by

United States Marine Field McConnell

Plum City Online - (AbelDanger.net)

January 23, 2016

1. Abel Danger (AD) asserts that Serco – formerly RCA GB 1929 – provides resilient services to a narco-banking cartel through its long-range loan-shark group which injects news at mass casualty events to deflect public/media attention from the Serco cartel.

2. AD asserts that Serco's loan sharks flew the now-blackmailed users of Trump Shuttle and Con Air ('JPATS') aircraft to the Pickton pig farm in British Columbia for betting on the time hookers took to die as they passed through a wood chipper.

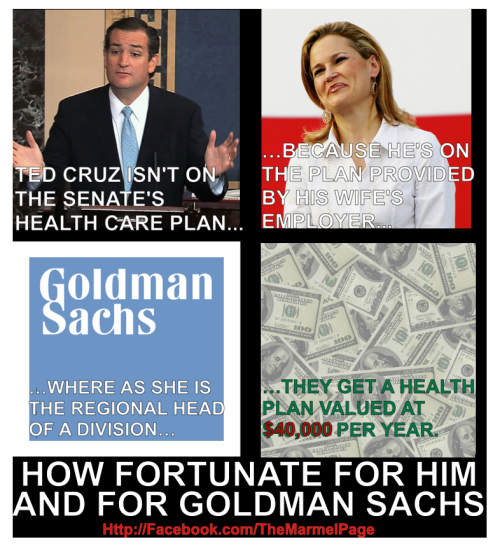

3. AD asserts that Serco narco-banks own the pig-farm mortgage through bcIMC – the B.C. Investment Management pension fund – and arranged a "Vampire City" loan through Goldman Sachs and Citibank for Heidi Cruz to finance the launch of her husband's presidential candidacy.

United States Marine Field McConnell (http://www.abeldanger.net/2010/01/field-mcconnell-bio.html) offers to show voters how to win resilience wars with Serco's City Vampire as it extends its control over the government of the United States.

Torture at the Tower of London

Copy of SERCO GROUP PLC: List of Subsidiaries AND [Loan Shark] Shareholders!

(Mobile Playback Version)

Serco... Would you like to know more?

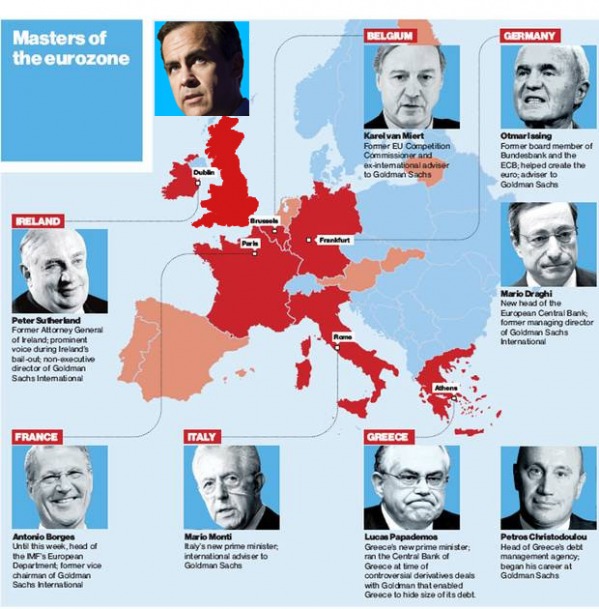

Goldman Sachs: The Vampire Squid

Con Air

"[Note Serco loan sharks inject news and social media plays through the Defense Red Switch network; nominally in the custody of POTUS 44 and the National Command Authority] The 2016 presidential campaign of Ted Cruz, the junior United States Senator from Texas, was announced through social media and a later event at Liberty University on March 23, 2015. Cruz has been seen as a potential candidate for the Republican nomination for President of the United States since shortly after taking office in 2013."

"AUG 8, 2013 @ 01:43 PM 13,203 VIEWS

"The Great Vampire Squid Keeps On Sucking

Jake Zamansky , CONTRIBUTOR I write about securities law Opinions expressed by Forbes Contributors are their own.

The now famous Rolling Stone magazine article in 2009 by Matt Taibbi unforgettably referred to Goldman Sachs, the world's most powerful investment bank, as a "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money."

At the time, Taibbi was describing Goldman’s role in the 2008 financial crisis and the speculative bubble of mortgage-backed securities assets which later came crashing down."

JOHN CASSIDY

JANUARY 14, 2016

Ted Cruz's Goldman Sachs Problem

BY JOHN CASSIDY

Going into tonight's G.O.P. debate, in South Carolina, the Times story is the talk of the political class. The author, Mike McIntire, revealed that, in 2012, Cruz used a loan that his wife took out from Goldman to help to finance his successful Senate campaign, during which he honed his reputation as a critic of bank bailouts and corporate cronyism. The Goldman loan, which was for between two hundred and fifty thousand and half a million dollars, wasn't disclosed to the Federal Election Commission, as it should have been. Rather than publicly acknowledging its existence, Cruz subsequently told reporters that he and his wife had liquidated practically all of their personal savings to help pay for the campaign.

Based on McIntire's inspection of the annual ethics reports that Cruz and other Senators are obliged to file, which require them to list all of the assets they own, this appears to have been a fib. In addition to taking out the loan from Goldman in 2012, which was a margin loan attached to a brokerage account, the Cruzes took out a credit line, of similar size, from Citibank [Loan shark banker for Trump Shuttle Inc!]. Between the beginning and end of 2012, the value of the cash and securities that the family owned didn't diminish to zero, or anything near it. Rather, it "saw a net increase of as much as $400,000," McIntire reported.

