From United States Marine Field McConnell

Plum City Online - (AbelDanger.net)

June 30, 2015

1. In 1856, Allan Pinkerton hired Kate Warne to train actors for cross-dressing roles in murder-for-hire scripts as pioneered by Eugène François Vidocq founder of the Sûreté Nationale, and updated with online betting at the Pickton pig farm in B.C. (1996-2001).

2. Pinkerton's allegedly deployed Alinskyite cross-dressing community organisers to monitor the red-lining practises of banks such as HSBC and liquidate the assets of banks denying loans to Serco 8(a) protege companies on the basis of race, ethnic origin, sex or religion.

3. Pinkerton's actors and 8(a) companies have allegedly hacked the international banks' foreign-exchange onion-router networks with the Serco GMT atomic clock and trapped Greece with odious debts of 320bn euros which – being illegally contracted – should not be paid.

Readers are invited to browse Abel Danger's website where United States Marine Field McConnell has proof by contradiction – no rebuttal – of a conspiracy between Pinkerton and Serco to deploy cross-dressing actors with murder-for-hire scripts to liquidate banks and sovereign states which deny loans to groups on the basis of race, ethnic origin, sex or religion.

Pinkerton personal protection services

Prequel 1: #2389: Marine Brief – Pinkerton's Cross-Dressing Pedophile Elites – Serco's 8(a) Barry, Groomed by Turdi – GMT Langham Clock, BBC Building 7

"APTN National News Cameron Ward has won one of his battles. Ward is the lawyer representing the families of Robert Pickton’s victims at the Missing Women Commission of Inquiry, and he’s received the unpublished manuscript of a book written about the Robert Pickton case by [Cross-Dressing] Detective Lori Shenher.

Shenher was critical of senior officers in the Vancouver Police Department when she took the stand at the MWCI earlier this year, and while sections of the book have been redacted by both Shenher and the VPD, Ward says that “the document will be interesting”.

APTN National News reporter Rob Smith talks to Ward about the manuscript, and what might happen next at the inquiry."

"Pinkerton provides the expertise and a vast array of supporting resources to provide reliable personal protection anywhere throughout the country – or around the globe – at a moment's notice. DELIVERING RELIABLE PERSONAL PROTECTION SERVICES 24/7 For more than 160 years, Pinkerton's highly skilled and trained agents have provided protection for corporate leaders and their workforce, famous entertainers, athletes, royal families and diplomats. Our services range from providing one-time executive drivers to developing long-term comprehensive personal protection service programs. Pinkerton also offers expertise in protecting a company's assets. We respond 24 hours a day to both known and unforeseen threats. This enables our clients to go about their day-to-day business as usual."

"Greek debt 'illegal, illegitimate and odious'

18 June 2015 Last updated at 09:35 BST

A committee convened by the Greek parliament has claimed much of the country's debt of 320bn euros was illegally contracted and should not be paid.

Following an official parliamentary investigation, speaker Zoe Konstantopoulou described the debt as illegal, illegitimate and odious. She told the BBC that Greek people "should fight for justice".

Opposition parties have criticised the move saying it was a political tactic by the cash strapped government.

However the evidence marshalled by the debt truth committee could be used in a potential court case by the Greek government, should it seek a legal route out of its massive debts.

The concept of odious debt is established in international law where dictatorships or illegitimate governments have borrowed money and later been succeeded by democratic regimes."

"Mortgage discrimination or mortgage lending discrimination is the practice of banks, governments or other lending institutions denying loans to one or more groups of people primarily on the basis of race, ethnic origin, sex or religion. One of the most notable instances of widespread mortgage discrimination occurred in United States inner city neighborhoods from the 1930s up until the late 1970s. There is evidence that the practice still continues in the United States today.[1]..

