________

Source: Matt Ehret's Insights

February 18, 2021 | Matthew Ehret

It is more than a little depressing to consider the impending systemic meltdown that immanently presses upon our current world. Since the 1971 floating of the U.S. dollar, a once proud and productive western industrial economic system has been increasingly asset stripped by bank deregulation, outsourcing, cheap labor and monetarism into a cult of post industrialism which has wrecked moral and economic havoc upon the world.

If America and the western order is to somehow find its moral fitness to survive and if a world war is to be avoided in the coming near-term future, then certain fundamental banking reforms will be needed. Among the most important of these reforms will be a breaking up of banking activities into two categories under a renewal of the Glass-Steagall bank reform which was repealed by Bill Clinton in 1999. These two categories would include: 1) speculative trash and illegitimate usury which must be "deleted" under a debt jubilee and 2) legitimate savings and other useful commercial banking activities tied to "real" values without which society couldn't sustain itself.

February 18, 2021 | Matthew Ehret

It is more than a little depressing to consider the impending systemic meltdown that immanently presses upon our current world. Since the 1971 floating of the U.S. dollar, a once proud and productive western industrial economic system has been increasingly asset stripped by bank deregulation, outsourcing, cheap labor and monetarism into a cult of post industrialism which has wrecked moral and economic havoc upon the world.

If America and the western order is to somehow find its moral fitness to survive and if a world war is to be avoided in the coming near-term future, then certain fundamental banking reforms will be needed. Among the most important of these reforms will be a breaking up of banking activities into two categories under a renewal of the Glass-Steagall bank reform which was repealed by Bill Clinton in 1999. These two categories would include: 1) speculative trash and illegitimate usury which must be "deleted" under a debt jubilee and 2) legitimate savings and other useful commercial banking activities tied to "real" values without which society couldn't sustain itself.

Many readers might immediately scoff at my words, and assert that such a reform were impossible at this late stage of rot and corruption in western society but I would retort with the question: If this were so impossible, then how was it done already at a similar time of crisis only 87 years ago under similar circumstances of economic breakdown, fascism and world war? How have other national resistance movements blocked this sort of misanthropic agenda from succeeding in the past?

In this case, I speak of course of the forgotten Pecora Commission and an often-forgotten war on Wall Street which changed the course of human history.

What was the Pecora Commission?

Many are aware of the economic meltdown of October 24, 1929 that ushered in four years of depression onto America (and much of the western world). However not many people are aware of the intense fight that was launched by patriots in both parties against the Wall Street/deep state parasite of that age which prevented both a fascist coup against the newly elected Franklin Roosevelt while also crippling Wall Street's command of American life. In spite of whitewashing revisionist history books that contaminated the past 70 years, America's recovery from the depression never occurred without a life or death struggle and this struggle was made possible, in large measure by the courageous work of an Italian lawyer from New York. This man's name was Ferdinand Pecora.

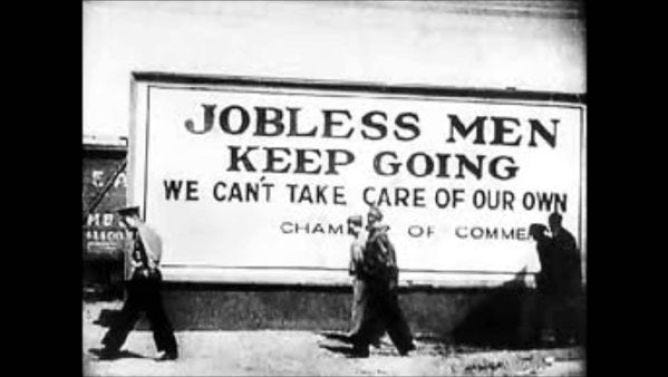

By 1932, when Senators Peter Norbeck (R-SD) and George Norris (R-NB) spearheaded the establishment of the U.S. Committee on Banking and Currency, the American economy was on life support and the people were so desperate that a fascist dictatorship in America would have been welcomed with open arms if only bread could be put on the table. Unemployment had reached 25%, while over 40% of banks had gone bankrupt and 25% of the population had lost their savings. Thousands of tent cities called 'Hoovervilles' were spread across the USA and over 50% of America's industrial capacity had shut down. Thousands of farms had been foreclosed and the engines of American industry had ground to a screeching halt.

Across the ocean, the fascist regimes of Germany, Italy and Spain were growing more powerful by the day fed by injections of hundreds of millions of dollars of capital by London and Wall Street bankers. Notable among these pro-fascist financiers was none other than Bush family patriarch Prescott, who provided millions in loans to Hitler's bankrupt Nazi party in 1932 (and continued doing business with the party through 1942- having only stopped after being found guilty for "trading with the enemy").

