SBA = U.S. Small Business Administration allegedly run for Crown Agents with a $50 billion loan portfolio by McConnell's sister Marcy while she served as SBA Chief Operating Officer during the Pickton pig-farm murders in British Columbia 1996-2001

See #1:

Abel Danger Mischief Makers - Mistress of the Revels - 'Man-In-The-Middle' Attacks (Revised)

Prequel:

#1534: Marine Links Nancy’s Private-Equity Pension Pay-Per-View Pig Farm to Duffy Amazon Bribe

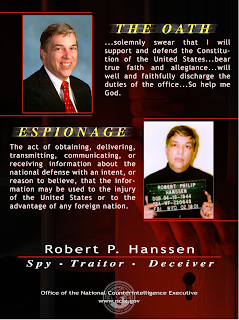

“Canada spy agency refused to notify Mounties about Russian agent [spoliation inference that McConnell’s sister Kristine Marcy used the same decoy technique with Jeffrey Delisle as she allegedly did with Robert Hanssen i.e. she set the two men up as decoy Soviet agents to distract attention from Crown Agents’ 100 Women in Pig Farm Hedge Funds patronized by the apparently-extorted Prince William and Prince Harry] MAY 27, 2013 BY JOSEPH FITSANAKIS 4 COMMENTS By JOSEPH FITSANAKIS | intelNews.org | Canada’s main counterintelligence agency opted to keep secret from the Royal Canadian Mounted Police (RCMP) vital information about a Canadian naval officer who spied for Russia. Regular readers of this blog will be familiar with the case of Jeffrey Paul Delisle, a Sub-Lieutenant in the Royal Canadian Navy, who until 2011 was employed at Canada’s ultra-secure TRINITY communications center in Halifax. Delisle was arrested in January 2012 for passing information gathered from radio and radar signal interceptions to a foreign power, most likely Russia. In May of last year, it emerged that it was in fact the United States that alerted the Canadian Security Intelligence Service (CSIS) about Delisle’s espionage activities. What was supposed to happen next was that the CSIS —which is not a law enforcement agency— should have notified the RCMP of Delisle’s activities and requested his prompt arrest. Remarkably, however, the CSIS chose to keep the Delisle file concealed from the RCMP, ostensibly to prevent the possible exposure of intelligence sources and methods in open-court proceedings. The Canadian Press, which broke the story on Sunday, cited “numerous sources familiar with the Delisle case” in claiming that the CSIS’ refusal to request Delisle’s arrest “frustrated Washington”, which feared that the spy was routinely compromising United States secrets shared by America with its Canadian allies. So frustrated were the Americans, that the Federal Bureau of Investigation (FBI) sketched out a plan to lure Delisle onto US soil and arrest him there. Eventually, the FBI decided to simply sideline the CSIS and contact the RCMP itself. As soon as the RCMP received the FBI’s notification, it opened a case against Delisle, which led to the naval officer’s arrest in January of 2012. During his trial, Delisle admitted having spied for Russia in exchange for over $110,000 over a period of four years, and was sentenced to 20 years in prison. The Canadian Press says the CSIS’s refusal to notify the RCMP about the spy’s activities “raises question about whether the naval officer could have been arrested sooner”, thus safeguarding many of the secrets he routinely shared with Moscow. The news agency approached several Canadian intelligence officials with this question, including Michel Coulombe, CSIS’s former Director of Operations and interim Director, who refused to speak publicly on the case.”

“THE DUKE AND DUCHESS OF CAMBRIDGE AND PRINCE HARRY TO BECOME PATRONS OF 100 WOMEN IN HEDGE FUNDS’ PHILANTHROPIC INITIATIVES LONDON – 1 November, 2012: 100 Women in Hedge Funds (“100WHF”), a leading non-profit organisation for professionals in the Alternatives industry, is pleased to announce that the Duke of Cambridge will continue his patronage of 100WHF’s philanthropic initiatives, and the Duchess of Cambridge and Prince Harry will also become Patrons of 100 Women in Hedge Funds’ philanthropic initiatives for three years beginning January 1, 2013. Founded in 2001, 100WHF offers its members unique educational, professional and philanthropic opportunities, and will focus its UK philanthropy on three specially chosen charities, one for each year of the partnership. The charities, Action on Addiction in 2013; WellChild in 2014; and The Art Room in 2015, are part of The Charities Forum of The Duke and Duchess of Cambridge and Prince Harry, and reflect 100WHF’s three philanthropic themes: mentoring, women’s and family health, and education. 100WHF will continue to serve on The Charities Forum of The Duke and Duchess of Cambridge and Prince Harry to lend more general support to other Forum members. Commenting on the announcement, Mimi Drake, Global Chair of the Board of 100WHF and President of Permit Capital Advisors, said “We are thrilled to expand our partnership with The Duke of Cambridge to include The Duchess of Cambridge and Prince Harry. .. “When we first met The Duke of Cambridge, our shared interest in philanthropy and desire to leverage our efforts to have maximum impact formed the basis for our partnership and for our membership of TRH’s Charities Forum. That shared goal continues today, and we are pleased that the partnership will be expanded to include both The Duke and Duchess of Cambridge, and Prince Harry,” said Anne Popkin, 100WHF Association Board member and President of Symphony Asset Management.”