Contemporary mortgage discrimination[edit]

Several class action mortgage discrimination claims have been filed against lenders across the country, alleging that that lenders disproportionately targeted minorities for high cost, high risk subprime lending, which has resulted in disproportionately higher rates of default and foreclosure for minority African American and Hispanic borrowers.[6] FHA loans, a Federal Mortgage program, went to the white majority and reached few minorities. In a study done in Syracuse, between 1996 and 2000, of the 2,169 FHA loans issued only 29 or 1.3 percent went to predominantly minority neighborhoods compared with 1,694 or 78.1 percent that went to white neighborhoods.[7][8] Mortgage discrimination played a significant part in the real estate bubble that popped during the later part of 2008, it was found that minorities were disproportionately steered by lenders into subprime loans.[9]

In 1993 President Bill Clinton made changes to the Community Reinvestment Act to make mortgages more obtainable for lower and lower-middle-class families. In 1993 the Federal Bank of Boston issued a report entitled “Closing the Gap: A Guide to Equal Opportunity Lending." The 30 page document was intended to serve as a guide to loan officers to help curb discriminatory lending [10] "Closing the Gap," instructs banks to hire based upon diversity needs, sweeten the compensation structure for working with lower income applicants, encourages shifting high risk, low income applications to the sub prime market, by saying "the secondary market [Subprime Market] is willing to consider ratios above the standard 28/36," and "Lack of credit history should not be seen as a negative factor."

While, "Closing the Gap" was not an industry-wide mandate, it illustrates the efforts banks took to meet public pressure to overcome mortgage discrimination. Under the Clinton administration community organizers pressured banks to increase their loans to minorities. Karen Wegmann, the head of Wells Fargo's community development group in 1993 told the New York Times, "The atmosphere now is one of saying yes." [11] The same New York Times article echoed "Closing the Gap," writing, "The banks have also modified some standards for credit approval. Many low-income people do not have credit-bureau files because they do not have credit cards. So lenders are accepting records of continuously paid utility bills as evidence of creditworthiness. Similarly, they will accept steady income from several employers instead of the length of time at one job."

Because of looser loan restrictions many people who did not qualify for a mortgage before now could own a home.[12] The banks issued loans with teaser rates, knowing that when higher variable rates kicked in later the borrowers would not be able to meet their payments. As long as housing prices kept rising and borrowers could refinance easily, everyone appeared to be doing well.[12]

Minorities willingly entered sub-prime mortgages in far greater numbers than whites and represented a disproportional percentage of foreclosures.[13][14]

Recently, the NAACP has submitted a lawsuit concerning alleged injustices in the lending industry.[15] An analysis, by N.Y.U.’s Furman Center for Real Estate and Urban Policy, illustrated stark racial differences between the New York City neighborhoods where subprime mortgages were common and those where they were rare. The 10 neighborhoods with the highest rates of mortgages from subprime lenders had black and Hispanic majorities, and the 10 areas with the lowest rates were mainly non-Hispanic white. The analysis showed that even when median income levels were comparable, home buyers in minority neighborhoods were more likely to get a loan from a subprime lender.[1] Discrimination motivated by prejudice is contingent on the racial composition of neighborhoods where the loan is sought and the race of the applicant. Lending institutions have been shown to treat black and Latino mortgage applicants differently when buying homes in white neighborhoods than when buying homes in black neighborhoods.[16] An example of this occurred in the 60's and 70's on the near northside of Chicago. Thousands of blacks, Latinos, and poor people were systematically dislocated and prevented from acquiring loans by realtors and lending institutions with the blessings of the city's urban renewal program.[citation needed]

Reverse redlining[edit]

Reverse redlining is a term that was coined by Gregory D. Squires, a Professor of Sociology and Public Policy and Public Administration at George Washington University. This phenomenon occurs when a lender or insurer particularly targets minority consumers, not to deny them loans or insurance, but rather to charge them more than would be charged to a similarly situated majority consumer, specifically marketing the most expensive and onerous loan products. These communities had largely been ignored by most lenders just a couple decades earlier. However these same financial institutions in the 2000s saw black communities as fertile ground for subprime mortgages. Wells Fargo for instance partnered with churches in black communities, where the pastor would deliver "wealth buildling" seminars in their sermons, and the bank would make a donation to the church in return for every new mortgage application. There was pressure on both sides, as working-class blacks wanted a part of the nation’s home-owning trend.[17][18]

