by

United States Marine Field McConnell

Plum City Online - (AbelDanger.net)

February 2, 2016

1. Abel Danger (AD) asserts that Goldman Sachs operates an online 'Vampire' death pool in Houston and employs Heidi Cruz to bring in investors to bet on the times of death of high-value carbon-spewing targets at real or simulated mass-casualty events and media plays.

2. AD asserts that Goldman Sachs, HSBC and HMG government secretly outsourced the operation of the U.S. Patent and Trademark Office to their investee Serco and adopted Crown Rights rules for the Navy Onion Router devices used to spot fix and crash MH Flights 370 and 17 in 2014

3. AD asserts that Barack Obama – named as Barry Soetoro at Serco's National Visa Center – authorized Serco's long range 8(a) teams to synchronize the firebombing of the BP Deepwater Horizon and the carbon-capping of the crew with the Vampire death betting pool in Houston.

United States Marine Field McConnell (http://www.abeldanger.net/2010/01/field-mcconnell-bio.html) offers to show Americans how to win a resilient patent war with Serco shareholders and their long-range assassination teams in the Vampire death pool.

Copy of SERCO GROUP PLC: List of Subsidiaries AND [Loan Shark] Shareholders!

(Mobile Playback Version)

Serco... Would you like to know more?

Goldman Sachs: The Vampire Squid

Naudet brothers 9/11 Documentary - 1st plane hits North Tower

"Behind the Sordid World of Online Assassination Betting

Jamie Bartlett

6/01/15 11:35am

Filed to: BIBLIOTECH

I have heard rumors about this website, but I still cannot quite believe that it exists. I am looking at what I think is a hit list.

There are photographs of people I recognize—prominent politicians, mostly—and, next to each, an amount of money. The site's creator, who uses the pseudonym Kuwabatake Sanjuro, thinks that if you could pay to have someone murdered with no chance—I mean absolutely zero chance—of being caught, you would.

That's one of the reasons why he has created the Assassination Market.

There are four simple instructions listed on its front page:

Add a name to the list Add money to the pot in the person's name Predict when that person will die Correct predictions get the pot

The Assassination Market can't be found with a Google search. It sits on a hidden, encrypted part of the internet that, until recently, could only be accessed with a browser called The Onion Router, or Tor. Tor began life as a U.S. Naval Research Laboratory project, but today exists as a not-for-profit organization, partly funded by the U.S. government and various civil liberties groups, allowing millions of people around the world to browse the internet anonymously and securely."

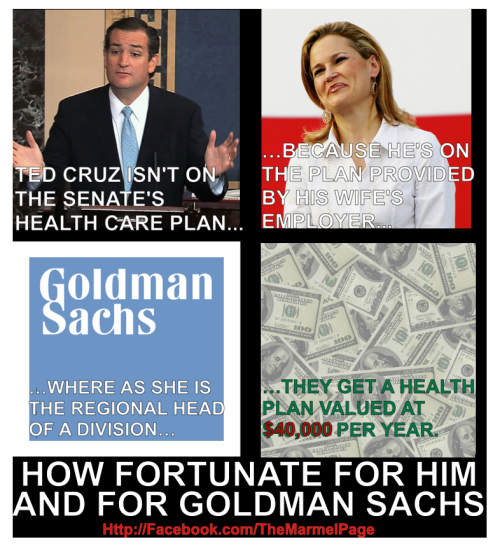

"Heidi Cruz (née Nelson on August 7, 1972) is an American investment manager at Goldman Sachs. She is the wife of senator and presidential candidate Ted Cruz.[1][2] Heidi Cruz was born on August 7, 1972 in San Luis Obispo, California, where her parents, Peter (a dentist)[3] and Suzanne Nelson, performed dental work as missionaries for the Seventh-day Adventist Church.[4] She accompanied them to Nigeria and Kenyaon missionary trips.[1][5][6] Cruz announced in fifth grade that she intended to one day attend Harvard Business School, her mother reflecting that she was unsure of how her daughter knew of the school and described her as "driven".[7] Cruz's political interest developed when she traveled to Washington with her parents at age 8,[7] and grew when she was age 12 and read an issue of Time magazine concerning the 1984 presidential election, while working at a bread stand.[8]

She graduated with a B.A. in Economics and International Relations from Claremont McKenna College in 1994. She was active in Claremont McKenna's Republican group and according to her mentor Edward Haley, she had an interest in appointive office.[7]During her time at Claremont McKenna College, she studied abroad at the University of Strasbourg.[9] In 1995, she received a Masters of European Business from Université Libre de Bruxelles in Brussels, Belgium and in 2000, she graduated with a M.B.A. from Harvard Business School.[1][6][10]