The Cruz campaign sought to brush off the Times story. A spokeswoman told McIntire that the failure to report the loan from Goldman to the F.E.C. was "inadvertent." Cruz himself told reporters, "if it was the case that they"—the two bank loans—"were not filed exactly as the F.E.C. requires, then we'll amend the filing.""

"The Trials And Triumphs Of Heidi Cruz

Ted and Heidi Cruz have always had big ambitions for public service. A decade ago, uprooting her career was a difficult detour.

Posted on Mar. 18, 2015, at 4:22 p.m.

McKay Coppins

BuzzFeed News Reporter

Megan Apper

BuzzFeed News Reporter Around 10 p.m. on the night of Aug. 22, 2005, the Austin Police Department dispatched Officer Joel Davidson to an intersection a couple miles west of the Texas city's downtown. A passerby had called to report that a woman in a pink shirt was sitting on the ground near the MoPac Expressway with her head in her hands, and no sign of a vehicle nearby. When the officer arrived, he found the woman on a swath of grass between an onramp and the freeway. She said her name was Heidi Cruz.

According to a police report recently obtained by BuzzFeed News, Officer Davidson proceeded to question Cruz, whose husband, Ted, was then serving as Texas solicitor general. He asked what she was doing by the expressway; she replied that she lived on nearby Hartford Street, and "had been walking around the area." She went on to tell Davidson that she was not on any medication and that she hadn’t been drinking, aside from “two sips of a margarita an hour earlier with dinner.” He wrote that he “did not detect any signs of intoxication."

The heavily redacted report goes on to describe that Davidson believed Cruz was a "danger to herself," and notes that she was sitting 10 feet away from traffic. He asked if he could transport her somewhere — the proposed location is redacted — but she was "reluctant, stating that maybe she should … get a ride home” instead. Eventually, Cruz followed him to his patrol car, and they departed the scene.

In response to questions about the incident, an adviser to Heidi Cruz's husband, Sen. Ted Cruz, sent a statement to BuzzFeed News shedding light on a period of their lives that the couple has not previously discussed in public.

"About a decade ago, when Mrs. Cruz returned from D.C. to Texas and faced a significant professional transition, she experienced a brief bout of depression," said Jason Miller, an adviser to the senator. "Like millions of Americans, she came through that struggle with prayer, Christian counseling, and the love and support of her husband and family." BuzzFeed News requested an interview with Heidi Cruz to further discuss that night in 2005, and how she dealt with depression. A spokesman replied that she would consider the offer, and then two days later, reported back that she politely declined. ….

After a few years at J.P. Morgan in New York, she went to Harvard Business School and emerged, MBA in hand, with a bevy of lucrative job offers — including a highly coveted spot at Goldman Sachs.

Instead, she took an unpaid job on George W. Bush's 2000 campaign. ..

She turned down Goldman, packed her bags, and headed for Austin, where she took a position on the campaign's policy team, stashing her workout gear in a tiny cubicle, and spending long days tinkering with budget math and editing memos.

It was there that she met Ted Cruz, the ostentatiously brilliant, motor-mouthed Harvard Law grad who liked to talk about his debate championships, Supreme Court clerkship, and big plans for the future. Some in Bush headquarters were repelled by Ted's transparent ambition and steroid-infused self-confidence, but Heidi was drawn to him. She ended the campaign with a new husband, and an offer to work at the U.S. trade representative’s office.

Those who encountered the couple were often struck by their almost palpable affection for each other — and the sharp contrast in their personal styles. Both Cruzes carry a kind of intensity about them, but whereas Ted's often manifested itself in passionate bursts of rhetoric that were not always properly calibrated to the setting, Heidi’s was quieter, more polished and restrained. "It's hardly a revelation that Ted says off-the-wall things, whether it's with friends at dinner, or on the floor of the Senate. Heidi's not like that. She's not confrontational," said Haley, who added, "They're obviously deeply committed to one another." Another friend recalled, "He would light up every time he talked about her. It was always when he seemed the most human." ..

Her career took off. When Cruz moved to a job at the Department of the Treasury in 2002, she worked with the economist Brock Blomberg on the Latin America desk, shaping policy in response to the emerging market crises of the time. "I never thought of her as a true believer in the sense that she was very ideological," Blomberg recalled. Instead, she distinguished herself with a tenacious drive and a tireless work ethic. "The one thing I can say is she's a very earnest person. Whenever she had an opportunity, she gave it 100%."

Then, in 2003, Cruz was appointed director of Western Hemisphere on the National Security Council, reporting directly to Condoleezza Rice — exactly the kind of job she had been working toward since she carried textbooks across Claremont's campus. Cruz was viewed by many inside the White House as a rising star, and it seemed likely that she would continue to rise if Bush were re-elected.

Things hadn’t been going as well for the other Cruz in the Bush administration. After the campaign, Ted had landed with a thud at the Federal Trade Commission — a low-profile post far away from the action that offered little excitement for someone with his ambition. When he was offered the position of Texas solicitor general — a gig that would place him center stage in federal courtrooms, delivering forceful conservative arguments on behalf of the Lone Star State — it was a no-brainer. Ted moved back to Austin to begin making his name as a litigator, while Heidi stayed in Washington for her dream job at the White House. For more than a year, they maintained a long-distance marriage, flying back and forth on weekends and holidays. …

Upon returning to Texas, Cruz took a job as a vice president at Goldman Sachs in Houston. But after several years away from Wall Street, she felt out of practice and anxious about proving herself to her colleagues and subordinates — some of whom, she suspected, questioned her abilities, as she described at length in a panel discussion years later. She also quickly found that Houston’s finance scene was considerably less accommodating to high-powered women than those of Washington or Manhattan.

"When I came out of Washington and the White House, I didn't feel that there was really a glass ceiling in the administration … and Texas was very different," she would later say in a 2011 panel discussion. She was the only woman in Goldman's Houston office, and described fumbling with hunting lingo during conversations with male clients. In the "very traditional culture” where she lived, few of the women in their social circles had careers.