A survey of two districts of similar incomes, one being largely white and the other largely black, found that branches in the black community offered largely subprime loans and almost no prime loans. Studies found out that high-income blacks were almost twice as likely to end up with subprime home-purchase mortgages as low-income whites. Loan officers were clearly aware that they were exploiting their customers, in some cases referring to blacks as "mud people" and to subprime lending as “ghetto loans."[13][17][18] A lower savings rate and a distrust of banks stemming from a legacy of redlining may help explain why there are fewer branches in minority neighborhoods. In recent years while subprime loans were not sought out by borrowers, brokers and telemarketers actively pushed them. A majority of the loans were refinance transactions allowing homeowners to take cash out of their appreciating property or pay off credit card and other debt.[19]

"Barack Obama's transsexual nanny Evie in fear for her life in Jakarta slum

Barack Obama's former Indonesian carer, who dressed as a woman but was born a man, has given up her feminine identity and is living in a Jakarta slum in fear after a life-time of beatings and taunts.

By Ian MacKinnon, Bangkok 11:50AM GMT 05 Mar 2012

The transsexual, who goes by the name of Evie, looked after the young "Barry" Obama for several years when as an eight-year-old he lived in Jakarta.

But Evie, who always dressed as a man in front of the future US president and his younger sister Maya, believes he would never have known of the cross-dressing.

Evie, 66, who real name is Turdi and is described as male in his identity papers, did however amuse the young "Barry" Obama, as school friends knew him, by sometimes trying mother Ann Dunham's lipstick.

"He was so young," said Evie. "And I never used to let him see me wearing women's clothes. But he did see me trying on his mother's lipstick sometimes. That used to really crack him up."

Yet neighbours in the Menteng neighbourhood of central Jakarta remember the popular Turdi working at the house and recall seeing her in the evenings wearing make-up and tight, flowery dresses.

Ann Dunham moved to the Indonesian capital after meeting and marrying second husband Lolo Soetoro, and Barack Obama lived there from age of six until he was 10 while the country was in the grip of the dictator General Suharto."

"The Sûreté was founded in 1812 by Eugène François Vidocq, who headed it until 1827. It was the inspiration for Scotland Yard, the FBI, and other departments of criminal investigation throughout the world. Vidocq was convinced that crime could not be controlled by then-current police methods, so he organized a special branch of the criminal division modeled on Napoleon's political police. The force was to work undercover and its early members consisted largely of reformed criminals. By 1820 – eight years after its formation – it had blossomed into a 30-man team of experts that had reduced the crime rate in Paris by 40%."

"Eugène François Vidocq, in his Voleurs (1837), mentions an establishment run by a certain Cottin for the benefit of pederasts in the Paris of the July Monarchy. The ex-police chief Louis Canler reported in his memoires that an individual nicknamed la mere des tantes, "the mother of the queens," kept a house of male prostitution that attracted a varied clientele. Under the Second Empire Paris had a world-renowned male brothel kept by an elderly proprietor who had been a hustler in his youth but was left destitute by the Revolution of 1848. Toward 1860 he organized his establishment in such a manner that clients of every social and economic class could frequent its premises. The room corresponded in price to the degree of luxury that it afforded, and could be rented by the hour or by the day, as well as reserved by correspondence in advance. Likewise a customer with a particular sexual preference could arrange to have his desires satisfied by an appropriate partner, and if he was not pressed for time, even without advance notice he could have a prompt search made for the hustler of his choice. The proprietor energetically managed the affairs of the brothel, aided by the pan-European notoriety which it enjoyed among both potential clients and aspiring employees. Thus modem capitalist methods of business administration filtered down to the market for illicit sexual pleasures in the prosperous France of Napoleon III."

"Is Barack Obama Gay? While the always-eloquent Michelle Antoinette Obama might deny it publicly, there's clear evidence that Barack Obama is indeed homosexual…and is specifically what’s known in the black street slang as "being on the Down Low" or "being a cake boy". The Obamas' marriage is an elaborate sham concocted for their mutual benefit, where Michelle serves as Barack's beard and in return she gets to enjoy a life of fabulous wealth and power she could only dream of growing up in Chicago and depending on Jesse Jackson for jobs and other favors. Why don't more people talk about this reality openly?

