________

Source: S&P Global Market Intelligence

BIS to test international settlements for digital currencies with central banks

By Gaurav Raghuvanshi | September 2, 2021

The Bank for International Settlements and four central banks will test the use of digital currencies for cross-border transactions, as global regulators seek to improve the speed of movement of money in a cheaper, more transparent manner.

Source: S&P Global Market Intelligence

BIS to test international settlements for digital currencies with central banks

By Gaurav Raghuvanshi | September 2, 2021

The Bank for International Settlements and four central banks will test the use of digital currencies for cross-border transactions, as global regulators seek to improve the speed of movement of money in a cheaper, more transparent manner.

The BIS Innovation Hub, along with Reserve Bank of Australia, Monetary Authority of Singapore, Bank Negara Malaysia and South African Reserve Bank, aims to develop prototype shared platforms for cross-border transactions using multiple central bank digital currencies, or CBDCs, the group of global regulators said in a Sept. 2 press release.

The project "brings together central banks with years of experience and unique perspectives in CBDC projects and ecosystem partners at advanced stages of technical development on digital currencies," said Andrew McCormack, the chief of the BIS Innovation Hub Singapore Centre. The Geneva-based group is confident that the experiment will "lay the foundation for global payments connectivity," McCormack added.

Interest in CBDCs, which are envisaged as digital notes of fiat currencies, is rising with changes in the way payments are expected to be made in the future. Central banks globally are keen to protect the public's trust in money as a clutch of cryptocurrencies seek legitimacy as an alternative form of money. A BIS survey of central banks found that 86% were actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.

The proposed platform will allow financial institutions to transact directly with each other in the digital currencies issued by participating central banks, eliminating the need for intermediaries and cutting the time and cost of transactions, BIS said. The project will explore the international dimension of CBDC design and support the G20 group of nations' effort to enhance cross-border payments.

The project is a "significant contribution" to the global vision to make payments cheaper and faster, said Sopnendu Mohanty, the chief of financial technology at the Singapore central bank. "The findings on how a common platform can be governed effectively and managed efficiently will shape the blueprint of the next-generation payment systems."

The results of the experiment, expected to be published in early 2022, will be used to develop future platforms for global and regional settlements, BIS said. Prototypes of the proposed shared platforms will be developed in collaboration with technical partners on different distributed ledger technology platforms and demonstrated at the Singapore FinTech Festival in November.

The project will also explore governance and operating designs that would enable central banks to share CBDC infrastructures and gain from collaboration between public and private sector experts, it added.

The project "brings together central banks with years of experience and unique perspectives in CBDC projects and ecosystem partners at advanced stages of technical development on digital currencies," said Andrew McCormack, the chief of the BIS Innovation Hub Singapore Centre. The Geneva-based group is confident that the experiment will "lay the foundation for global payments connectivity," McCormack added.

Interest in CBDCs, which are envisaged as digital notes of fiat currencies, is rising with changes in the way payments are expected to be made in the future. Central banks globally are keen to protect the public's trust in money as a clutch of cryptocurrencies seek legitimacy as an alternative form of money. A BIS survey of central banks found that 86% were actively researching the potential for CBDCs, 60% were experimenting with the technology and 14% were deploying pilot projects.

The proposed platform will allow financial institutions to transact directly with each other in the digital currencies issued by participating central banks, eliminating the need for intermediaries and cutting the time and cost of transactions, BIS said. The project will explore the international dimension of CBDC design and support the G20 group of nations' effort to enhance cross-border payments.

The project is a "significant contribution" to the global vision to make payments cheaper and faster, said Sopnendu Mohanty, the chief of financial technology at the Singapore central bank. "The findings on how a common platform can be governed effectively and managed efficiently will shape the blueprint of the next-generation payment systems."

The results of the experiment, expected to be published in early 2022, will be used to develop future platforms for global and regional settlements, BIS said. Prototypes of the proposed shared platforms will be developed in collaboration with technical partners on different distributed ledger technology platforms and demonstrated at the Singapore FinTech Festival in November.

The project will also explore governance and operating designs that would enable central banks to share CBDC infrastructures and gain from collaboration between public and private sector experts, it added.

By Fintan Dunne | October 5, 2021

Building on the bitcoin model, central banks are planning to produce their own "digital currencies". Removing any and all remaining privacy, granting total control over every transaction, even limiting what ordinary people are allowed to spend their money on.

From the moment bitcoin and other cryptocurrencies first emerged, sold as an independent and alternative medium of exchange outside the financial status quo, it was only a matter of time before the new alternative would be absorbed, modified and redeployed in service of the state.

Enter "Central Bank Digital Currencies": the mainstream answer to bitcoin.

For those who have never heard of them, "Central Bank Digital Currencies" (CBDCs) are exactly what they sound like, digitized versions of the pound/dollar/euro etc. issued by central banks.

Like bitcoin (and other crypto), the CBDC would be entirely digital, thus furthering the ongoing war on cash. However, unlike crypto, it would not have any encryption preserving anonymity. In fact, it would be totally the reverse, potentially ending the very idea of financial privacy.