The Committee on Banking and Currency was a relatively impotent body when it began in 1932, but when Senator Norbeck called in Ferdinand Pecora to lead it in April 1932, everything began to change. A first generation Italian-American, Pecora was forced to quit high school after his father was injured in order to support his family. Years later, the young man found work as a clerk in a law firm, and managed to work his way through law school, passing the bar in 1911. His unimpeachable reputation earned him the animosity of powerful NY financiers who ensured that his successes in prosecuting brokers never resulted in attaining Attorney General, where he made a name for himself shutting down over 100 illegal brokerage houses that speculated on fraudulent securities during the depression.

Within days of accepting the Washington job as Chief Council of Norbeck's committee (for the meager salary of $250/month), Pecora was granted broad subpoena powers to audit banks and drag the most powerful men in America to testify in the committee's hearings.

In his first two weeks, Pecora made headlines by auditing the books of major Wall Street banks and pulled in pro-fascist National City President Charles Mitchell (then preparing to advise Benito Mussolini) to testify. Within days, Mitchell's team of expensive defense attorneys could do nothing but watch in despair as the powerful financier admitted to short selling his own bank's stocks during the depression, scamming depositors with purchases of Cuban junk debt and avoiding taxes for years. Mitchell was forced to resign in shame followed days later by NY Stock Exchange Chair Dick Whitney- who left the court in handcuffs.

This crackdown on Wall Street's abuses were highly publicized and put the spotlight on the criminal schemes used to gamble with savings and commercial bank deposits on securities and futures markets which led to the orchestrated collapse of the bubble economy in 1929 (ironically much of the bubble built up during the "easy-money days" of the "roaring 20s" was centered in the housing market). Pecora's crackdown also set the tone for the incoming Roosevelt administration.

Unlike the previous 1911 Pujo Commission, which also exposed Wall Street's abuses of power, the Pecora Commission was supported by a President who actually cared about the Constitution and amplified Pecora's powers even further. When FDR was told that supporting Pecora's exposures of financial crimes would hurt the economy, the President famously responded with "they should have thought of that when they did the things that are being exposed now." FDR followed up that warning by encouraging the attorney to take on John Pierpont Morgan Jr.

Rather than controlling an American institution as many believed 70 years ago and today, J.P. Morgan Jr. was actually running an operation that had earlier been created in the mid-19th century as part of a British infiltration of America. As historian John Hoefle pointed out in a 2009 EIR study:

"The House of Morgan was, in truth, a British operation from its inception. It began life as George Peabody & Co., a bank founded in London in 1851 by American George Peabody. A few years later, another American, Junius S. Morgan, joined the firm, and upon Peabody's death the firm became J.S. Morgan & Co. Junius Morgan brought in his son, J. Pierpont Morgan, to head the New York office of J.S. Morgan, and the New York office became J.P. Morgan & Co. From its original role in helping the British gain control of American railroads, the Morgan bank became a leading force in the oligarchy's war against the American System, using the deep pockets of its imperial masters to become a powerhouse in not only finance but steel, automobiles, railroads, electricity generation, and other industries."

By 1933, the House of Morgan grew into a multi-headed hydra controlling utilities, holding companies, banks and countless other subsidiaries.

Please go to Matt Ehret's Insights to read more.

The Criminality of Global Capitalism

In this case, I speak of course of the forgotten Pecora Commission and an often-forgotten war on Wall Street which changed the course of human history.

What was the Pecora Commission?

Many are aware of the economic meltdown of October 24, 1929 that ushered in four years of depression onto America (and much of the western world). However not many people are aware of the intense fight that was launched by patriots in both parties against the Wall Street/deep state parasite of that age which prevented both a fascist coup against the newly elected Franklin Roosevelt while also crippling Wall Street's command of American life. In spite of whitewashing revisionist history books that contaminated the past 70 years, America's recovery from the depression never occurred without a life or death struggle and this struggle was made possible, in large measure by the courageous work of an Italian lawyer from New York. This man's name was Ferdinand Pecora.

By 1932, when Senators Peter Norbeck (R-SD) and George Norris (R-NB) spearheaded the establishment of the U.S. Committee on Banking and Currency, the American economy was on life support and the people were so desperate that a fascist dictatorship in America would have been welcomed with open arms if only bread could be put on the table. Unemployment had reached 25%, while over 40% of banks had gone bankrupt and 25% of the population had lost their savings. Thousands of tent cities called 'Hoovervilles' were spread across the USA and over 50% of America's industrial capacity had shut down. Thousands of farms had been foreclosed and the engines of American industry had ground to a screeching halt.