Well, since at least the 1964 election the agenda-driven media in this country has aggressively promoted the Left's favored candidates while strategically targeting conservatives for destruction. A copy of the Alinsky Rules for Radicals sits in every newsroom in the country, where "journalists" employ Alinsky Methods to polarize, ostracize, ridicule, and impugn Republicans at every available opportunity. In the zeal to destroy conservative politicians, the agenda-drive media quite often reports rumors and innuendo as concrete fact. Leftist websites like Politico.com rush to be first! in reporting Republican scandals, never much worrying about being "right".

But for Democrats? You don’t need to look very hard for irrefutable evidence that the media protects its favored Leftist politicians and zealously maintains whatever story most benefits Democrats. This entails forever protecting secrets like Barack Obama's homosexuality (and drug use) and pretending that the Obamas are the most perfect heterosexual black couple since Cliff and Clair Huxtable from the tee-vee.

Read more http://hillbuzz.org/is-barack-obama-gay"

"Wanted: French sleuth, with attitude By Mary Blume Published: Friday, September 10, 2004 PARIS — It isn't for want of trying, but for all their enthusiasm for crime novels the French have never succeeded in the private eye genre, as a small exhibition at the Bibliothèque des littératures policières suggests.

There are plenty of private detective agencies in Paris, more than 80, compared with about 50 in 1914, but a singular lack of colorful characters. Perhaps the simplest explanation is the right one — the police are so powerful and inquisitive here that a private eye automatically is a minor player.

Another reason may be that France can boast in Eugene-Francois Vidocq (1775-1857) a detective who was larger in life than any fictional character could ever be. An ex-con, forger, thief, smuggler, bigamist and possible cross-dresser, Vidocq used his excellent criminal connections to become a police informer, and in a stunning example of poacher-turned-gamekeeper, rose to the exalted police rank of head of the Sûreté. By 1825 Vidocq's men (and women) were making 1,500 arrests a year and their boss had a very smart carriage and diamond studs.

After being forced to resign from the Sûreté, Vidocq opened the world's first modern detective agency, which specialized in debt-collecting and, synergistically, in money-lending, did a few abductions for hire, sold false decorations and inspired Allan Pinkerton in America, who called himself the Vidocq of the West.

At its height the agency employed 40 agents with such nicknames as Cyclops, Man About Town and the Satyr. They kept strict hours and were not allowed to spit on the floor. Vidocq was receiving up to 40 clients a day in his tasteful office decorated with paintings of Damiens being quartered and John the Baptist losing his head and with such homely mottoes as, "In the underworld two and two do not make four. Two and two make twenty-two."

Vidocq has been amply written about, most recently this summer by James Morton, an English solicitor, in "The First Detective." His own mendacious memoirs in four volumes sold so well that his English publisher added a couple of volumes to satisfy demand. Vidocq didn't mind ghost writers but was hurt by those who failed to emphasize his sensitivity and remorse.

Born in the reign of Louis XVI, he was an expert trimmer who survived the mighty political upheavals of his time without a scar. He was also, Morton suggests, something of a sociopath who as a boy in Arras tortured children and domestic pets, robbed his baker father's till and stole his mother's savings, which she never held against him. He clearly had presence, charm and good looks, and thrived, as Michel Foucault observed, "in the disturbing moment when criminality became one of the mechanisms of power." Vidocq, says Foucault, "marks the moment when delinquency, detached from other illegalities, was invested by power and turned inside out."

In London in 1845 Vidocq was invited to address the House of Lords on prison discipline and on the same trip held an exhibition of his collections of paintings ("very old works by very young masters," said one journalist), waxed fruits, murderers' mementos, instruments of torture and examples of the manacles and weighted boots he had been forced to wear in jail."

