It's Time to Investigate the Players to Prove the Public Has Been Manipulated for Personal Gain

________

Source: Wall Street On Parade

The Fed Hasn't Spent a Dime Yet for Main Street Versus $735 Billion for Wall Street

By Pam Martens and Russ Martens: May 13, 2020 ~

The stimulus bill known as the CARES Act (Coronavirus Aid, Relief, and Economic Security Act) was signed into law by President Donald Trump on March 27. Among its many features (such as direct checks to struggling Americans and enhancing unemployment compensation by $600 per week for four months to unemployed workers so they could pay their rent and buy food) the bill also carved out a dubious $454 billion (or 25 percent of the total $1.8 trillion spending package) for the U.S. Treasury to hand over to the Federal Reserve. This was the Faustian Bargain the Democrats had to agree to in order to get the deal approved by the Wall Street cronies in the Senate.

If you subtract the $454 billion from the $1.8 trillion total spending package, that left $1.346 trillion for other purposes. But the $454 billion wasn't really just $454 billion. It was going to be leveraged up by a factor of 10 to 1 into a $4.54 trillion bailout for Wall Street. This, effectively, meant that the CARES Act provided $1.346 trillion for average Americans and other purposes versus $4.54 trillion for Wall Street. In short, the assistance going to Wall Street was more than 3 times larger than that going to families and workers.

White House Economic Advisor Larry Kudlow, U.S. Treasury Secretary Steve Mnuchin, and Federal Reserve Chairman Jerome Powell had cooked up a scheme where the $454 billion would be handed over to the Fed, then split up into chunks, placed into Special Purpose Vehicles (SPVs) and then leveraged up by as much as 10 to 1 to provide bailouts to Wall Street. The $454 billion is being designated by the Fed as "loss absorbing capital," meaning that taxpayers will eat the first $454 billion in losses on these Wall Street bailout programs.

Here's where $215 billion out of the total $454 billion has thus far been earmarked by the Fed for its Wall Street bailout programs:

Primary Market Corporate Credit Facility (PMCCF)

$50 billion has been earmarked to prop up the corporate bond market by buying up new issues of corporate bonds that the big Wall Street banks don't want to be involved with. (See its Term Sheet here.) This facility will be leveraged up to buy $500 billion in corporate bonds, both investment grade and junk-rated, as long as they were rated investment grade as of March 22.

Secondary Market Corporate Credit Facility (SMCCF)

$25 billion has been earmarked to create this $250 billion program to buy up corporate bonds in the secondary market along with Exchange Traded Funds (ETFs). Both investment grade and junk-rated bonds and ETFs will be purchased. (See the Term Sheet here.)

Term Asset-Backed Securities Loan Facility (TALF)

$10 billion is earmarked for TALF which will leverage itself up to a $100 billion program that will provide loans against collateral composed of asset-backed securities. (See the Term Sheet here.)

Commercial Paper Funding Facility (CPFF)

$10 billion is earmarked for this Fed program. We could not find any statement on the ultimate size of this program. (See Term Sheet here.) The program is described by the Fed as providing "a liquidity backstop to U.S. issuers of commercial paper through a dedicated funding vehicle that will purchase eligible three-month unsecured and asset-backed commercial paper from eligible issuers using financing provided by the Federal Reserve Bank of New York."

Money Market Mutual Fund Liquidity Facility (MMMFLF)

$10 billion has been earmarked to bailing out money market funds with bad paper that can't be rolled over. (See Term Sheet here.)

Main Street Lending Program (MSLP)

$75 billion has been earmarked to fund a Fed facility of $600 billion that is preposterously being called the Main Street Lending Program. (See Term Sheet here.) The program will make loans to businesses that have up to 15,000 employees and 2019 revenues of $5 billion or less. If that doesn't sound like a business you would find on your hometown's Main Street, see our article: JPMorgan, Wells Fargo, Citigroup and Fossil Fuel Industry Get Bailed Out Under Fed's "Main Street" Lending Program.

Municipal Liquidity Facility (MLF)

$35 billion of taxpayers' money will fund a $500 billion Fed facility to make loans to states and municipalities that are experiencing cash flow stress as a result of the coronavirus pandemic. (See Term Sheet here.) This will help Wall Street banks by preventing them from having to write down, or take loan loss reserves against, loans they have made to these states and municipalities.

Please go to Wall Street On Parade to read the entire article.

________

Source: The Solari Report

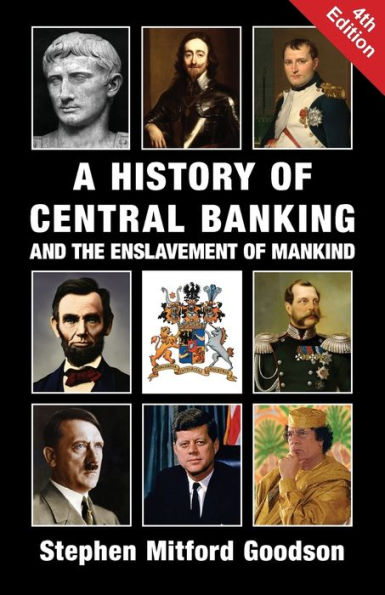

Book Review: A History of Central Banking

April 6, 2020

"Usury once in control will wreck the nation." ~William Lyon Mackenzie King

By Catherine Austin Fitts

When the history of the failure of the United States is written, the virus that brought the empire to its knees will be financial criminality and usury.

The NY Fed, a privately owned back that serves as depository of the US Government and agent for the Exchange Stabilization Fund, has systematically run the government accounts outside the law – $21 trillion is missing from the US government as of 2015, after which the US government adopted a policy of keeping its books and accounts secret.

The NY Fed and its member banks are legally liable – both for the $21 trillion as well as for stuffing our pension funds and retirement accounts with worthless paper in a manner violating securities laws. If you hear proposals that ownership of the NY Fed should be transferred to federal control, beware a transfer of $21+ trillion of liabilities to protect the private owners from having to return their winnings.

The NY Fed members banks can today borrow at 0-1% using our credit. With a 0% reserve requirement, they can create money out of thin air on a near infinite basis. But the average credit card holder in American pays 17+%. This is usury. It used to be illegal. The day it was made legal was the day that America’s failure became a fait accompli. It’s the magic of compound interest.

The current coronavirus "plandemic" in one sense is a cover story. There is indeed a virus destroying the world – financial criminality and usury. Now that it is destroying the dollar system, the same players are marketing new digital systems. The idea is that once they have wrecked the global economy at great profit to themselves, we can look to them to bring up a new system.

Good luck with that.

Stephen Mittord Goodson's 4th Edition of A History of Central Banking and the Enslavement of Mankind is a unique look at the devastation that has been wrought through the centuries by privately owned central banks and the privileges their shareholders claim. It is a rare history not funded or written by the private owners of the central banks and the universities and think tanks they control.

If you want to understand why a world so blessed with wealth could become so poor so quickly, this is a book well worth reading.

Related reading:

Purchase Book

Stephen Mitford Goodson on Wikipedia

Books by Stephen Mitford Goodson

Caveat Emptor: Why Investors Need to do Due Diligence on US Treasury and Related Securities

_________

Related:

Origin Begins at Fertilization - Catholic Church: Reform or Leave America

Do You Know The Origin of Your Life?

'Painfully evident' damage: Deutsche Bank now thinks the US economy will shrink by nearly 40% in the 2nd quarter following coronavirus lockdowns

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.