Career

In 2003, she worked for the Bush administration on economic policy,[1][11] eventually becoming the director for the Western Hemisphere on the National Security Council under National Security Advisor Condoleezza Rice in 2003.[1][10][12] Cruz remembered liking her tenure with the Bush administration and found her work to be "personally fulfilling."[13] After commuting to see her husband for a year,[14] she left Washington DC in 2004 to support his run for elective office in Texas.[15] Cruz did not see this as her giving up her career but merely as relocating, and she took her time to become used to the new environment, initially difficult since most of her family was in California and she had several colleagues in New York.[13] …

In 2012, it was widely reported, she agreed to cash in the couple’s entire liquid net worth to finance his Senate campaign in 2012. She saw this as an investment through her experience as a Goldman Sachs banker.[12] In January 2016, questions were raised on the front page of the New York Times as to whether the couple did actually cash in their entire liquid net worth, and it was revealed that the campaign was also financed by a previously undeclared loan Heidi took from Goldman Sachs. Addressing the matter, Cruz reflected that the couple had stalled their lives and finances for his campaign for the U.S. Senate, which she concluded Texans were thankful for.[54]"

In 2005, she joined Goldman Sachs, serving as a private wealth manager[16] and is currently the Region Head for the Southwest Region in the Investment Management Division of Goldman Sachs in Houston.[1][10][17] Peter Conway, Cruz's employer, assisted in her recruitment and was impressed by her being among the first to arrive and last to leave, remembering her doing well in a field of men. Conway would later recommend her to lead the office. Cruz used politics to gain common ground with her clients and deployed her husband to join her in meeting with potential investors.[14] She had served as vice president for seven years before the promotion in 2013.[18] She took a leave of absence without pay for her husband's 2016 presidential campaign.[15]"

"The Deepwater Horizon drilling rig explosion refers to the April 20, 2010 explosion and subsequent fire on the Deepwater Horizon semi-submersible Mobile Offshore Drilling Unit (MODU), which was owned and operated by Transocean and drilling for BP in the Macondo Prospect oil field about 40 miles (60 km) southeast of the Louisiana coast. The explosion killed 11 workers and injured 16 others. The explosion caused the Deepwater Horizon to burn and sink, resulting in a massive offshore oil spill in the Gulf of Mexico, considered the largest accidental marine oil spill in the world, and the largest environmental disaster in U.S. history.[2][3][4]"

"Hong Kong: German insurer Allianz [Serco shareholder] said on Monday it was the lead re-insurer to the AirAsia jet missing off the Indonesian coast with 162 people on board, making it the third major airline accident it has been involved in this year.

The German company, which has Malaysia Airlines as a client, was the main reinsurer to flight MH370 that disappeared over the Indian Ocean in March, as well as to flight MH17 which was shot down in July while flying over Ukraine.

"We can confirm that Allianz Global Corporate & Specialty UK (AGCS) is the lead re-insurer for AirAsia, for aviation hull and liability insurance," an Allianz spokeswoman said in a statement emailed to Reuters."

"Onion routing network for securely moving data through communication networks

US 6266704 B1 ABSTRACT The onion routing network is used to protect Internet initiators and responders against both eavesdropping and traffic analysis from other users of the Internet. In the onion routing of the invention, instead of making connections directly to a responding machine, users make connections through onion routers. The onion routing network allows the connection between the initiator and responder to remain anonymous. Anonymous connections hide who is connected to whom and for what purpose from outside eavesdroppers."

"Hillary Clinton agrees patents be suspended until corporations pay their taxes

By Gene Quinn on January 12, 2016

Last week The Hill reported that Hillary Clinton promised to use patents owned by giant technology companies as leverage to get them to pay higher taxes. If you listen to the actual exchange between Clinton and a supporter it goes deeper than promising to leverage patents to ensure payment of taxes, rather Clinton agreed that patents should be suspended until companies repatriate foreign profits held in offshore accounts. The exchange came thanks to a question from the audience at a campaign stop in Sioux City, Iowa, on Tuesday, January 5, 2016. Here was the question and response.

QUESTION: We have major corporations in this country— GE, Apple, many others— that are salting money away offshore. Can't we use their patents as leverage to make them pay their taxes?

HILLARY CLINTON: Yes.

QUESTION: Is that possible?

HILLARY CLINTON: Yes, we can and we will. You know—

QUESTION: We should suspend their patents until they pay their taxes.