"Kate Warne & Women's Security Careers Today by: Ginger Happe, Tatiana Scatena do Valle and Ellen Lemire on June 2, 2015 in All Posts, Hazard & Event Risk, Market & Economic Risk, Operational & Physical Risk, Technology & Informational Risk

Kate Warne is an iconic historical figure in the detective and investigative field. Back in 1856, she walked into the Chicago office of the Pinkerton Detective Agency seeking a job opportunity. It was immediately thought that she was interested in a secretarial or office position. Instead, she was extremely proactive in making her case for the agency to hire their first woman detective. She was convincing enough to make that idea sound not as crazy as the initial shared opinion by the men in charge.

Kate's hiring opened the door for women in the investigative and security field, but although landing the job was impressive, it was only the very first step. She indelibly left her mark on the industry by being able to successfully put her vision into motion and achieve everything she enthusiastically expressed during that Chicago job interview.

Undercover Investigative Services: Not Just Bond or Bauer"

"Ikun is a part of the Mission Systems Group of companies managed by Akima, LLC, whose portfolio of businesses currently provides services and products to the federal government and commercial customers. As a certified ANC 8(a) Small Disadvantaged Business through January 2018, Ikun enables government agencies to streamline procurements and recognize socioeconomic goals. Our association with our parent company, Akima, extends our resources and capabilities beyond those of typical 8(a) companies. Click links below to review the FAR Clauses that govern ANC 8(a) contracting: .. March 27, 2013 Ikun was awarded a subcontract from Serco to perform immigrant visa support services at the National Visa Center located in Portsmouth, NH [and operated by Serco since 1994]. Ikun's staff performs various services to ensure that the visa case files are documentarily complete prior to applicant interviews with consular officers located at U.S. consulates around the world."

"The 8(a) Business Development Program assists in the development of small businesses owned and operated by individuals who are socially and economically disadvantaged, such as women and minorities. The following ethnic groups are classified as eligible: Black Americans; Hispanic Americans; Native Americans (American Indians, Eskimos, Aleuts, or Native Hawaiians); Asian Pacific Americans (persons with origins from Burma, Thailand, Malaysia, Indonesia, Singapore, Brunei, Japan, China (including Hong Kong), Taiwan, Laos, Cambodia (Kampuchea), Vietnam, Korea, The Philippines, U.S. Trust Territory of the Pacific Islands (Republic of Palau), Republic of the Marshall Islands, Federated States of Micronesia, the Commonwealth of the Northern Mariana Islands, Guam, Samoa, Macao, Fiji, Tonga, Kiribati, Tuvalu, or Nauru); Subcontinent Asian Americans (persons with origins from India, Pakistan, Bangladesh, Sri Lanka, Bhutan, the Maldives Islands or Nepal). In 2011, the SBA, along with the FBI and the IRS, uncovered a massive scheme to defraud this program. Civilian employees of the U.S. Army Corps of Engineers, working in concert with an employee of Alaska Native Corporation Eyak Technology LLC allegedly submitted fraudulent bills to the program, totaling over 20 million dollars, and kept the money for their own use.[26] It also alleged that the group planned to steer a further 780 million dollars towards their favored contractor.[27]"

"Serco farewell to NPL after 19 years of innovation 8 January 2015 .. During that period under Serco's management and leadership.. .. NPL's caesium fountain atomic clock is accurate to 1 second in 158 million years and NPL is playing a key role in introducing rigour to high frequency [spread bet and spot-fixed assassination] trading in the City through NPLTime."

Serco... Would you like to know more?

