________

Source: Asia Pacific Foundation

April 9, 2019 | Authors: Dongwoo Kim, Isaac Lo

On March 15, 2019, China passed its new Foreign Investment Law at the dual 'Two Sessions' meeting of the Chinese People's Political Consultative Conference (CPPCC) and the National People's Congress (NPC), China's chief legislative body. The new law will come into force on January 1, 2020, replacing the Chinese-Foreign Equity Joint Ventures Law, the Foreign Capital Enterprises Law, and the Chinese-Foreign Contractual Joint Ventures Law.

China's new Foreign Investment Law is as an attempt by Beijing to establish China as an adherent of fair trade practices, to position it as a responsible participant in the international trade system, and to demonstrate that Beijing has a strong grip on its country's economy.

There are six chapters in the Foreign Investment Law covering several key topics, from investment promotion to legal obligations. There are also a number of key articles of note:

• Article 4: Foreign investors will be treated no less favourably than domestic investors in the investment access stage except in areas specified in China's Market Access Negative List.• Article 16: Guarantees foreign capital enterprises' right to bid for public procurement projects.• Article 17: Foreign companies can issue stocks, bonds, or other instruments to finance operations.• Article 22: Prohibits any administrative agency or its personnel from forcing technological transfer from foreign companies operating in China.• Article 23: All government agencies must protect commercial secrets of foreign companies.• Article 26: Establishes complaint mechanisms for foreign investors.• Article 39: The State will punish government employees who abuse their authority, neglect their duties, abuse their power for personal gain, or leak foreign companies' commercial secrets to others. Where criminality is constituted, the government will seek criminal responsibility in accordance with relevant laws.• Article 40: Any country or region that implements prohibitive or restrictive measures on the People's Republic of China (PRC), the PRC can take corresponding measures toward that country or region. On paper, the new Foreign Investment Law is expected to expand foreign investors' market access to China (article 4, 16, 17) and enhance the protection of their intellectual property (article 22, 23, 26, 39).

What are China's motives?

The new law is comprehensive and wide-sweeping, but it must be viewed within the context of China's current position and future motivations vis-à-vis the global order. In other words, we must consider what China wants to achieve through this law. And why it's taking this tact now.

First, the move to adopt the new Foreign Investment Law is widely seen as an 'olive branch' within the context of the ongoing U.S.-China trade war. Last June, the Trump administration, citing China's "unfair trade practices," imposed a 25 per cent tariff on US$50 billion worth of goods from China. Addressing the complaint of “unfair trade practices," most prominently the forced transfer of technology for foreign companies operating in China, the new law can be interpreted as an attempt to de-escalate this conflict.

Second, this is a posture by Beijing to showcase to the world that it is no longer an outlier in the global order, but rather a power that is ready to lead. The U.S.-China trade war is part of the greater geopolitical rivalry between the two powers. As Trump continues to disrupt the global economy with isolationist rhetoric and protectionist acts, China has been busy repositioning itself as a responsible, ‘open’ nation willing to continue supporting and arguably leading today's international trade system.

Third, and related to the second point, this is Beijing's attempt not only to present itself as a respectable member – if not one of the leaders – of the international community, but also to demonstrate that it has a strong grip on its own economy. The weakness in rule of law in China has been consistently cited as a major challenge for foreign investors, and also a sign of China's perceived status as a second-class member of the international community. The new Foreign Investment Law seeks to assuage these concerns by confirming China as a favourable destination for foreign investment where the rule of law is upheld, and foreign investors treated fairly.

These changes were coming, it should be noted, regardless of the trade war with the U.S. and the global campaign against Huawei/5G. In fact, the draft of the law for public consultation was released in January 2015. Indeed, the new law is not merely a one-off response to China's recent challenges, but rather an attempt to tackle a greater, long-term challenge of trust-building that Beijing has been wrestling with since 1978, when Deng Xiaoping opened China's economy to the world.

An emphasis on technology

Technology is a key element in China's new Foreign Investment Law. Beijing's ability to rapidly harness and control disruptive new forms of technology such as artificial intelligence (AI) has created much anxiety outside China, particularly in the more 'liberal' states of the West. In fact, given the intense focus on high-tech in the U.S.-China trade war, Craig Allen of the US-China Business Council said, "the trade part is incidental: it's a technology war, not a trade war."

While China presents a difficult opportunity to forgo, companies risk losing their proprietary technology due to lax enforcement of IP laws (and rule of law in general). In the absence of these legal strictures, Chinese companies have been able to appropriate the proprietary technology of foreign companies. Chinese companies, with the advantages of being local, have then been able to outpace the original owners of the technologies without consequence.

Article 22 of the new law, which prohibits forced technological transfer through administrative agency or personnel, is a direct response to concerns that foreign investors have raised for years over being 'forced' to part with their IP. According to a 2018 Wall Street Journal article, China's tactics for forced technology transfer have included "pressuring U.S. partners in joint ventures to relinquish technology, using local courts to invalidate American firms' patents and licensing arrangements, dispatching antitrust and other investigators, and filing regulatory panels with experts who may pass trade secrets to Chinese competitors." The new law directly addresses this issue.

Beijing has also faced criticism that, collaborating with its state-owned enterprises (SOEs), it targets IP theft of advanced technologies from foreign firms that it deems relevant to the national interest. The issues of forced technological transfer and IP violations are under renewed scrutiny due to the growing influence of China as a global power, and the proportional increase of fear from other countries that view Beijing as a potential threat to the existing global order. As technology – especially strategic information and communication technology – becomes increasingly important to global competitiveness, the perception of co-ordinated, even state-sanctioned IP theft has raised red flags outside China, especially in the United States.

