Money Laundering Scheme That Citi Overlooked for Years

How Citigroup's Banamex USA unit turned a blind eye on the Mexican border.

Alan Katz Alanrkatz Dakin Campbell dakincampbell

November 20, 2015 — 2:00 AM PST

When Antonio Peña Arguelles opened an account in 2005 at Citigroup's Banamex USA, the know-your-customer documents said he had a small business breeding cattle and white-tailed deer, ranch-raised for their stately antlers. About $50 a month would come into the account, according to the documents.

A week later, Peña Arguelles wired in $7.09 million from an account in Mexico, allegedly drug money from Los Zetas, a violent cartel founded by former Mexican soldiers, documents in his money-laundering case in Texas say. In all, Peña Arguelles shuttled $59.4 million through the account, according to a confidential report by banking regulators that berated Banamex USA in 2013 for its failure to comply with anti-money-laundering rules.

Banamex USA didn't file a suspicious activity report about the account, according to regulators, even after Peña Arguelles’s brother Alfonso was killed in late 2011, his body dumped at the Christopher Columbus monument in Nuevo Laredo, Mexico, with a banner draped above it accusing Antonio of being a money launderer and stealing from the Zetas. The bank didn’t produce an activity report after U.S. prosecutors asked for the account documents at the end of that year or when Peña Arguelles was indicted in early 2012 for conspiracy to launder monetary instruments. And it didn't file one until May 2013, months after the Federal Deposit Insurance Corp. and the California Department of Business Oversight issued a written order in August 2012 demanding the bank check old accounts."

"Super Serco bulldozes ahead

By DAILY MAIL REPORTER

UPDATED: 23:00 GMT, 1 September 2004

SERCO has come a long way since the 1960s when it ran [Resilience exercises and] the 'four-minute warning' system to alert the nation to a ballistic missile attack.

Today its £10.3bn order book is bigger than many countries' defence budgets. It is bidding for a further £8bn worth of contracts and sees £16bn of 'opportunities'.

Profit growth is less ballistic. The first-half pre-tax surplus rose 4% to £28.1m, net profits just 1% to £18m. Stripping out goodwill, the rise was 17%, with dividends up 12.5% to 0.81p.

Serco runs the Docklands Light Railway, five UK prisons, airport radar and forest bulldozers in Florida.

Chairman Kevin Beeston said: 'We have virtually no debt and more than 600 contracts.'

The shares, 672p four years ago, rose 8 1/4p to 207 1/4p, valuing Serco at £880m or nearly 17 times earnings.

Michael Morris, at broker Arbuthnot, says they are 'a play on UK government spend' which is rising fast."

"Serco Combined Resilience Exercising

http://www.epcollege.com/EPC/media/MediaLibrary/Downloads/Gold-Standard.pdf

Types of Exercise Workshop Exercises These are structured discussion events where participants can explore issues in a less pressurized environment.

They are an ideal way of developing solutions, procedures and plans rather than the focus being on decision making. Table Top Exercises These involve a realistic scenario and will follow a time line, either in real-time or with time jumps to concentrate on the more important areas. The participants would be expected to be familiar with the plans and procedures that are being used although the exercise tempo and complexity can be adjusted to suit the current state of training and readiness. Simulation and media play can be used to support the exercise. Table-top exercises help develop teamwork and allow participants to gain a better understanding of their roles and that of other agencies and organisations.

Command/Control Post Exercises These are designed primarily to exercise the senior leadership and support staff in collective planning and decision making within a strategic grouping. Ideally such exercises would be run from the real command and control locations and using their communications and information systems. This could include a mix of locations and varying levels of technical simulation support. The Gold Standard system is flexible to allow the tempo and intensity to be adjusted to ensure maximum training benefit, or to fully test and evaluate the most important aspects of a plan. Such exercises also test information flow, communications, equipment, procedures, decision making and coordination.

Simulation and Media Support

The method of delivering an exercise is flexible and will be designed with the client to meet their requirements with options ranging from simple paper-based delivery through to full use of their real communications systems [Red Switch Network and Hawkeye onion router surveillance aircraft] and advance computer simulation [In Trump's death pool and war room suites]. In addition, media play can also be added in the form of news injects and the provision of experienced journalists and television crews to help test procedures and also assist in training key staff.

Gold Standard Emergency Planning College

The Hawkhills, Easingwold, York North Yorkshire, YO61 3EG +44(0) 1347 821406

enquiries@emergencyplanningcollege.com www.epcollege.com"

"Serco farewell to NPL after 19 years of innovation [outsourced by David Cameron at Treasury] … 8 January 2015

Serco said goodbye to the National Physical Laboratory (NPL) at the end of December 2014 after 19 years of extraordinary innovation and science that has seen the establishment build a world-leading reputation and deliver billions of pounds of benefit for the UK economy. It has been estimated that work carried out by the Centre of Carbon Measurement at NPL will save eight million tonnes of carbon emissions reductions (2% of UK footprint) and over half a billion pounds in economic benefit [bullshit] over the next decade. .. · NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency [death-pool] trading in the City through NPLTime."

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.