HILLARY CLINTON: You are right. You know, American companies have, I think, a couple trillion dollars stashed overseas. Now technically it's on their books, but they park it somewhere they don’t want to pay their taxes. And I think we have to reform our whole tax code because the way it is working now it is driving companies away, and its driving companies to engage in all these really gimmicky tax games that they are playing. And we have to get a fair, consistent tax program so that corporations pay their fair share just like the wealthy, and that's what I'm going to try and do.

According to the report the Clinton Campaign did not elaborate on what Secretary Clinton might have meant when she responded that patents would be used as leverage.

It is impossible to know whether or how Hillary Clinton would leverage patents in order to force companies, such as GE and Apple, to repatriate money from overseas and thereby incur enormous tax liability. This may be nothing more than Clinton not properly hearing the question, or all of the question, but it could be much more and should be at least somewhat disconcerting to those in tech companies who are generously funding her campaign (see here and here). Nevertheless, it is deeply troubling that Clinton agreed with the person asking the question when he offered the suggestion that patents should be suspended until taxes are paid.

Is it possible that the United States Patent and Trademark Office in a Clinton Administration might stop issuing patents to companies that refuse to repatriate money to the United States? Is it possible that patents would be withheld from those who more generally are not paying their taxes, or paying "enough" in taxes? Is it possible that already issued patents would become unenforceable or somehow otherwise suspended, as suggested by the above Clinton Q&A? These would be extraordinary steps, not to mention ones without precedent.

There is no legal authority to hold patents hostage as a bargaining chip to force corporations or individual patent owners to pay more or higher taxes, and no authority to suspend patents for failure to pay taxes or repatriate foreign profits. To be legal such a move would require a significant amendment to the patent laws of the United States. There would be enormous administrative burden imposed on those seeking patents and on the Patent Office.

In the question and answer above, Clinton says that the tax code is driving corporations away, but suspending patents or otherwise taking them hostage or somehow leveraging them to ensure taxes are paid or foreign profits repatriated would all but certainly do more to drive corporations away than anything the government has ever done. Indeed, a rule that tied paying taxes, or repatriation of foreign profits to the United States, to obtaining a patent would almost certainly create an extraordinary disincentive to seek a patent in the United States, which itself would lead to a nearly unimaginable parade of horribles at a time that the U.S. economy is nearly wholly reliant on innovation and technology. Holding patents hostage to force higher taxes or repatriation of foreign profits would be an ill-advised, shortsighted decision that would risk the destruction of the U.S. patent system.

While Hillary Clinton's record on patent matters is not extensive, when she was a U.S. Senator from the State of New York she never embraced patent reform despite it being an issue of great importance for the senior Senator from New York, Senator Chuck Schumer (D-NY). In fact, during the 2008 Presidential Campaign Hillary Clinton publicly expressed opposition to patent reform because, in her view, it was bad for innovators. Why would she now be taking a stance that would categorically be bad for innovators and innovation?

Perhaps this rather brief question and answer at a campaign stop in Iowa does accurately reflect Clinton's view of the patents and patent portfolios of the high tech elite. Perhaps she believes patents are pawns in a game of collecting the tax revenue she believes these companies are illegally withholding by keeping funds offshore and outside of the jurisdiction of the Internal Revenue Service. If patents are to be used as pressure points against patent owners it should cause great concern within the patent community and lead to supporters with patent portfolios asking Clinton some direct questions about what she plans for their future."

"Taking, Tort, or Crown Right? The Confused Early History of Government Patent Policy

Sean M. O'Connor

University of Washington - School of Law

John Marshall Review of Intellectual Property Law, Vol. 12, No. 1, pp. 145-204, 2012

University of Washington School of Law Research Paper No. 2013-24

Abstract: From the early days of the Republic, Congress and the federal courts grappled with the government’s rights to own or use patents it issued. Courts rejected the British "Crown Rights" rule that allowed the sovereign to practice whatever patents it issued. Instead, the federal government was conceptualized as a legal person on par with any other persons with regard to issued patents. But, this simple rule presented challenges as complexities arose in three intertwined patent rights scenarios. The first involved inventions by government employees. The second revolved around government and government contractor use of patents held by private citizens. And the third involved inventions by federal contractors and their employees arising under federal funding. While these three scenarios seem quite distinct today, nineteenth and early twentieth century courts often treated them as overlapping. The confusion was not resolved until the mid-twentieth century when a combination of executive branch and Congressional legislation set the roots of current government patent policy. This Article reviews the history in detail and illuminates current government patent policy debate occurring through such seemingly diverse cases as Stanford v. Roche and Zoltek Corp. v. United States."