In this context, Article 22's language around forced technology transfer is significant in that it articulates Beijing's message to the world that China is open for trade and investment as an honest broker, while simultaneously pointing to the growing importance of technology in today's geopolitics.

Please go to Asia Pacific Foundation to read the entire article.

The new law is comprehensive and wide-sweeping, but it must be viewed within the context of China's current position and future motivations vis-à-vis the global order. In other words, we must consider what China wants to achieve through this law. And why it's taking this tact now.

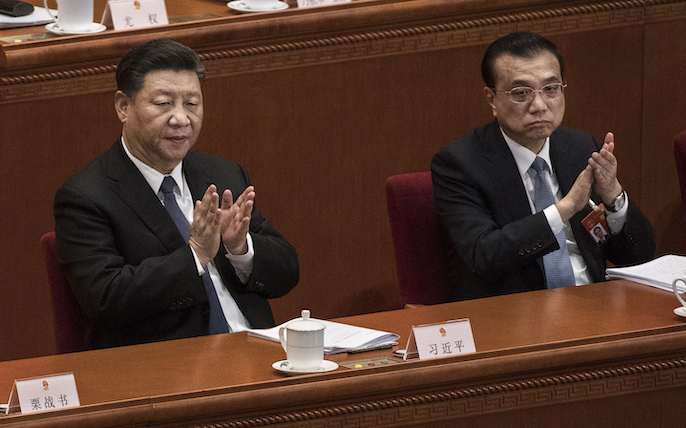

Chinese President Xi Jinping, left, and Prime Minister Li Keqiang applaud during the third plenary session of the National People's Congress at The Great Hall Of The People on March 12, 2019 in Beijing, China. The annual Two Sessions gathering of Communist Party officials and delegates lays out a road map for the governments year ahead, including economic growth targets, diplomacy and military spending. | Photo: Kevin Frayer/Getty Images

First, the move to adopt the new Foreign Investment Law is widely seen as an 'olive branch' within the context of the ongoing U.S.-China trade war. Last June, the Trump administration, citing China's "unfair trade practices," imposed a 25 per cent tariff on US$50 billion worth of goods from China. Addressing the complaint of “unfair trade practices," most prominently the forced transfer of technology for foreign companies operating in China, the new law can be interpreted as an attempt to de-escalate this conflict.

Second, this is a posture by Beijing to showcase to the world that it is no longer an outlier in the global order, but rather a power that is ready to lead. The U.S.-China trade war is part of the greater geopolitical rivalry between the two powers. As Trump continues to disrupt the global economy with isolationist rhetoric and protectionist acts, China has been busy repositioning itself as a responsible, ‘open’ nation willing to continue supporting and arguably leading today's international trade system.

Third, and related to the second point, this is Beijing's attempt not only to present itself as a respectable member – if not one of the leaders – of the international community, but also to demonstrate that it has a strong grip on its own economy. The weakness in rule of law in China has been consistently cited as a major challenge for foreign investors, and also a sign of China's perceived status as a second-class member of the international community. The new Foreign Investment Law seeks to assuage these concerns by confirming China as a favourable destination for foreign investment where the rule of law is upheld, and foreign investors treated fairly.

These changes were coming, it should be noted, regardless of the trade war with the U.S. and the global campaign against Huawei/5G. In fact, the draft of the law for public consultation was released in January 2015. Indeed, the new law is not merely a one-off response to China's recent challenges, but rather an attempt to tackle a greater, long-term challenge of trust-building that Beijing has been wrestling with since 1978, when Deng Xiaoping opened China's economy to the world.

An emphasis on technology

Technology is a key element in China's new Foreign Investment Law. Beijing's ability to rapidly harness and control disruptive new forms of technology such as artificial intelligence (AI) has created much anxiety outside China, particularly in the more 'liberal' states of the West. In fact, given the intense focus on high-tech in the U.S.-China trade war, Craig Allen of the US-China Business Council said, "the trade part is incidental: it's a technology war, not a trade war."

While China presents a difficult opportunity to forgo, companies risk losing their proprietary technology due to lax enforcement of IP laws (and rule of law in general). In the absence of these legal strictures, Chinese companies have been able to appropriate the proprietary technology of foreign companies. Chinese companies, with the advantages of being local, have then been able to outpace the original owners of the technologies without consequence.

Article 22 of the new law, which prohibits forced technological transfer through administrative agency or personnel, is a direct response to concerns that foreign investors have raised for years over being 'forced' to part with their IP. According to a 2018 Wall Street Journal article, China's tactics for forced technology transfer have included "pressuring U.S. partners in joint ventures to relinquish technology, using local courts to invalidate American firms' patents and licensing arrangements, dispatching antitrust and other investigators, and filing regulatory panels with experts who may pass trade secrets to Chinese competitors." The new law directly addresses this issue.

Beijing has also faced criticism that, collaborating with its state-owned enterprises (SOEs), it targets IP theft of advanced technologies from foreign firms that it deems relevant to the national interest. The issues of forced technological transfer and IP violations are under renewed scrutiny due to the growing influence of China as a global power, and the proportional increase of fear from other countries that view Beijing as a potential threat to the existing global order. As technology – especially strategic information and communication technology – becomes increasingly important to global competitiveness, the perception of co-ordinated, even state-sanctioned IP theft has raised red flags outside China, especially in the United States.

In this context, Article 22's language around forced technology transfer is significant in that it articulates Beijing's message to the world that China is open for trade and investment as an honest broker, while simultaneously pointing to the growing importance of technology in today's geopolitics.

Please go to Asia Pacific Foundation to read the entire article.

________

Related:

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.