And building financial models for the profit of a major investment bank wasn't the same as trying to improve markets in poor Latin American countries. Asked years later whether she missed the public sector after leaving it in 2004, she responded, "I'm always quite honest in my answer so I have to say that I really do … I think there is an important role to making a profit and doing so through a pretty definable skill set, and you can certainly impact industry. But to impact countries rather than companies, individually, is exciting and so I miss that component to it."

These were some of the frustrations weighing on Cruz during the “professional transition" in 2005 that would, according to the senator's office, lead her late one August night to the grass by an expressway onramp. This period had been a sharp detour for a woman who had carefully plotted a career path she believed would enable her to serve the public and do good in the world. ..

When Ted did eventually embark on a long-shot bid for the U.S. Senate in 2012, he suggested to Heidi, "Sweetheart, I'd like us to liquidate our entire net worth" — more than $1 million — "and put it into the campaign." The way he would tell it to the New York Times, his steadfast rock of a wife “astonished" him when she said without hesitating, "Absolutely." But in her version of the story, she reacted to her husband's proposal more like the savvy banker that she was. As she would recall to Politico, she proposed not investing any of their own money in the campaign "unless it made the difference between winning and losing." Really, she wanted to test the viability of his campaign by seeing if he could drum up funds from other donors. As she put it, it was "just common investment sense."

November 2012 was a big month for the Cruzes: Nine days after Ted won his insurgent Senate race, Goldman Sachs announced that Heidi would be promoted to managing director. And though she continued to miss the public sector, her success at Goldman enabled her to get the firm involved in various philanthropic projects, temporarily satisfying her appetite for service, she has said…..

Andrew Kaczynski contributed reporting to this story.

Correction (8:04 p.m., March 18): When a police officer approached Cruz in 2005, he wrote that he believed she was a "danger to herself." A previous version of this story misquoted the report, which is linked above.”

"Greg Smith: Goldman Sachs' London office was 'like the Wild West' A former Goldman Sachs employee, who claims the bank was obsessed with “elephant” trades that made millions, says its London office was like the "Wild West".

By Richard Blackden, US business editor

8:27PM BST 22 Oct 2012

• Greg Smith: London office like the "Wild West"

• Goldman trainees routinely forced to attend 6am "bootcamps"

• Traders hired a topless model called Ms Silicone

• Managing directors allegedly referred to clients as "muppets"

• Smith saw CEO Blankfein "air-drying" naked at in-house gym

The accusations are among several made by Greg Smith, a former salesman who resigned from Goldman in March in a letter to The New York Times and whose book about his 12 years at the bank was published in the US on Monday.

The 33-year-old, who transferred from Goldman's New York office to London in January 2011, writes that he should have worn "cowboy boots" when he arrived at the office on Fleet Street because "London really was the Wild West."

He claims that by the time he quit, the US investment bank was only interested in trades that would make it more than $1m (£624,000) even if its customers had different needs.

Soon after he began working in London, Mr Smith says he asked a colleague to prepare materials to help him sell simpler equity derivatives to customers. Smith says the colleague declined to help, adding: "We've been told by management to focus on trades that could yield a possible one-million-dollar profit for the firm."

The bank has been braced for the publication of Why I Left Goldman Sachs and says Mr Smith’s motivation in writing the book was frustration that he had not progressed more swiftly up the ranks at the bank. The South African was denied a promotion in the months before he left and his compensation did not match the $1m he had hoped for.

The book's central allegation is that during his 12 years at the bank, it changed from being one that put customers first, to one that consistently put the bank's profits first.

As Europe's debt crisis intensified during the summer of 2011, Mr Smith writes that the recommendations that Goldman’s salespeople made to clients on which European bank shares to buy and sell were driven by trades that Goldman’s dealers wanted to get in or out of.

The former salesman, who was earning $500,000 a year by the time he left, does not disguise that he enjoyed the trappings that came from working at Goldman. During his year in London, he lived in an 800sq ft flat in Belsize Park and saw the men’s finals at both Wimbledon and the French Open.

However, he claims that, despite the bank conducting a study of its own business principles in 2010 following a $550m settlement with US regulators over alleged mis-selling, the bank was not taking reform seriously enough.

"It was the corrosive atmosphere in the London office that, slowly but surely, started to wear me down," Mr Smith wrote. Goldman declined to comment."

"B.C. pension fund invested in defence, oil, tobacco

The pension fund that underwrites retirement for B.C.'s firefighters, police officers and public workers is heavily invested in the oilsands, mining companies, defence contractors and big tobacco.

An evaluation of B.C. Investment Management Corp.'s (bcIMC) equity holdings has revealed how billions of dollars of public money is invested. Although bcIMC's $32.5 billion in equity investments, the largest chunk of its total assets, are spread across dozens of companies ranging from Air France to billionaire Warren Buffett's Berkshire Hathaway, the pension fund also has holdings in large defence contractors such as Lockheed Martin and General Dynamics."

"$10M mortgage on pig farm

Steve Mertl Canadian Press

Sunday, August 21, 2005 VANCOUVER --The B.C. government has put a mortgage worth $10 million on accused serial killer Robert Pickton's notorious pig farm to cover his publicly funded defence, The Canadian Press has learned. Robert Pickton's farm in Port Coquitlam, B.C. December 20, 2004. (CP/Chuck Stoody) But no one at the Attorney General's Ministry will say if that figure represents the estimated cost of Pickton's seven-member legal team in the long and hugely complex case.

And Robert Pickton's share of the property _ his brother and sister are co-owners is currently worth only a fraction of that amount. It's also saddled with several other mortgages and legal judgments that pre-date the province's mortgage.