"Serco Awarded $95 Million Patent Classification Contract with the U.S. Patent and Trademark Office

November 30, 2015 RESTON, VA – November 30, 2015 – Serco Inc., a provider of professional, technology, and management services, announced today the Company has been awarded a patent classification services contract with the United States Patent and Trademark Office (USPTO). Serco will provide initial patent classification and reclassification services to support USPTO's core mission of examining, granting, and disseminating patents and trademarks. The recompete contract has a one-year base period with four one-year option periods, and is valued at $95 million over the five-year period, if all options and award terms are exercised.

Serco's highly trained Scientists and Engineers are responsible for reviewing, analyzing, and applying classification symbols to newly submitted patent applications to assist with the USPTO examination process. Throughout the classification process, our team performs comprehensive performance management; quality assurance; information security; training; knowledge management; and IT support, engineering, and development of custom software.

Serco has supported the USPTO under this program since its inception in 2006, and currently processes approximately 1,600 applications a day, and over 400,000 applications annually. Under the contract, Serco has been instrumental in assisting the USPTO as it transitioned to a new international classification standard called Cooperative Patent Classification (CPC) and will continue to provide services within CPC that enables the USPTO to align and lead within the global intellectual property environment. Work on this program will continue to take place in Harrisonburg, Virginia.

“We are extremely honored to have been selected to continue to deliver patent classification services to the U.S. Patent and Trademark Office," said Dan Allen, Chairman and CEO of Serco Inc. “Our team continues our focus on operational excellence and incorporating innovative solutions, for classification services, in the most economic and efficient manner.”

About Serco Inc.: Serco Inc. is a leading provider of professional, technology, and management services. We advise, design, integrate, and deliver solutions that transform how clients achieve their missions. Our customer-first approach, robust portfolio of services, and global experience enable us to respond with solutions that achieve outcomes with value. Headquartered in Reston, Virginia, Serco Inc. has approximately 10,000 employees and an annual revenue of $1.2 billion. Serco Inc. is a wholly-owned subsidiary of Serco Group plc, a $5.9 billion international business that helps transform government and public services around the world. More information about Serco Inc. can be found at www.serco-na.com."

"AUG 8, 2013 @ 01:43 PM 13,203 VIEWS

"The Great Vampire Squid Keeps On Sucking

Jake Zamansky , CONTRIBUTOR I write about securities law Opinions expressed by Forbes Contributors are their own. The now famous Rolling Stone magazine article in 2009 by Matt Taibbi unforgettably referred to Goldman Sachs, the world's most powerful investment bank [and principal Serco shareholder with the U.K. Cabinet Office], as a "great vampire squid wrapped around the face of humanity, relentlessly jamming its blood funnel into anything that smells like money." At the time, Taibbi was describing Goldman's role in the 2008 financial crisis and the speculative bubble of mortgage-backed securities assets which later came crashing down."

"18 U.S. Code § 1958 - Use of interstate commerce facilities in the commission of murder-for-hire Whoever travels in or causes another (including the intended victim) to travel in interstate or foreign commerce, or uses or causes another (including the intended victim) to use the mail or any facility of interstate or foreign commerce, with intent that a murder be committed in violation of the laws of any State or the United States as consideration for the receipt of, or as consideration for a promise or agreement to pay, anything of pecuniary value, or who conspires to do so, shall be fined under this title or imprisoned for not more than ten years, or both; and if personal injury results, shall be fined under this title or imprisoned for not more than twenty years, or both; and if death results, shall be punished by death or life imprisonment, or shall be fined not more than $250,000, or both."

"Opened in 1994 as the successor to the Transitional Immigrant Visa Processing Center in Rosslyn, Va., the NVC centralizes all immigrant visa preprocessing and appointment scheduling for overseas posts. The NVC collects paperwork and fees before forwarding a case, ready for adjudication, to the responsible post. The center also handles immigrant and fiancé visa petitions, and while it does not adjudicate visa applications, it provides technical assistance and support to visa-adjudicating consular officials overseas. Only two Foreign Service officers, the director and deputy director, work at the center, along with just five Civil Service employees. They work with almost 500 contract employees doing preprocessing of visas, making the center one of the largest employers in the Portsmouth area. The contractor, Serco, Inc., has worked with the NVC since its inception and with the Department for almost 18 years. The NVC houses more than 2.6 million immigrant visa files, receives almost two million pieces of mail per year and received more than half a million petitions from the U.S. Citizenship and Immigration Service (USCIS) in 2011. Its file rooms' high-density shelves are stacked floor-to-ceiling with files, each a collection of someone’s hopes and dreams and each requiring proper handling."