Across the ocean, the fascist regimes of Germany, Italy and Spain were growing more powerful by the day fed by injections of hundreds of millions of dollars of capital by London and Wall Street bankers. Notable among these pro-fascist financiers was none other than Bush family patriarch Prescott, who provided millions in loans to Hitler's bankrupt Nazi party in 1932 (and continued doing business with the party through 1942- having only stopped after being found guilty for "trading with the enemy").

The Committee on Banking and Currency was a relatively impotent body when it began in 1932, but when Senator Norbeck called in Ferdinand Pecora to lead it in April 1932, everything began to change. A first generation Italian-American, Pecora was forced to quit high school after his father was injured in order to support his family. Years later, the young man found work as a clerk in a law firm, and managed to work his way through law school, passing the bar in 1911. His unimpeachable reputation earned him the animosity of powerful NY financiers who ensured that his successes in prosecuting brokers never resulted in attaining Attorney General, where he made a name for himself shutting down over 100 illegal brokerage houses that speculated on fraudulent securities during the depression.

Within days of accepting the Washington job as Chief Council of Norbeck's committee (for the meager salary of $250/month), Pecora was granted broad subpoena powers to audit banks and drag the most powerful men in America to testify in the committee's hearings.

In his first two weeks, Pecora made headlines by auditing the books of major Wall Street banks and pulled in pro-fascist National City President Charles Mitchell (then preparing to advise Benito Mussolini) to testify. Within days, Mitchell's team of expensive defense attorneys could do nothing but watch in despair as the powerful financier admitted to short selling his own bank's stocks during the depression, scamming depositors with purchases of Cuban junk debt and avoiding taxes for years. Mitchell was forced to resign in shame followed days later by NY Stock Exchange Chair Dick Whitney- who left the court in handcuffs.

This crackdown on Wall Street's abuses were highly publicized and put the spotlight on the criminal schemes used to gamble with savings and commercial bank deposits on securities and futures markets which led to the orchestrated collapse of the bubble economy in 1929 (ironically much of the bubble built up during the "easy-money days" of the "roaring 20s" was centered in the housing market). Pecora's crackdown also set the tone for the incoming Roosevelt administration.

Unlike the previous 1911 Pujo Commission, which also exposed Wall Street's abuses of power, the Pecora Commission was supported by a President who actually cared about the Constitution and amplified Pecora's powers even further. When FDR was told that supporting Pecora's exposures of financial crimes would hurt the economy, the President famously responded with "they should have thought of that when they did the things that are being exposed now." FDR followed up that warning by encouraging the attorney to take on John Pierpont Morgan Jr.

Rather than controlling an American institution as many believed 70 years ago and today, J.P. Morgan Jr. was actually running an operation that had earlier been created in the mid-19th century as part of a British infiltration of America. As historian John Hoefle pointed out in a 2009 EIR study:

"The House of Morgan was, in truth, a British operation from its inception. It began life as George Peabody & Co., a bank founded in London in 1851 by American George Peabody. A few years later, another American, Junius S. Morgan, joined the firm, and upon Peabody's death the firm became J.S. Morgan & Co. Junius Morgan brought in his son, J. Pierpont Morgan, to head the New York office of J.S. Morgan, and the New York office became J.P. Morgan & Co. From its original role in helping the British gain control of American railroads, the Morgan bank became a leading force in the oligarchy's war against the American System, using the deep pockets of its imperial masters to become a powerhouse in not only finance but steel, automobiles, railroads, electricity generation, and other industries."

By 1933, the House of Morgan grew into a multi-headed hydra controlling utilities, holding companies, banks and countless other subsidiaries.

Please go to Matt Ehret's Insights to read more.

________

Related:

DAVID MEETS GOLIATH IN EPIC GAMESTOP HEARINGS

The Gamers' Uprising Against Wall Street Has Deep Populist Roots

GameStop Hearing: Citadel's Ken Griffin Doesn't Let the Brutal Facts Get in the Way of His Testimony

More:

DAVID MEETS GOLIATH IN EPIC GAMESTOP HEARINGS

The Gamers' Uprising Against Wall Street Has Deep Populist Roots

GameStop Hearing: Citadel's Ken Griffin Doesn't Let the Brutal Facts Get in the Way of His Testimony

More:

HONORED TO BE AN ESSENTIAL PUBLIC SERVICE PROVIDER.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.