Even if it could be sold, relatives of the Pickton's alleged victims have other ideas for the land, including turning it into a memorial park or using proceeds of development to compensate the families.

The government's mortgage was registered on the suburban Port Coquitlam property and a nearby smaller parcel, on Feb. 28, 2003, a year after police raided the farm and arrested Pickton.

He faces face 27 counts of first-degree murder related to women, mostly drug-addicted prostitutes, who disappeared from Vancouver's seedy Downtown Eastside in the 1990s. He has not yet entered a plea, and the legal process against him has not as yet resulted in any court findings that he was responsible for any of the deaths.

Documents obtained by The Canadian Press show a mortgage principal of $10 million with no interest rate and no repayment schedule.

The lender is listed as the B.C. Crown, represented by the attorney general. The mortgage was handled by a lawyer for the ministry's legal services branch, who authorized its registration in a Feb. 27 letter to the New Westminster land title office.

Pickton, his brother David and sister Linda Wright each own one-third shares in the pig farm located on Port Coquitlam's Dominion Avenue, which they inherited from their parents. The Pickton brothers split the ownership of the smaller Burns Road property that housed Piggy's Palace, often used for parties.

B.C. Assessment, which tracks property values for tax purposes, valued the seven-hectare pig farm at about $5.9 million as of last fall, up from $4.2 million in the previous assessment. The Burns Road property is assessed at about $140,000.

Both are still zoned for agricultural use, although the surrounding land, some of it former Pickton property, was rezoned and now has big-box stores and condominiums.

Pickton lived in a mobile home on the Dominion Avenue property, running a small-scale piggery and slaughter operation. The brothers also ran a variety of other small businesses from there.

Attorney General's Ministry officials would not say whether the $10 million figure is an estimate of the properties' future value or perhaps a ballpark figure for the cost of Pickton's defence.

"I'd love to answer your question but it's not a matter of choice," said assistant deputy minister Jerry McHale, responsible for justice services. "I'm bound by the confidentiality. We just can't get into the funding arrangements during the trial.'' Attorney General Wally Oppal was unavailable for comment. Pickton was committed for trial after a lengthy preliminary hearing in 2003. Pre-trial hearings began in June under a publication ban and the trial itself won't start until sometime next year, with thousands of pieces of evidence and testimony from dozens of witnesses. Pickton's lead defence lawyer, Peter Ritchie, also would not discuss his funding arrangements with the government nor speculate on the defence's ultimate cost.

The stepmother of Marnie Frey, one of Pickton's alleged victims, is angry his defence could ultimately be paid out of the public purse.

"Why does he have seven lawyers?" Lynn Frey asks. "Nobody else ... has that many lawyers to defend them. Why doesn't he just have one lawyer and be done with it?"

But Russ MacKay, executive director of the B.C. Trial Lawyers' Association, says while such arrangements are extremely rare, Pickton's platoon of lawyers is fair given the mountain of evidence expected at the trial.

Pickton has been in custody since his arrest on Feb. 7, 2002. Police investigators, bolstered by civilian experts, spent more than a year combing the Pickton properties for evidence.

Documents show Pickton initially mortgaged his share of the larger Dominion Avenue property to Ritchie for $375,000 in April 2002. The mortgage, in the form of a demand loan, was to cover Ritchie's retainer.

It was apparently superseded the following February by the government's $10-million mortgage on the Dominion Avenue and Burns Road properties. Both mortgages carry Pickton's signature.

When shown a copy of the mortgage that he had provided, Ritchie said it was no longer applicable.

With property holdings and business interests, Pickton never qualified for legal aid. The Legal Services Society of B.C. normally pays defence lawyers $80 an hour on lengthy cases and $125 an hour for exceptional ones.

Ritchie launched what's known as a Robotham application in 2002, asking a judge to order Pickton to receive a publicly funded defence.

The hearing ended in October 2002 with Associate Chief Justice Patrick Dohm of B.C. Supreme Court ordering the Attorney General's Ministry to negotiate a funding arrangement directly with Ritchie.

An expert in real-estate law who didn't want to be named says it's not unusual for mortgages not to reflect the value of a property. The $10-million principal in the Pickton mortgage may represent an estimate of the government's maximum security, he says.

Whether it can recover any of that is another question.

Land title records show a long list of charges, mortgages and judgments registered against the two properties, often against Pickton's share and most pre-dating the government's mortgage.

Linda Wright, for example, registered a mortgage in 1998 on the smaller Burns Road. property owned by her brothers. She and David Pickton registered a mortgage on the pig farm itself through a numbered company, also in 1998.

Karin Joesbury, whose daughter Andrea was another of Pickton's alleged victims, also registered a certificate of pending litigation against the pig farm in 2002 as part of a lawsuit filed against Pickton, the RCMP and Vancouver police.

If the government wants to foreclose on the properties it would have to take Pickton's brother and sister to court and apply to force a sale because of their joint ownership, the real estate lawyer says.

Once it does, the rule of "first in time, first in line," applies, meaning earlier creditors would be paid before the province.

Frey says the costs of Pickton's defence should come out of his assets but is torn on what should happen to the properties if he is convicted.

"One time there was talk of some family members wanting to make it a memorial area, a memorial park," she says.

"I would never want it as a memorial park. I'd like to see the monies divided between all the families and their children."

However Maggie de Vries, whose sister Sarah is among the women who vanished from the Downtown Eastside, says she's not opposed to using the properties to pay for Pickton's defence but is not interested in seeing the land become a park.

"That idea doesn't appeal to me at all," de Vries said. "I personally wouldn't go to a memorial site there or want to be involved with setting one up."

Frey says she has no objection if the land was rezoned and developed if proceeds were used to help the victims' children, many of whom are in government care. "They've already got townhouses and an elementary school (on) the property that he sold even before he got arrested," she says.

