The real purpose of A.I. is to determine maximum amount of output from the citizen/subjects without actually killing the "mice" in the experiment. These systems are rapidly being deployed in Asia especially in Japan and China. These technocratic systems are coming to America, Canada and Europe as well. If you want to see the reach Google will have inside the homes located in these smart cities of the future, Google's updated Android can now listen inside your home for "suspect sounds." The Google Android no doubt will notify the occupants in the home to stop having sex unless they put masks on.

The Federal Reserve is "hosing down the US economy" with free money spewing all over the place. The magic money being sprayed out of the Federal Reserve reflects a deformed broken and very dangerous system. There just doesn't seem to be an end to this magic money being printed in the trillions of dollars. There is no way the economy can survive this constant injection of magic money, not when there aren't fundamentally sound companies with an ongoing business depending on magic money bailouts.

The problem with the Federal Reserve hosing down the economy is that hose doesn't go directly to the people. A "groundbreaking study" by the RAND Corporation put the first-ever price tag on how much income inequality costs American workers. The bill? $50 trillion. You read that right: $50 trillion has been diverted from working Americans to the wealthiest 1% since 1975. To make sense of this staggering number, read the study yourself, and remember that the RAND Corp. is also part of this system:

________

Source: Zero Hedge

The Circle Is Complete: BOJ Joins Fed And ECB In Preparing Rollout Of Digital Currency

by Tyler Durden | Friday October 9, 2020

First it was the Fed, then the ECB, and now the BOJ: the world's central banks are quietly preparing to unleash digital currencies on an unsuspecting population in one final last-ditch attempt to spark inflation and do away with the current monetary orthodoxy which has failed to push living conditions for the masses higher (but most importantly, has failed to inflate away a growing mountain of insurmountable global debt).

On Friday, the Bank of Japan joined the Fed and ECB when it said it would begin experimenting on how to operate its own digital currency, rather than confining itself to conceptual research as it has to date.

Digitalization has advanced in various areas at home and abroad on the back of rapid development of information communication technology. There is a possibility of a surge in public demand for central bank digital currency (CBDC) going forward, considering the rapid development of technological innovation. While the Bank of Japan currently has no plan to issue CBDC, from the viewpoint of ensuring the stability and efficiency of the overall payment and settlement systems, the Bank considers it important to prepare thoroughly to respond to changes in circumstances in an appropriate manner.

The bank explained that it might provide general purpose CBDC if cash in circulation drops "significantly" and private digital money is not sufficient to substitute the functions of cash, while promising to supply physical cash as long as there is public demand for it.

The move, as Reuters reports, came in tandem with an announcement by a group of seven major central banks, including the BOJ, on what they see as core features of a central bank digital currency (CBDC) such as resilience and a clear legal framework. It also falls in line with new Japanese Prime Minister Yoshihide Suga's focus on promoting digitalization and administrative reform to boost the country's competitiveness.

In a report laying out its approach on CBDC, the BOJ said it will conduct a first phase of experiments on basic functions core to CBDCs, such as issuance and distribution, early in the fiscal year beginning in April 2021. The experiments will be part of the BOJ’s efforts to look more closely into how it can issue general-purpose CBDCs, intended to be used widely among the general public including companies and households.

Naturally, to avoid sparking a panic that paper money is on its way out - and thus prompt the population to hoard it - the BOJ said that CBDCs "will complement, not replace, cash and focus on making payment and settlement systems more convenient." However, how exactly it is "more convenient" for the central bank to be able to remotely extinguish any amount of money in one's digital wallet without notice, remains a mystery.

Unlike the Fed, the BOJ plans to have financial institutions and other private entities serve as intermediaries between the central bank and end users, rather than have companies and households hold deposits directly with the BOJ.

"While the BOJ currently has no plan to issue CBDC ... it’s important to prepare thoroughly to respond to changes in circumstances,” the report said.

In the second phase of experiments, the BOJ will look at the potential design of CBDCs such as whether it should set a limit on the amount issued and pay a remuneration on deposits.

In the final step before issuance, the BOJ will launch a pilot program involving private firms and households, it said.

The BOJ added it would be desirable for the CBDC to be used not only for domestic but cross-border payments, in short don't worry, this is just an experiment... but once operational it will take over the entire existing monetary system.