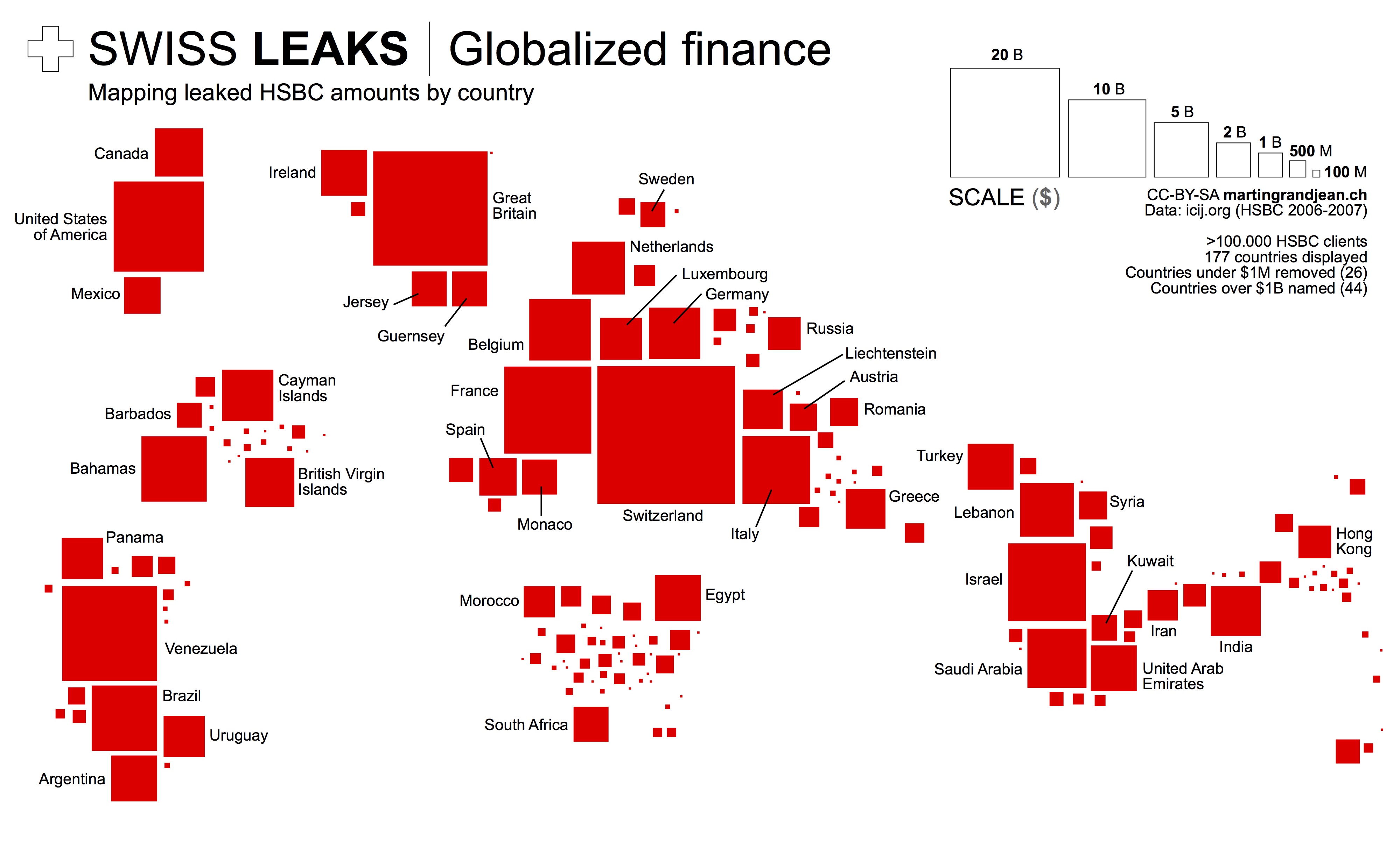

SWISSLEAKS - "HSBC developed dangerous clients: arms merchants, drug dealers, terrorism financers"

Copy of SERCO GROUP PLC: List of Subsidiaries AND Shareholders! (Mobile Playback Version) [HSBC is Serco's drug-hub Silk Road banker and a major shareholder with the 9/11 8(a) lenders including Her Majesty's Government and JPMorgan]

Yours sincerely,

Field McConnell, United States Naval Academy, 1971; Forensic Economist; 30 year airline and 22 year military pilot; 23,000 hours of safety; Tel: 715 307 8222

David Hawkins Tel: 604 542-0891 Forensic Economist; former leader of oil-well blow-out teams; now sponsors Grand Juries in CSI Crime and Safety Investigation

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.