"Obviously it's a great development area. It's a good place to be. I would personally never want to live there."

© Canadian Press 2005"

"18 U.S. Code § 1958 - Use of interstate commerce facilities in the commission of murder-for-hire Whoever travels in or causes another (including the intended victim) to travel in interstate or foreign commerce, or uses or causes another (including the intended victim) to use the mail or any facility of interstate or foreign commerce, with intent that a murder be committed in violation of the laws of any State or the United States as consideration for the receipt of, or as consideration for a promise or agreement to pay, anything of pecuniary value, or who conspires to do so, shall be fined under this title or imprisoned for not more than ten years, or both; and if personal injury results, shall be fined under this title or imprisoned for not more than twenty years, or both; and if death results, shall be punished by death or life imprisonment, or shall be fined not more than $250,000, or both."

"8(a) Business Development Program [Run through the Serco protégée company Base One Technologies] The 8(a) Business Development Program assists in the development of small businesses owned and operated by individuals who are socially and economically disadvantaged, such as women and minorities. The following ethnic groups are classified as eligible: Black Americans; Hispanic Americans; Native Americans (American Indians, Eskimos, Aleuts, or Native Hawaiians); Asian Pacific Americans (persons with origins from Burma, Thailand, Malaysia, Indonesia, Singapore, Brunei, Japan [Mineta interned in WWII], China (including Hong Kong), Taiwan, Laos, Cambodia (Kampuchea), Vietnam, Korea, The Philippines,U.S. Trust Territory of the Pacific Islands (Republic of Palau), Republic of the Marshall Islands, Federated States of Micronesia, the Commonwealth of the Northern Mariana Islands, Guam, Samoa, Macao, Fiji, Tonga, Kiribati, Tuvalu, or Nauru); Subcontinent Asian Americans (persons with origins from India, Pakistan, Bangladesh, Sri Lanka, Bhutan, the Maldives Islands or Nepal). In 2011, the SBA, along with the FBI and the IRS, uncovered a massive scheme to defraud this program. Civilian employees of the U.S. Army Corps of Engineers, working in concert with an employee of Alaska Native Corporation Eyak Technology LLC allegedly submitted fraudulent bills to the program, totaling over 20 million dollars, and kept the money for their own use.[26] It also alleged that the group planned to steer a further 780 million dollars towards their favored contractor.[27]"

"Serco also integrated voice, video teleconferencing capabilities and situational awareness displays, along with the VDI, into the facility's network distribution system across multiple networks. The result is an integrated IP-based total capability that is centrally managed and consistent across all platforms. Serco also implemented Defense Red Switch Network (DRSN), completed a structured fiber optic and Category 6 cabling system, and participated in the construction design working group to ensure supporting systems (e.g. Power and HVAC) were able to support the 24 AF's IT needs. As a result of Serco's support, 24th Air Force enjoys a true state-of-the-art environment that has delivers the high level of performance and security requires to continue fulfilling the important missions protecting the nation’s security."

"Opened in 1994 as the successor to the Transitional Immigrant Visa Processing Center in Rosslyn, Va., the NVC centralizes all immigrant visa preprocessing and appointment scheduling for overseas posts. The NVC collects paperwork and fees before forwarding a case, ready for adjudication, to the responsible post. The center also handles immigrant and fiancé visa petitions, and while it does not adjudicate visa applications, it provides technical assistance and support to visa-adjudicating consular officials overseas. Only two Foreign Service officers, the director and deputy director, work at the center, along with just five Civil Service employees. They work with almost 500 contract employees doing preprocessing of visas, making the center one of the largest employers in the Portsmouth area. The contractor, Serco, Inc., has worked with the NVC since its inception and with the Department for almost 18 years. The NVC houses more than 2.6 million immigrant visa files, receives almost two million pieces of mail per year and received more than half a million petitions from the U.S. Citizenship and Immigration Service (USCIS) in 2011. Its file rooms' high-density shelves are stacked floor-to-ceiling with files, each a collection of someone’s hopes and dreams and each requiring proper handling."

"The Telgraph .. Police drop investigation into Serco prisoner transport contract The outsourcing group said there was no evidence of individual or corporate wrongdoing

The City of London Police has closed an investigation into Serco's prisoner transport contract after more than a year of work, enabling the firm to continue with the contract until 2018.

The Ministry of Justice called in the police in August 2013 to examine whether Serco had misleadingly recorded prisoners as being ready for court when they were not, in order to meet the performance criteria of the contract.

However, Serco said on Friday that the probe into the Prisoner Escort and Custody Services (PECS) contract had been closed after the police found no evidence to support bringing charges against the outsourcing firm or its staff.

"The information obtained was also sufficient for the City of London Police to conclude there was no evidence of any corporate-wide conspiracy or an intention to falsify figures to meet the DRACT [designated ready and available for court time] contract requirement by senior Serco management or at the board level of the company," the firm said in a statement. The Ministry of Justice had said it would end the contract immediately if the firm's board was found to have done wrong."

"NOSE DIVE

10.04.1512:01 AM ET

The Crash of Trump Air The real story behind The Donald's brief and bizarre career as an airline chieftain.

Donald Trump strode into a ballroom at the Plaza Hotel he owned on October 12, 1988, to announce his acquisition of yet another trophy property: the venerable Eastern AIR Shuttle, which had pioneered the original power flights between New York, Washington, and Boston.

The 42-year-old Manhattan real estate tycoon exuded an outsize confidence, airily waving aside any concerns about his ignorance of the business he was wading into. "It's a diamond, it's an absolute diamond," he crowed to the packed crowd.

Classic Trump bravado, of course, but the airline insiders he'd tapped to run the show were already rolling their eyes. "When he started with that 'diamonds in the sky' line, I said, 'We're going to have to settle for cubic zirconia,'" said Henry Harteveldt, a former TWA and Continental executive who was the nascent line’s new marketing director.