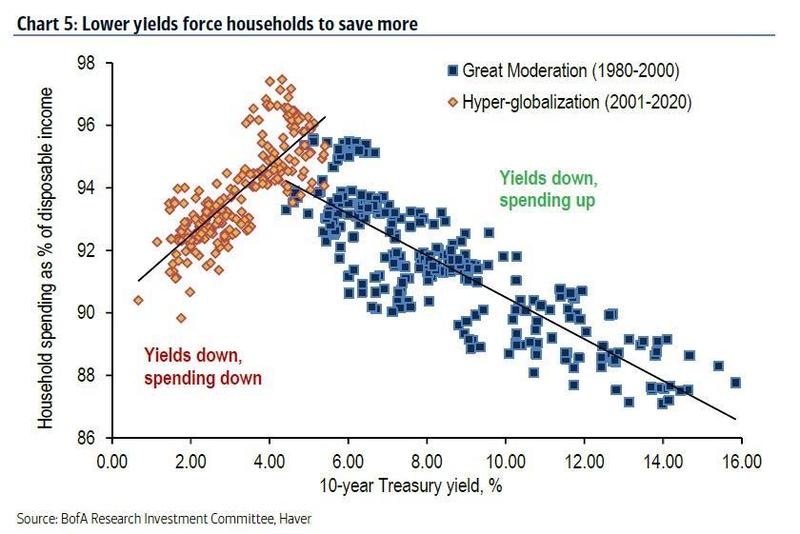

To be sure, having complete control over the entire monetary transmission mechanism, all the way to each quantum of currency in circulation has been a central banker dream. A key reasons for negative rates was for banks to force consumers to pull their money out of the bank and spend it, thus lifting the velocity of money. Alas, as we showed previously, the lowest interest rates in history merely prompted even more savings and less spending, resulting in catastrophic consequences for the financial sectors wherever negative rates were adopted, such as Japan and Europe.

The move, as Reuters reports, came in tandem with an announcement by a group of seven major central banks, including the BOJ, on what they see as core features of a central bank digital currency (CBDC) such as resilience and a clear legal framework. It also falls in line with new Japanese Prime Minister Yoshihide Suga's focus on promoting digitalization and administrative reform to boost the country's competitiveness.

In a report laying out its approach on CBDC, the BOJ said it will conduct a first phase of experiments on basic functions core to CBDCs, such as issuance and distribution, early in the fiscal year beginning in April 2021. The experiments will be part of the BOJ’s efforts to look more closely into how it can issue general-purpose CBDCs, intended to be used widely among the general public including companies and households.

Naturally, to avoid sparking a panic that paper money is on its way out - and thus prompt the population to hoard it - the BOJ said that CBDCs "will complement, not replace, cash and focus on making payment and settlement systems more convenient." However, how exactly it is "more convenient" for the central bank to be able to remotely extinguish any amount of money in one's digital wallet without notice, remains a mystery.

Unlike the Fed, the BOJ plans to have financial institutions and other private entities serve as intermediaries between the central bank and end users, rather than have companies and households hold deposits directly with the BOJ.

"While the BOJ currently has no plan to issue CBDC ... it’s important to prepare thoroughly to respond to changes in circumstances,” the report said.

In the second phase of experiments, the BOJ will look at the potential design of CBDCs such as whether it should set a limit on the amount issued and pay a remuneration on deposits.

In the final step before issuance, the BOJ will launch a pilot program involving private firms and households, it said.

The BOJ added it would be desirable for the CBDC to be used not only for domestic but cross-border payments, in short don't worry, this is just an experiment... but once operational it will take over the entire existing monetary system.

To be sure, having complete control over the entire monetary transmission mechanism, all the way to each quantum of currency in circulation has been a central banker dream. A key reasons for negative rates was for banks to force consumers to pull their money out of the bank and spend it, thus lifting the velocity of money. Alas, as we showed previously, the lowest interest rates in history merely prompted even more savings and less spending, resulting in catastrophic consequences for the financial sectors wherever negative rates were adopted, such as Japan and Europe.

Until now, Japan had been cautious about moving too quickly on digital currencies given the social disruptions it could cause in a country that has the world's most cash-loving population. But China's steady progress toward issuing digital currency has prompted the government to reconsider, especially if China takes the lead in sparking a new reflationary tide once it converts its entire population to digital currency, and pledged in this year's policy platform to look more closely at the idea.

Of course, the real reason behind central bank urgency to implement digital currencies is simple and has nothing to do with serving the population, increasing facility of transfers, or enhancing stability and efficiency of payment and settlement systems. It has everything to do with having discrete control over inflation, and enabling worldwide "helicopter money." This is how DoubleLine fixed income portolio manager Bill Campbell described it in his latest must-read note "The Pandora's Box of Central Bank Digital Currencies."