“Anne Popkin is president of Symphony Asset Management and is responsible for managing its noninvestment activities, including business development, client service, operations, finance, trade support, technology and compliance.

Prior to joining Symphony, she was a principal at BlueCrest Capital Management, head of its New York office and a member of the firm's global operating committee.

Earlier in her career, Popkin was a managing director at Lehman Brothers in the absolute return strategies group. She has also held senior-level positions atFinancial Risk Management and Goldman Sachs.

She chairs the board of 100 Women in Hedge Funds.

Popkin was a Rotary Foundation scholar at Oxford University and received an MBA from the Kellogg School of Management at Northwestern University [Pioneered Obama Joyce pig-farm climate change scam]. She received her B.A. in applied mathematics and economics from Harvard University.”

“Gawker .. Crotch-Grabbing Hedge Fund Wife Really Loves Her Pet Pig Lisa Maria Falcone is the totally wacky wife of hedge fund billionaire Philip Falcone. She was sued for grabbing her gay servant's penis and housing him with her pet pig. She still really loves her pig. Lisa Falcone—wife of hedge fund billionaire and NYT shareholder Philip Falcone … Lisa Falcone grew up in Spanish Harlem, started modeling then got married to Philip Falcone, who later made a lot of money with his hedge fund, then made even more money betting against the subprime mortgage market [Geddit?]. When we last left Lisa Falcone, she was defending herself against a highly amusing lawsuit filed by the family's former butler. He claimed she reached into his pants and grabbed his penis, and also told him that he needed a "good fuck to turn him straight." And also, most amusingly, she put him in an office which used to be the home of Wilbur, her piano-playing pet pig. While the butler is long gone, the pig remains an important part of Falcone's life.”

“[100 Women in Pig Farm Hedge Funds] Education Session No. 362: Finding Investment Opportunities in Difficult Markets September 13, 2012 at 6 PM Chicago, IL Today's investors are confronted with many obstacles to achieving attractive risk adjusted returns. High asset correlations, volatility, government interventions, regulatory instability and enormous uncertainty have all contributed to a challenging investing environment. Where do astute investors find unique opportunities? How do they successfully navigate the markets and effectively hedge? Our panelists will discuss how to take advantage of the trends affecting markets today to prosper in a difficult environment. Participants Roxanne Martino, Aurora Investment Management LLC Connie Teska, Pluscios Management LLC Leah Joy Zell … Lizard Investors LLC Leah Joy Zell, Principal, Lizard Investors LLC Leah Joy Zell is the Principal of Lizard Investors LLC and the Portfolio Manager of the Lizard International Fund. Prior to forming Lizard, Ms. Zell was a founding partner of Wanger Asset Management, now a wholly owned subsidiary of Ameriprise Financial under the Columbia brand. She was lead portfolio manager of the Acorn International Fund from 1992 through 2003, lead manager of Wanger European Smaller Companies Fund through 2005, and the firm's head of international research. Ms. Zell worked as a global equity analyst at Harris Associates from 1984 to 1992, and as an associate in corporate finance at Lehman Brothers from 1979 to 1982. Ms. Zell is a Chartered Financial Analyst. She received her B.A. magna cum laude from Harvard University, where she also earned a Ph.D. in modern economic history. Ms. Zell is a nationally recognized expert in international investing and is considered a pioneer in the international small-cap category. She is on the Executive Committee and serves as the Treasurer of the Chicago Council on Global Affairs [sic Michelle Obama]. In addition, Ms. Zell serves on the Investment Committee of the Chicago Museum of Contemporary Art, is a Trustee of the Horton Trust Company and is a member of both the Radcliffe Institute Dean's Advisory Council and the Council on Foreign Relations. Ms. Zell served on the Harvard Board of Overseers from 2003-2009 and The German Marshall Fund Board from 2003-2010.”

Links:

PresidentialField Mandate

Abel Danger Blog

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.