Now, you may not have heard much about the CBDC plans, lost as they are in the tangle of the ongoing "pandemic", but the campaign is there, chugging along on the back pages for months now. There are stories about it from both Reuters and the Financial Times just today. It's a long, slow con, but a con nonetheless.

The countries where the idea progressed the furthest are China and the UK. The Chinese Digital Yuan has been in development since 2014, and is subject to ongoing and widespread testing. The UK is nowhere near that stage yet, but Chancellor Rishi Sunak is keenly pushing forward a digital pound that the press are calling "Britcoin".

Other countries, including New Zealand, Australia, South Africa and Malaysia, are not far behind.

The US is also researching the idea, with Jerome Powell, head of Federal Reserve, announcing the release of a detailed report on the "digital dollar" in the near future.

The proposals for how these CBDCs might work should be enough to raise red flags in even the most trusting of minds.

Most people wouldn't like the idea of the government monitoring "all spending in real-time", but that’s not the worst it.

By far the most dangerous idea is that any future digital currency should be "programmable". Meaning the people issuing the money would have the power to control how it is spent.

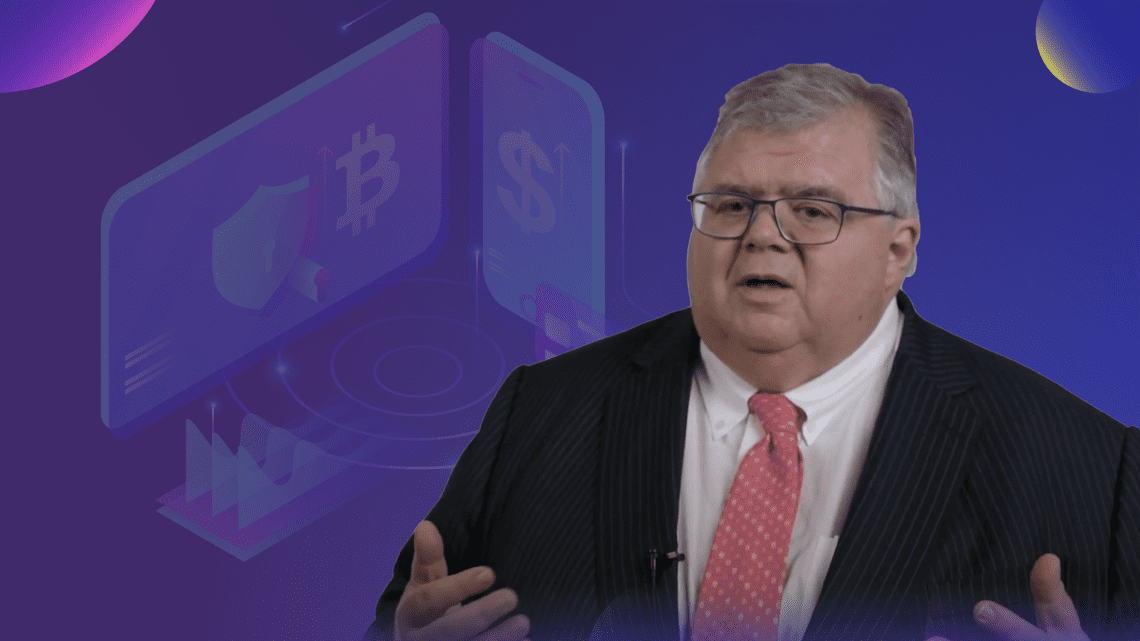

That's not an interpretation or a "conspiracy theory", just listen to Agustin Carstens, head of the International Settlement Bank, speaking earlier this year:

The key difference [with a CBDC] is that the central bank would have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and the have the technology to enforce that."…which tells you not only that they want and are seeking this power, but how they justify it to themselves. They transform other people's money into an "expression of their liability", and so consider it's only right that they control it.

An article in the Telegraph, back in June, was just as candid [our emphasis]:

"Digital cash could be programmed to ensure it is only spent on essentials, or goods which an employer or Government deems to be sensible."The article goes on to quote Tom Mutton, a director at the BoE:

You could introduce programmability […] There could be some socially beneficial outcomes from that, preventing activity which is seen to be socially harmful in some way.Governments and employers making sure the money they issue can only be used on "sensible" things, and not be used in "socially harmful" ways? It doesn't take much imagination to see just how this system could evolve and re-shape society into a truly dystopian nightmare.

Please go to Break for News to read more.

________

Editor's note: Here is Agustín Carstens' version of what CBCDs are at the BIS. The future of who's monetary system? The central bankers monetary system? There has been populist sentiment for the past century in the US ever since 1913 with a healthy mistrust of the Federal Reserve and now we are going to see a continuation of this only in digital form. Note that Agustín Carstens states that "the Covid-19 pandemic may have further accelerated the pace of digital change." Well of course, that is specifically what the fake global planned Covid "pandemic" was designed and planned to do all along. It was implemented to roll out these digital technologies along with CBCDs likely being tethered to your smart phones using your own unique QR code digital identifier.