"We inherited more than 20 of the world's oldest 727 airplanes, because that's what had been allocated to the shuttle,” said Harteveldt, now head of Atmosphere Research, a travel data research firm. "At first all we could do was to clean the planes and put a sticker with Trump's name on the side."

And so began one of the stranger episodes in aviation history.

Trump, according to sources close to him at the time, seemed less interested in the inner workings of the business than in what it could do for his brand. "It was this flying billboard for Trump properties," said Harteveldt. “At the time, he was expanding his casino business [in Atlantic City], jet fuel was still relatively cheap. It was a combination of vanity and the lure of an appealing business." Trump, sources said, apparently also dreamed of creating a national airline 10 times the size of the shuttle, a natural fit with the hotels he was rapidly collecting.

That was not to be, and interestingly, Trump's airline dalliance appears to have been airbrushed from his official biography. He makes virtually no mention of it in the numerous memoirs and self-help books he's penned since its demise in late 1991 [with one exception: in the 2008 tome Trump Never Give Up: How I Turned My Biggest Challenges into Success, he admits that the shuttle "never turned a proper profit," but in typical fashion, accepts no responsibility and blames the failure on ‘timing” and the vagaries of the airline business.] Other business setbacks like his casino bankruptcies have been spun into inspirational comeback tales in the Trump narrative—or used by Trump's rivals for the GOP presidential nomination as a way to bash him on the debate stage. His airline adventure, on the other hand, is an outlier: maybe that has something to do with the fact that Trump never was able to get his airline to produce enough cash flow to pay down the massive debt Trump accumulated when he bought the shuttle.

The story does, however, reveal much about the Trump now appearing in the national spotlight. He lied about his competitors. He trotted out plans to attract customers—but many of them made no sense from a business standpoint. Those who worked with him at the airline describe him as a loose cannon; a generous and engaged boss on the one hand, obnoxious and impulsive at other times—especially in public.

As former Trump Shuttle president Bruce Nobles told The Daily Beast, "I cringed every time he opened his mouth."

"He really didn't understand the business and at times he said things that really weren’t helpful” to his new company, Nobles said. "That was his style and it really hasn't changed."

And this tale might also say something about how Trump may behave as this presidential contest continues: When that sunny business climate turned stormy, Trump got out of the airline business—and fast.

He spent more than $1 million on each jet, going well beyond the normal cabin upgrades to add thick maroon carpeting, maple-veneer paneling, beige leather seats, and even faux marble sinks and gold-colored fixtures in the lavatories.

The aviation business has always been a tough one. More than a few corporate titans have been humbled by it. (Think Carl Icahn and TWA, Kirk Kerkorian and his MGM airline.) "I remember telling [Trump]: ‘There's an old saying in the business: the way to make a little money in the airlines is to start with a lot," said Nobles, who'd previously helmed the rival Pan Am shuttle. Airlines have been notoriously poor investments, what with high fixed costs and a vulnerability to unpredictable forces like gyrating fuel prices and economic downturns. In fact, although the economy in general was in decent shape in 1988, the airline business Trump was entering was in turmoil—dozens of airlines had shut down since deregulation was passed in 1978, and many major airlines had either merged or gone into bankruptcy court protection.

One of the first signs of trouble came soon after the deal was signed when the neophyte airline chief set out to destroy his rival—the Pan Am Shuttle, its only direct competition in the market. The Eastern Shuttle, which had had the market all to itself before deregulation, had struggled to keep up when New York Air, and later Pan Am, offered free drinks and food and made the Eastern flights (which then had neither) look spartan by comparison.

Trump decided he’d win customers away from Pan Am—by scaring them. Pan Am was unsafe, he said. He had no proof of this, of course; his message was simply: "I wouldn't fly them; they're losing money and their planes are old," all of which was equally true of Eastern and the planes he’d just bought. Trump’s seasoned airline hands were horrified; even in the combative airline business, such talk was regarded as out of bounds, as it would only stoke more general fears of flying. Moreover, it revealed his lack of understanding of this business—at the time, competitors would help each other if delays or other problems arise. "We told him 'Don’t attack Pan Am, they're the grandfather of this business,'" said Harteveldt.

Next, Trump turned his attention to his fleet, where he was soon to get an education in airline economics. Trump had paid $365 million for the assets of the Eastern shuttle operation and its 17 planes, which he'd spun as a great deal—negotiated down from the $400 million asking price. But later, as the closing was delayed by Eastern’s bankruptcy and other bidders emerged, Trump tried to get Eastern chief Frank Lorenzo to lower the price, since the value of the asset had indeed diminished. Instead Trump ended up taking five additional planes as compensation, which he described as a victory in his book The Art of Survival, published in 1990, when the airline was still flying. "This allowed me to refurbish my fleet without taking any planes out of service," he said.

True, but the shuttle needed only 16 planes to operate a full hourly schedule at its three cities, with one or two jets as spares, and extra aircraft are anathema to an airline—they don't make money sitting on the ground. Even though Trump was later to deploy some of them on flights to Florida, those additional planes were later to prove a drag on the airline as it struggled to make enough money to service its heavy debt. "Lorenzo must have been laughing all the way to the bank," wrote John O'Donnell, former president of the Trump Plaza Hotel, wrote in his book Trumped!

"The shuttle was a clear example of how the exaggerated value of his [Trump's] name led him into a purchase whose foolishness was apparent almost immediately," he added. (The Trump organization declined to comment for this article.)

To his credit, though, Trump decided that since the planes, on average about 20 years old, needed an overhaul anyway, he could use the chance to spiff up passenger comfort and service. He spent more than $1 million on each jet, going well beyond the normal cabin upgrades to add thick maroon carpeting, maple-veneer paneling, beige leather seats, and even faux marble sinks and gold-colored fixtures in the lavatories.