"The Telgraph .. Police drop investigation into Serco prisoner transport contract The outsourcing group said there was no evidence of individual or corporate wrongdoing

The City of London Police has closed an investigation into Serco's prisoner transport contract after more than a year of work, enabling the firm to continue with the contract until 2018.

The Ministry of Justice called in the police in August 2013 to examine whether Serco had misleadingly recorded prisoners as being ready for court when they were not, in order to meet the performance criteria of the contract.

However, Serco said on Friday that the probe into the Prisoner Escort and Custody Services (PECS) contract had been closed after the police found no evidence to support bringing charges against the outsourcing firm or its staff.

"The information obtained was also sufficient for the City of London Police to conclude there was no evidence of any corporate-wide conspiracy or an intention to falsify figures to meet the DRACT [designated ready and available for court time] contract requirement by senior Serco management or at the board level of the company," the firm said in a statement. The Ministry of Justice had said it would end the contract immediately if the firm's board was found to have done wrong."

"Super Serco bulldozes ahead

By DAILY MAIL REPORTER

UPDATED: 23:00 GMT, 1 September 2004

SERCO has come a long way since the 1960s when it ran [Resilience exercises and] the 'four-minute warning' system to alert the nation to a ballistic missile attack.

Today its £10.3bn order book is bigger than many countries' defence budgets. It is bidding for a further £8bn worth of contracts and sees £16bn of 'opportunities'.

Profit growth is less ballistic. The first-half pre-tax surplus rose 4% to £28.1m, net profits just 1% to £18m. Stripping out goodwill, the rise was 17%, with dividends up 12.5% to 0.81p.

Serco runs the Docklands Light Railway, five UK prisons, airport radar and forest bulldozers in Florida.

Chairman Kevin Beeston said: 'We have virtually no debt and more than 600 contracts.'

The shares, 672p four years ago, rose 8 1/4p to 207 1/4p, valuing Serco at £880m or nearly 17 times earnings.

Michael Morris, at broker Arbuthnot, says they are 'a play on UK government spend' which is rising fast."

"Serco Combined Resilience Exercising

http://www.epcollege.com/EPC/media/MediaLibrary/Downloads/Gold-Standard.pdf

Types of Exercise Workshop Exercises These are structured discussion events where participants can explore issues in a less pressurized environment.

They are an ideal way of developing solutions, procedures and plans rather than the focus being on decision making. Table Top Exercises These involve a realistic scenario and will follow a time line, either in real-time or with time jumps to concentrate on the more important areas. The participants would be expected to be familiar with the plans and procedures that are being used although the exercise tempo and complexity can be adjusted to suit the current state of training and readiness. Simulation and media play can be used to support the exercise. Table-top exercises help develop teamwork and allow participants to gain a better understanding of their roles and that of other agencies and organisations.

Command/Control Post Exercises These are designed primarily to exercise the senior leadership and support staff in collective planning and decision making within a strategic grouping. Ideally such exercises would be run from the real command and control locations and using their communications and information systems. This could include a mix of locations and varying levels of technical simulation support. The Gold Standard system is flexible to allow the tempo and intensity to be adjusted to ensure maximum training benefit, or to fully test and evaluate the most important aspects of a plan. Such exercises also test information flow, communications, equipment, procedures, decision making and coordination.

Simulation and Media Support

The method of delivering an exercise is flexible and will be designed with the client to meet their requirements with options ranging from simple paper-based delivery through to full use of their real communications systems [Red Switch Network and Hawkeye onion router surveillance aircraft] and advance computer simulation [In Trump's death pool and war room suites]. In addition, media play can also be added in the form of news injects and the provision of experienced journalists and television crews to help test procedures and also assist in training key staff.

Gold Standard Emergency Planning College

The Hawkhills, Easingwold, York North Yorkshire, YO61 3EG +44(0) 1347 821406

enquiries@emergencyplanningcollege.com www.epcollege.com"

"Serco farewell to NPL after 19 years of innovation [outsourced by David Cameron at Treasury] … 8 January 2015

Serco said goodbye to the National Physical Laboratory (NPL) at the end of December 2014 after 19 years of extraordinary innovation and science that has seen the establishment build a world-leading reputation and deliver billions of pounds of benefit for the UK economy. It has been estimated that work carried out by the Centre of Carbon Measurement at NPL will save eight million tonnes of carbon emissions reductions (2% of UK footprint) and over half a billion pounds in economic benefit [bullshit] over the next decade. .. · NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency [death-pool] trading in the City through NPLTime."

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.