With QE, central banks have printed excess reserves that have benefited only the very wealthy and large institutions. The innovation of a digital currency system as described by Mastercard could deliver stimulus directly to consumers. Such a mechanism could open veritable floodgates of liquidity into the consumer economy and accelerate the rate of inflation. While central banks have been trying without success to increase inflation for the past decade, the temptation to put CBDCs into effect might be very strong among policymakers. However, CBDCs would not only inject liquidity into the economy but also could accelerate the velocity of money. That one-two punch could bring about far more inflation than central bankers bargain for.

When first implementing QE, central banks promised that this measure would be temporary and would be unwound after the crisis ended, a pledge that I have doubted for a while. Central banks as we know have perpetuated QE as part of their updated toolbox of monetary policies. The first use of digital currencies in monetary policy might start small as policymakers, out of caution, seek to calibrate this experiment in quasi-fiscal stimulus. However, such initial restraint could give way to growing complacency and greater use of the tool – just as we saw with QE. The temptations of CBDCs are not limited to excesses in monetary policy. CBDCs also appear to be an effective mechanism for bypassing the taxation, debt issuance and spending prerogatives of government to implement a quasi-fiscal policy. Imagine, for example, the ease of enacting Modern Monetary Theory via CBDCs. With CBDCs, the central banks would possess the necessary plumbing to directly deliver a digital currency to individuals' bank accounts, ready to be spent via debit cards.

Let me quote again from Charles I. Plosser's warning in 2012: "Once a central bank ventures into fiscal policy, it is likely to find itself under increasing pressure from the private sector, financial markets, or the government to use its balance sheet to substitute for other fiscal decisions." With a flick of the digital switch, CBDCs can enable policymakers to meet, or cave in to those demands – at the risk of igniting an inflation conflagration, abandoning what little still survives of sovereign fiscal discipline and who knows what else. I hope the leaders of the world’s central banks will approach this new financial technology with extreme caution, guarding against its overuse or outright abuse. It’s hard to be optimistic. Soon our monetary Pandoras will possess their own box full of new powers, perhaps too enticing to resist.

Please go to Zero Hedge to read the entire article.

________

Source: Business Insider

Toyota is building a 175-acre smart city in Japan where residents will test out tech like AI, robotics, and smart homes. Here's what the 'city of the future' will look like.

By Katie Warren | January 28, 2020

• Toyota is building a 175-acre smart city in Japan at the base of Mount Fuji, the company announced earlier this month.

• The "city of the future" will function as a testing ground for technologies like robotics, smart homes, and artificial intelligence.

• It will start off with a population of 2,000 Toyota employees and their families, retired couples, retailers, and scientists.

• Residents will live in smart homes with in-home robotics and artificial intelligence systems to assist with daily living and monitor health.

• Only self-driving, zero-emissions vehicles will be allowed to drive on the main roads. Visit Business Insider's homepage for more stories.

Toyota is building a 175-acre smart city at the base of Japan's Mount Fuji, about 62 miles from Tokyo, the company announced earlier this month at CES, the biggest tech trade show of the year.

The "city of the future" will function as a testing ground for technologies like robotics, smart homes, and artificial intelligence and will be home to a starting population of 2,000 Toyota employees and their families, retired couples, retailers, and scientists, who will test and develop these technologies.

Residents of the city, which Toyota has dubbed the "Woven City," will live in smart homes with in-home robotics systems to assist with daily living and sensor-based artificial intelligence to monitor health and take care of other basic needs.

It will be designed by famed Danish architect Bjarke Ingels, who's behind high-profile projects such as 2 World Trade Center in New York City and Google's California and London headquarters. Ingels has designed the Woven City to be fully sustainable, with an ecosystem powered by hydrogen fuel cells and roads dedicated to self-driving, zero-emissions vehicles.

Construction of the Woven City will start in 2021, and Toyota plans to have the first residents move in within 5 years, a spokesperson told Business Insider.

The "city of the future" will function as a testing ground for technologies like robotics, smart homes, and artificial intelligence and will be home to a starting population of 2,000 Toyota employees and their families, retired couples, retailers, and scientists, who will test and develop these technologies.

Residents of the city, which Toyota has dubbed the "Woven City," will live in smart homes with in-home robotics systems to assist with daily living and sensor-based artificial intelligence to monitor health and take care of other basic needs.

It will be designed by famed Danish architect Bjarke Ingels, who's behind high-profile projects such as 2 World Trade Center in New York City and Google's California and London headquarters. Ingels has designed the Woven City to be fully sustainable, with an ecosystem powered by hydrogen fuel cells and roads dedicated to self-driving, zero-emissions vehicles.

Construction of the Woven City will start in 2021, and Toyota plans to have the first residents move in within 5 years, a spokesperson told Business Insider.

Please go to Business Insider to read the entire article.

________

Related:

There are other options starting with a genuine populist monetary reform:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.