"The bathroom was a work of art," joked Nick Santangelo, who ran maintenance and engineering at the shuttle. “They used ideas from the hotel business, which wasn't bad, but they didn't always work." Older jets in particular guzzle fuel and airline executives are obsessed with saving even a few ounces of weight. Not so Trump: "At first they wanted to put in a ceramic sink, that was too heavy," said Santangelo. "Then one of his henchman decided they were going to put brass handles on the doors you use to get out in an emergency. Normal handles weigh a few ounces, and these things probably weighed five pounds each... you'd kill to save one pound, and they wanted to add 20 to 30 pounds to each plane."

Still, the airline lured customers with frills like airport concierges who would book same-day reservations at fancy restaurants; gourmet food and drink and tarted-up departure lounges. "We spent a lot on service," recalls Harteveldt. "Bagels and coffee in the morning; boxed dinners with sliced chateaubriand and salad; the flight attendants hustled to serve everyone meals and then pour two or even three rounds of drinks" in the 45 minutes the plane was in the air.

Trump's flight attendants—the female ones, at least—wore matching fake pearl necklaces and earrings to go with what the Trump organization described as an "upscale" look, with outfits of navy with burgundy trim. The uniform belts incorporated the Trump Shuttle "T" logo.

It got noticed: an August 21, 1989 New York magazine column said that Trump apparently wanted his attendants to have "the look of old money." The jewelry was a “required part of the uniform," and the magazine quoted a spokesman as saying they were "real, of course," but according to Harteveldt, they were in fact faux. "But we did raffle off a pair of real ones," he said, and even as the go-go 1980s were winding down that was an unusual stunt for an airline.

And then there was the cult of Donald. Frequent travelers would often get thank-you letters after a flight with Trump's personal signature. A glossy inflight magazine was launched, and Trump at first insisted that the cover resemble theArt of the Deal, his best-selling business book. "The attention to detail was incredible," said Harteveldt. "Pretty soon we were at 50 percent of the market, and keep in mind, we started with about zero," the result of Eastern's prolonged labor strife, said Nobles. "But it was also 50 percent of a shrinking market," he said.

Yet another reality was setting in: Business travel was slowing in the Northeast.

Nonetheless, Nobles said the balance sheet improved as the shuttle regained market share, enough to show an operating profit, but not to cover debt payments. And the recession was not just affecting the airline but most of Trump’s other assets, like his hotels and casinos. In fact at one point Trump came up with a plan to help both, by giving away casino chips to his airline passengers in the expectation they'd come to one of his Atlantic City properties to redeem them. It was a bust. "I think something like two chips got cashed in," Nobles recalled with a laugh. ***

Trump’s airline, for all its brass-handled glitz, was a relatively minor player. So in late 1989, he made a bid for control of American Airlines, then the largest airline in the country—and one of the few that had avoided a bankruptcy or merger to survive. His $7.5 billion offer was, at $120 a share, well above the $83 per share the airline was then trading for. But Wall Street and industry insiders were unimpressed, especially after Trump boasted that he'd picked up "substantial insight" in the business he'd just entered. He was, after all, taking on American CEO Bob Crandall, one of the most respected executives in the business. When Crandall immediately took steps to thwart the unwanted advance the bid fizzled. Did Trump he seriously think he could fill Crandall’s shoes? "He thought he saw an opportunity, and he likes to own the best," said Nobles. "He thought American was the best airline, it was as simple as that."

Was Trump chastened? Probably not, but it may have dawned on him at that point that he was out of his depth.

"Trump did see that it was a difficult business," said Nobles. "The number of people who want to fly and the money they'll pay to do that is pretty much out of your control. All you can hope for is your fair share, and we got our fair share. But the size of the pot was shrinking." And in the final analysis, the shuttle, whether it had Trump’s or Eastern's name on it, was a basic conveyance, its short hops that departed on the hour, with no reservations required, were closer to a flying bus than a first-class hop across the pond. Things like punctuality were far more important to its clientele than a better cut of steak. When Trump looked back on the experience in 2008 and wrote that "I knew it could be successful…. it just needed to be buffed up a bit, to make the travel time a bit more luxurious," it's clear how little he learned.

Meanwhile, relations between Trump and some of his shuttle executives had started to fray as market conditions went south. Nobles had offered his resignation in early 1990, because he disagreed with some of Trump’s ideas for cutting costs, some of which flew in the face of reality. "He insisted I fly the planes with only two pilots in the cockpit," said Nobles, instead of the required trio at the controls. To a layman, that might not seem unreasonable, but it spoke volumes about Trump’s lack of understanding of the airlines—and of his very own fleet. The 727s Trump owned could not be flown with two pilots; it was designed for three and "would have been unflyable” otherwise, according to aviation expert (and Beast columnist) Clive Irving. "The FAA would have never permitted it," he said.

But Trump was unmoved. He fired Nobles in the middle of 1990 and did not honor the executive's severance contract. His reason? He told reporters at the time that while the airline was doing well, he just wasn’t pleased "with some of the people running it."

By the middle of 1991, it was clear that the situation was not going to improve; Trump had raised $380 million from a syndicate of 22 [narco?] banks led by Citicorp, putting in just $20 million of his own money. But the airline was just one of a cluster of assets that were at stake; and Trump finally hammered out a deal that gave bankers control of the airline; the climate was turned so sour that no bidders came forward to buy it. US Airways was later tapped to run it and by mid-1992, the plus-size "T" logos on the planes were replaced by more conventional airline livery.

