________

Source: Mining.com

By Frik Els | August 27, 2020 | Intelligence Markets China Copper

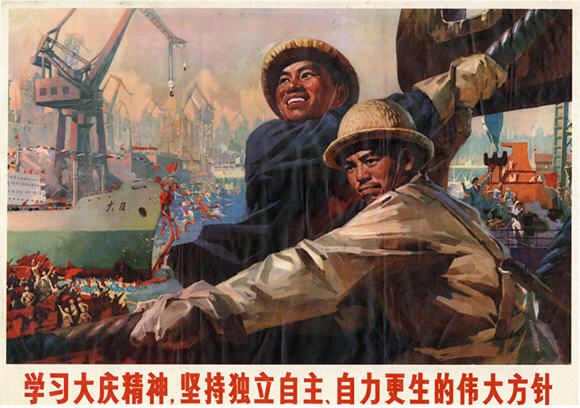

Study the spirit of Daqing, persevere in the great principles of acting independently and with the initiative in one's own hand and self-reliance. 1975. Image courtesy of chineseposters.net

Copper once again cleared the psychologically important $3 a pound level on Thursday on the back of falling inventories, booming Chinese demand and pandemic hit supply from South America, the US and Africa.

Copper for delivery in December trading on the Comex in New York exchanged hands for $3.0120 a pound ($6,605 a tonne) in morning trade, bringing gains for 2020 to more than 8% and a mouthwatering 52% since the covid-19 lows struck in March.

"CHINA IS IMPORTING MORE REFINED METAL FROM NEARLY EVERY COUNTRY SUGGESTING A STRUCTURAL SHIFT NOT A TEMPORARY CHANGE" ~Jonathan Barnes – RoskillA new report from Roskill suggests the rally in copper – which has surprised many with its speed – has further to go.

Jonathan Barnes, associate consultant for copper at the London-based metal and minerals research firm, says while the effects of covid-19 could decrease world consumption of the metal by 3%–4% this year, the drop in mine output and scrap flows has been greater.

Signs of panic buying

The effect of this is most visible in the fall in stocks around the world.

Total visible stocks globally, which include those on exchanges and bonded warehouses in China fell by 40% from March to end-July to below 600,000 tonnes. Inventories in LME warehouses are at 13-year lows.

China is responsible for more than half the world’s copper consumption and the country is sucking up copper at record-setting rates.

"China is importing more refined metal from nearly every country suggesting a structural shift not a temporary change," says Barnes.

"If you are looking for signs of panic buying, you can find evidence of that in China – total Chinese stocks represent less than two weeks’ consumption at current rates of use."In the rest of the world, where demand has dropped by much more relative to China, stocks represent only one week of consumption.

Please go to Mining.com to read the entire article.

________

More:

More:

Wow. Check out China's copper binge. Over 2 million tons imported between June to August. Never seen this scale of buys before. pic.twitter.com/p7ex6EDvfT

— David Ingles (@DavidInglesTV) September 7, 2020

Copper market soars as inventories decline on Chinese panic buying

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.