Editor's note: Here is Agustín Carstens' version of what CBCDs are at the BIS. The future of who's monetary system? The central bankers monetary system? There has been populist sentiment for the past century in the US ever since 1913 with a healthy mistrust of the Federal Reserve and now we are going to see a continuation of this only in digital form. Note that Agustín Carstens states that "the Covid-19 pandemic may have further accelerated the pace of digital change." Well of course, that is specifically what the fake global planned Covid "pandemic" was designed and planned to do all along. It was implemented to roll out these digital technologies along with CBCDs likely being tethered to your smart phones using your own unique QR code digital identifier.

Source: The Asian Banker

BIS' Carstens: "Digital currencies and the future of the monetary system"

Janauary 28, 2021 | By Agustin Carstens

Agustín Carstens, general manager of Bank for International Settlements (BIS), in a speech to Hoover Institution affiliates, Stanford University faculty and students on 27 January 2021, addressed the digitisation of money and the implications of central bank digital currencies for the monetary system.

• Why does the economy need digital currencies? Digital money is not new and commercial bank money has been digital for decades.It is stating the obvious that our economy is in the middle of a technological revolution. A combination of new digital technologies and greater online activity allows huge volumes of data to be collected, managed and telecommunicated. This has dramatically lowered the costs of many tasks. It has resulted in powerful, hyper-scalable applications that have disrupted entire industries – everything from taxis to print media. New players have entered the digital economy to provide these services. While advances in information technology and communications have been under way for many decades, the past decade has ushered in truly far-reaching changes. The COVID-19 pandemic may have further accelerated the pace of digital change.

• Who are and should be issuing the new forms of digital currencies, including central bank digital currencies, and how should they be designed?

• What is the concept behind crypto and digital currencies such as bitcoin and how do they impact the monetary system?

The technological revolution has also reached the financial system – and even the design of money itself. Just to name one example, on primary foreign exchange (FX) venues, market-makers can now access real-time prices at five-millisecond time intervals. Project Rio, a new application for monitoring fast-paced markets developed at the BIS Innovation Hub, allows the entire market order book to be monitored every 100 milliseconds, or 36,000 times every hour.

The first point of entry into finance is the market for payment services, which are foundational to all economic activity. Payments are attractive for digital disrupters because they are relatively less capital intensive than other financial services, and the information they generate is highly valuable for cross-selling. Perhaps it is no surprise that we've seen a burst of digital innovation in payments, including new digital payment offerings by fintech startups, big techs and incumbents.

Many payment innovations build on improvements to underlying infrastructures that have been many years in the making. For instance, harnessing technological progress, central banks around the world have instituted real-time gross settlement (RTGS) systems over the past decades. Meanwhile, operating hours of these systems have continued to lengthen around the globe, and in several countries are already operating almost 24/7. Also on the retail side, innovation is rampant, and a growing number of economies – 51 by our last count – have fast retail payment systems, which allow 24/7 instant settlement of payments between households and businesses. These include systems like the Unified Payment Interface (UPI) in India, CoDi in Mexico, PIX in Brazil and the FedNow proposal in the US. Together, these innovations have shown that the existing system can adapt, providing good examples of how innovation in public private partnerships is working.

Do we need new digital currencies? If so, who should issue them?

Yet no one is compelled to choose the path of the existing monetary system. In addition to improvements to existing systems, many attempts to innovate in less traditional fields have been unleashed. One example is digital currencies – which could transcend both traditional account-based money and physical cash. As already mentioned, account-based money has been digital for decades, as electronic deposits on a digital ledger. Yet there have been calls and attempts to digitise all money, including cash. In my view, fully replacing either bank accounts or cash is neither desirable nor realistic, but let us discuss what a further digitisation of money could look like.

Narayana Kocherlakota – one of the world’s leading monetary theorists, former president of the Federal Reserve Bank of Minneapolis and a former Stanford professor – argued in a famous 1998 paper that "money is memory". By substituting for an otherwise complex web of bilateral IOUs, money is a substitute for a publicly available and freely accessible device that records who owes what to whom.

The idea that money is the economy’s memory leads us to two forks in the road for the design of digital money. At these junctions, decisions about architecture and access need to be taken. First, it needs to be ensured that the memory is always and everywhere correct. In payments parlance, this means ensuring the integrity and safety of the payment system, as well as the finality of payments. How to do this relates to the role of a central intermediary versus a decentralised governance system. And second, rules to guide who has access to this information, and under what circumstances, need to be determined, with appropriate safeguards in place to protect privacy. In other words, we need to establish both proper identification and privacy in the payment system.

Please go to The Asian Banker to read more.

________

Related:

"Programmable Digital Currency": The next stage of the new normal?

Nigeria Central Bank Launches CBDC 'eNaira'

"Programmable Digital Currency": The next stage of the new normal?

Nigeria Central Bank Launches CBDC 'eNaira'

Pay close attention to Israel developing their own CBCD but based on the cryptocurrency platform ethereum.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.