For all that, it can be said that Trump's transformation of the Eastern Shuttle was not for naught; he'd ended up stuck with damaged goods when he bought the shuttle and made changes that were welcomed by both customers and employees (given the condition the shuttle was in when he took over, however, anything would have been an improvement). But other claims he's made about the shuttle over the years don't really stand up; yes, he did rescue a distressed property—but other bidders did come forward at the time and the value of the shuttle franchise was beyond dispute. True, he hired more than a thousand employees from Eastern—and most of them, understandably were happy to have jobs and enjoyed the brief ride while Trump was lavishing perks on his passengers. Most of them continued on after the tycoon departed. And Trump's brief shining moment as a flyboy remains a mere footnote in the annals of aviation.

As for the shuttle—it still chugs along today and on October 17 it will enter its fourth incarnation, as American Airlines formally takes over as part of its merger with US Airways."

"Inside the Money Laundering Scheme That Citi Overlooked for Years

How Citigroup's Banamex USA unit turned a blind eye on the Mexican border.

Alan Katz Alanrkatz Dakin Campbell dakincampbell

November 20, 2015 — 2:00 AM PST

When Antonio Peña Arguelles opened an account in 2005 at Citigroup's Banamex USA, the know-your-customer documents said he had a small business breeding cattle and white-tailed deer, ranch-raised for their stately antlers. About $50 a month would come into the account, according to the documents.

A week later, Peña Arguelles wired in $7.09 million from an account in Mexico, allegedly drug money from Los Zetas, a violent cartel founded by former Mexican soldiers, documents in his money-laundering case in Texas say. In all, Peña Arguelles shuttled $59.4 million through the account, according to a confidential report by banking regulators that berated Banamex USA in 2013 for its failure to comply with anti-money-laundering rules.

Banamex USA didn't file a suspicious activity report about the account, according to regulators, even after Peña Arguelles’s brother Alfonso was killed in late 2011, his body dumped at the Christopher Columbus monument in Nuevo Laredo, Mexico, with a banner draped above it accusing Antonio of being a money launderer and stealing from the Zetas. The bank didn’t produce an activity report after U.S. prosecutors asked for the account documents at the end of that year or when Peña Arguelles was indicted in early 2012 for conspiracy to launder monetary instruments. And it didn't file one until May 2013, months after the Federal Deposit Insurance Corp. and the California Department of Business Oversight issued a written order in August 2012 demanding the bank check old accounts."

"Super Serco bulldozes ahead

By DAILY MAIL REPORTER

UPDATED: 23:00 GMT, 1 September 2004

SERCO has come a long way since the 1960s when it ran [Resilience exercises and] the 'four-minute warning' system to alert the nation to a ballistic missile attack.

Today its £10.3bn order book is bigger than many countries' defence budgets. It is bidding for a further £8bn worth of contracts and sees £16bn of 'opportunities'.

Profit growth is less ballistic. The first-half pre-tax surplus rose 4% to £28.1m, net profits just 1% to £18m. Stripping out goodwill, the rise was 17%, with dividends up 12.5% to 0.81p.

Serco runs the Docklands Light Railway, five UK prisons, airport radar and forest bulldozers in Florida.

Chairman Kevin Beeston said: 'We have virtually no debt and more than 600 contracts.'

The shares, 672p four years ago, rose 8 1/4p to 207 1/4p, valuing Serco at £880m or nearly 17 times earnings.

Michael Morris, at broker Arbuthnot, says they are 'a play on UK government spend' which is rising fast."

"Serco Combined Resilience Exercising

http://www.epcollege.com/EPC/media/MediaLibrary/Downloads/Gold-Standard.pdf

Types of Exercise Workshop Exercises These are structured discussion events where participants can explore issues in a less pressurized environment.

They are an ideal way of developing solutions, procedures and plans rather than the focus being on decision making. Table Top Exercises These involve a realistic scenario and will follow a time line, either in real-time or with time jumps to concentrate on the more important areas. The participants would be expected to be familiar with the plans and procedures that are being used although the exercise tempo and complexity can be adjusted to suit the current state of training and readiness. Simulation and media play can be used to support the exercise. Table-top exercises help develop teamwork and allow participants to gain a better understanding of their roles and that of other agencies and organisations.

Command/Control Post Exercises These are designed primarily to exercise the senior leadership and support staff in collective planning and decision making within a strategic grouping. Ideally such exercises would be run from the real command and control locations and using their communications and information systems. This could include a mix of locations and varying levels of technical simulation support. The Gold Standard system is flexible to allow the tempo and intensity to be adjusted to ensure maximum training benefit, or to fully test and evaluate the most important aspects of a plan. Such exercises also test information flow, communications, equipment, procedures, decision making and coordination.

Simulation and Media Support

The method of delivering an exercise is flexible and will be designed with the client to meet their requirements with options ranging from simple paper-based delivery through to full use of their real communications systems [Red Switch Network and Hawkeye onion router surveillance aircraft] and advance computer simulation [In Trump's death pool and war room suites]. In addition, media play can also be added in the form of news injects and the provision of experienced journalists and television crews to help test procedures and also assist in training key staff.

Gold Standard Emergency Planning College

The Hawkhills, Easingwold, York North Yorkshire, YO61 3EG +44(0) 1347 821406

enquiries@emergencyplanningcollege.com www.epcollege.com"

"Serco farewell to NPL after 19 years of innovation [outsourced by David Cameron at Treasury] … 8 January 2015

Serco said goodbye to the National Physical Laboratory (NPL) at the end of December 2014 after 19 years of extraordinary innovation and science that has seen the establishment build a world-leading reputation and deliver billions of pounds of benefit for the UK economy. It has been estimated that work carried out by the Centre of Carbon Measurement at NPL will save eight million tonnes of carbon emissions reductions (2% of UK footprint) and over half a billion pounds in economic benefit [bullshit] over the next decade. .. · NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency [death-pool] trading in the City through NPLTime."

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.